US PCE mixed; markets edge higher amid monetary easing hopes

The Personal Consumption Expenditures (PCE) price index printed mixed results, with headline inflation rising modestly while core PCE eased slightly. Markets responded positively as investors continued to price a high probability of Federal Reserve easing in December, even though economic signals remain uneven. Consumer sentiment improved marginally and Canada reported a notable fall in unemployment, supporting the Canadian dollar.

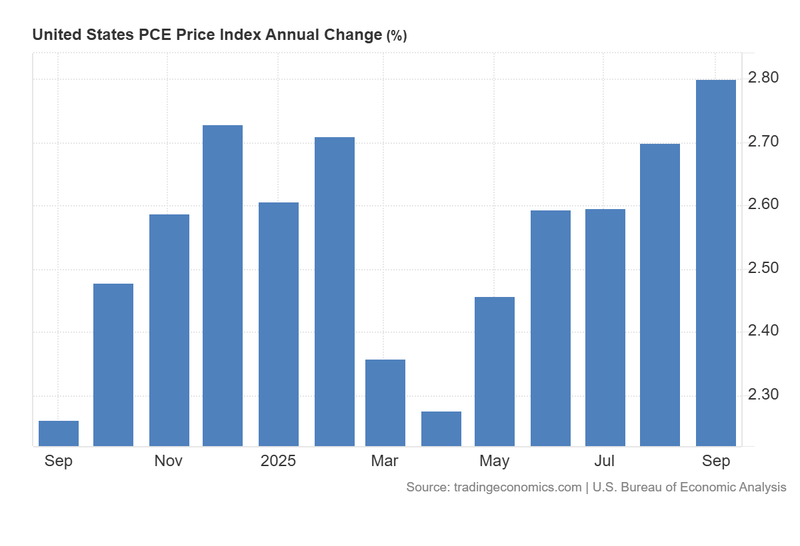

Headline PCE rose to 2.8 per cent year-on-year, while Core PCE decelerated to 2.8 per cent from 2.9 per cent, producing a mixed signal for the Fed.

The CME Group’s FedWatch Tool still prices roughly an 87 per cent chance of a 25 basis-point cut in December, reflecting market conviction that labour weakness will dominate policy considerations.

University of Michigan consumer sentiment recovered modestly to 53.3, with five-year inflation expectations easing to 3.2 per cent, indicating slightly less entrenched longer-term inflation fears.

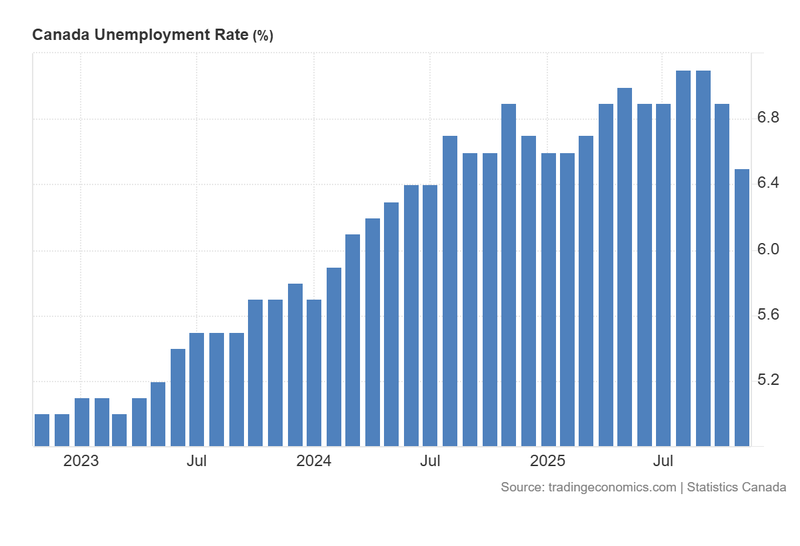

Canada’s unemployment rate fell substantially to 6.5 per cent, and employment change was +53.6k (previous +66.6k), prompting a strong appreciation in the Canadian dollar.

The PCE price index: mixed signals for the Fed

According to the Bureau of Economic Analysis, the PCE Price Index rose to 2.8 per cent year-on-year in September, broadly in line with consensus. The Core PCE Price Index — which strips out food and energy — edged lower to 2.8 per cent from 2.9 per cent. Over the past year headline PCE has exhibited a modest upward trend, particularly since April 2025, but the slight retreat in core inflation provides some comfort that underlying price pressures may be moderating.

International bodies, including the OECD, continue to warn that trade-policy-driven tariffs could trigger a rebound in inflation if corporate margins are squeezed and higher costs are passed through to consumers. Nevertheless, markets have interpreted the overall data as sufficiently benign to keep expectations for Fed easing intact: the FedWatch Tool still places the probability of a 25 basis-point cut in December at around 87 per cent.

Equity markets responded positively to the data: the S&P 500 rose 0.23 per cent to 6,873, the Dow Jones increased 0.31 per cent to 48,000, and the Nasdaq-100 gained 0.41 per cent to 25,684.

Figure 1. US PCE Price Index — annual change. Source: Bureau of Economic Analysis; chart via Trading Economics.

Consumer sentiment inches higher

The University of Michigan’s consumer sentiment index improved from 51.0 to 53.3, slightly above the consensus forecast of 52.0. The gain was driven largely by more favourable assessments of personal finances. Importantly, short-term inflation expectations fell from 4.5 per cent to 4.1 per cent, while five-year expectations retreated to 3.2 per cent from 3.4 per cent. Although these levels remain elevated in historical terms, the downward drift in expectations is a constructive development for policymakers concerned about second-round effects.

The slightly firmer consumer mood provided modest support to risk assets, but market participants continue to give more weight to the prospect of imminent monetary easing than to the incremental improvement in sentiment. The dollar index (DXY) was little changed, trading around 99.

Canada: unemployment down, currency strengthens

Statistics Canada reported a meaningful decline in the unemployment rate to 6.5 per cent from 6.9 per cent, beating the consensus forecast of 7.0 per cent. Employment rose +53.6k in November (previous +66.6k), a result that was markedly stronger than the modest decline that had been expected. The bulk of job gains occurred among younger workers, and the most dynamic sectors were natural resources, healthcare and social assistance, and accommodation and food services; wholesale and retail trade recorded some job losses.

The stronger labour print prompted a sharp market reaction: the Canadian dollar appreciated by roughly 0.90 per cent versus the US dollar. The development also underscores the divergent cyclical positions of the United States and Canada and will be monitored closely by the Bank of Canada when it assesses the appropriate policy stance.

Figure 2. Canada unemployment rate (2023–2025). Source: Statistics Canada; chart via Trading Economics.