US markets slide amid tech overvaluation worries

US equity indices fell for the week as investors reassessed lofty valuations in technology stocks—particularly firms exposed to artificial intelligence (AI)—while the ongoing US federal funding lapse raised concerns about delayed official employment statistics.

US indices declined amid renewed scrutiny of technology valuations, with AI-exposed stocks leading the sell-off.

The US government shutdown raises the prospect that official employment data due on Friday 7 November may be delayed, increasing macroeconomic uncertainty.

Key valuation metrics for several large tech firms are elevated, prompting questions about sustainability of current multiples.

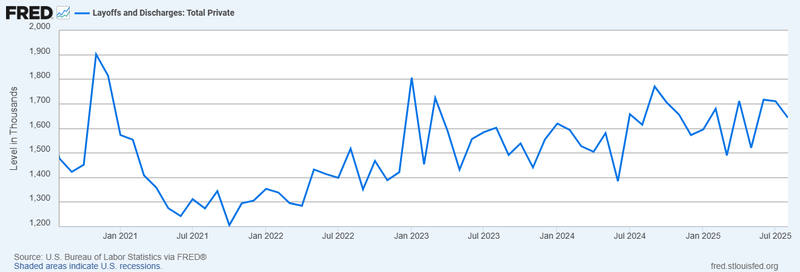

Layoff activity has risen on last months, adding to concerns that weaker employment could depress consumption and corporate earnings.

The Bank of England left Bank Rate unchanged at 4.00%; the Monetary Policy Committee split 5–4, with market participants anticipating a cut before year-end.

Markets fall on valuation concerns and data uncertainty

US equity markets fell in parallel as investors grew concerned that prices for many technology companies—especially those linked to AI—may have outpaced fundamentals. Valuation metrics such as price-to-earnings, price-to-book and PEG ratios for a number of large-cap technology firms have risen to levels that some market participants regard as extended (Q2 S&P500 analysis); this view has increasingly influenced flows over the past week.

Index moves were notable: the S&P 500 declined 1.12 per cent to 6,720, the Dow Jones Industrial Average fell 0.84 per cent to 46,912, and the Nasdaq-100 dropped 1.91 per cent to 25,130. Among the most affected individual names were Advanced Micro Devices (−7.21 per cent), Palantir Technologies (−6.84 per cent), Shopify (−4.22 per cent), NVIDIA (−3.61 per cent), Tesla (−3.45 per cent) and Qualcomm (−3.63 per cent).

Over the course of the week, indices’ performance reflected these valuation concerns: the Dow was down c. 1.53 per cent, the S&P 500 fell c. 1.92 per cent and the Nasdaq-100 declined c. 2.93 per cent.

Figure 1. US stock indices’ performance (current week). Source: Data from the NYSE Exchange and Nasdaq Exchange. Own analysis conducted via TradingView.

Why AI overvaluation concerns matter — and the employment link

Investors have priced substantial future earnings into a subset of technology firms on the expectation that AI will materially increase productivity and revenue. While revenue growth linked to AI programmes has been meaningful in several cases, questions persist about the timing and scale of profit realisation across the sector.

There are three central risks that feed valuation concerns:

- Execution and monetisation risk. Not all AI investments will generate the anticipated cash flows; some projects may take longer to monetise or may deliver lower margins than expected.

- Environmental and operational costs. Large-scale AI infrastructure—data centres and model training—can be energy- and water-intensive, adding to operating costs and regulatory scrutiny.

- Labour-market effects. Increased automation and AI adoption have coincided with elevated layoff activity in some sectors, potentially reducing consumption and, in turn, firms’ top-line growth.

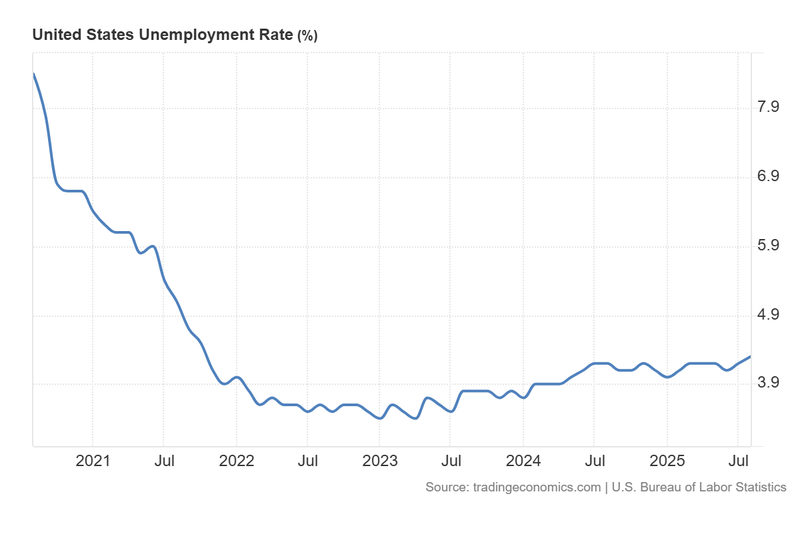

Labour-market indicators underscore the potential transmission mechanism. Challenger, Gray & Christmas – cited by CNBC – reported approximately 153,000 layoffs in October, an increase of c. 175 per cent year-on-year. The trend in layoffs and the upward trajectory in the unemployment rate (see Figures 2 and 3) raise the prospect that an extended period of elevated job losses could weigh on consumer spending and corporate revenues.

Figure 2. Layoffs and discharges: Total private (2021–2025). Source: U.S. Bureau of Labor Statistics, Layoffs and Discharges: Total Private, retrieved from FRED, Federal Reserve Bank of St. Louis.

Figure 3. United States Unemployment Rate (2021–2025). Source: U.S. Bureau of Labor Statistics. Figure obtained from Trading Economics.

A complicating factor is that the US government shutdown may delay the publication of official employment data due this week, such as the November non-farm payrolls and unemployment rate. In the absence of timely official statistics, markets are relying on private indicators, increasing uncertainty and price volatility.

BoE holds rates; sterling recovers

The Bank of England’s Monetary Policy Committee voted 5–4 to leave Bank Rate unchanged at 4.00 per cent, in line with market expectations. The split vote underscores the committee’s internal divergence: four members preferred an early cut while five favoured patience in light of persistent inflationary pressures and recent labour-market developments.

Sterling strengthened, rising c. 0.70 per cent against the US dollar to approximately US$1.3138. Market participants continue to price an easing of UK monetary policy before the end of the year, but the timing remains contingent on incoming inflation and employment data.