US Q3 GDP revised higher; 2026 rate-cut outlook holds

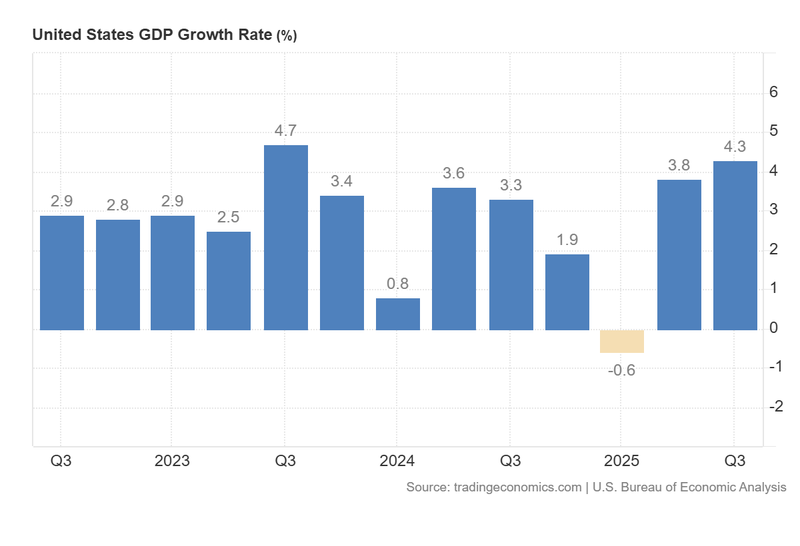

The US economy surprised to the upside after the Bureau of Economic Analysis revised third-quarter GDP to 4.3%, while industrial production reached its strongest year-on-year pace in three years. Markets reacted favourably, yet consumers remain cautious: the Conference Board’s confidence index fell to 89.1. Despite the stronger growth prints, market pricing continues to assign a meaningful probability to rate cuts in 2026.

Q3 US GDP was revised up to 4.3%, stronger than both the prior estimate and consensus forecasts.

US industrial production rose to 2.5% (YoY) — its best reading in three years — even as durable-goods orders weakened.

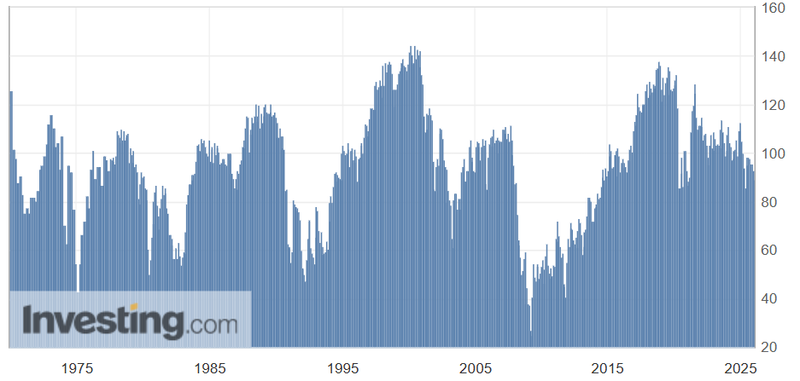

Consumer sentiment softened: the Conference Board’s index slipped to 89.1, signalling persistent uncertainty among households.

London’s FTSE 100 neared an all-time high, led by mining stocks amid broad strength in precious and industrial metals.

US GDP adjusted higher above estimates; forecast of cuts remains in place

The Bureau of Economic Analysis revised third-quarter real GDP growth to 4.3%, up from earlier estimates and comfortably above the consensus adjustment of c. 3.3%. It is the US economy’s strongest quarterly outturn since Q4 2023 and was driven primarily by robust consumer spending, despite weaker confidence readings among households.

Complementary data from the Federal Reserve showed industrial production improved to 2.5% year-on-year in November — the strongest three-year reading — reflecting firmer manufacturing and mining activity. Conversely, the Census Bureau reported a 2.2% decline in durable-goods orders for October; although notable, that fall remained modest by historical standards and did not negate the broader expansionary signal from GDP and output.

Despite the healthier growth profile, market-implied expectations for monetary policy continue to price easing next year. The CME Group’s FedWatch Tool still attributes material odds to two 25-basis-point cuts in 2026, even though the Federal Reserve’s official projections signalled only a single cut in its most recent outlook. Markets are thus balancing stronger near-term growth against persistent downside risks—notably to labour markets and inflation trajectories.

Market reaction: major US indices closed higher: the S&P 500 rose 0.46% to 6,909, the Dow Jones added 0.16% to 48,442, and the Nasdaq-100 gained 0.50% to 25,587. Ten-year US Treasury yields ticked up to 4.16%, while the dollar index (DXY) eased 0.37% to 97.88.

Figure 1. United States GDP Growth Rate (2022–2025). Source: US Bureau of Economic Analysis; chart reproduced from Trading Economics.

Conference Board U.S. consumer confidence below expectations

The Conference Board’s consumer confidence index fell to 89.1 from 92.9, underperforming the forecast of 91.7. The report attributes the decline to heightened anxieties over a possible rebound in inflation, the economic impacts of recently imposed tariffs, and political uncertainty. The series continues a broader downward trend that began in mid-2021 and underlines a disconnect: households are more cautious even as macro-aggregates such as GDP and industrial output look resilient.

Lower confidence can presage weaker consumption going forward, which would complicate the Fed’s policy calculus: stronger GDP today does not eliminate the risk that demand softening could dampen growth next year.

Figure 2. US Conference Board Consumer Confidence (1975–2025). Source: The Conference Board; chart obtained from Investing.

FTSE 100 near all-time highs boosted by mining companies

The FTSE 100 edged closer to its record level, closing 0.24% higher at 9,889 points — narrowly below its historic peak of 9,911. The advance was led by miners and commodity-linked names as precious and industrial metal prices continued to firm.

Commodity performance has been notable year-to-date: copper is up approximately 38%, aluminium around 17%, and palladium has surged by roughly 122%. In turn, the gold, silver, and platinum contracts closed on record highs, with a YTD performance of 72%, 140%, and 154% respectively. Those gains have underpinned miners’ earnings prospects and helped propel the UK index toward record territory, even as parts of the real economy face headwinds.