US stock market rises as Supreme Court overturns Trump tariffs

Major US indices advanced in tandem following a landmark ruling by the US Supreme Court, which declared President Donald Trump’s unilaterally imposed tariffs illegal. In a swift rebuttal, the President announced his intention to implement a new 10% global tariff via executive order, a move that has intensified political uncertainty within the United States.

The US Supreme Court ruled that tariffs imposed unilaterally by the executive branch were invalid, asserting that such measures require prior authorisation from Congress.

President Trump expressed outrage at the decision and announced to impose a new 10% global tariff, declaring he would seek alternative avenues to bypass congressional oversight.

The US PCE Price Index accelerated to 2.9%, with the Core PCE reaching 3%. Conversely, GDP growth slowed sharply from 4.4% in Q3 to 1.4% in Q4, complicating the outlook for the domestic economy.

Japan’s inflation rate fell significantly to 1.5%, its lowest level since April 2022. This deceleration provides the Bank of Japan (BoJ) with the flexibility to adopt a more accommodative monetary stance.

US stock indices advance amidst tariff overturn and heightened uncertainty

The Supreme Court of the United States ruled 6–3 that the tariffs unilaterally imposed by President Donald Trump are illegal. Consequently, the US government may be required to reimburse an estimated $175 billion to importers who sought judicial protection, although the final figure remains unconfirmed. While the President had invoked the International Emergency Economic Powers Act (IEEPA) to justify the measures, the Court held that the executive branch overstepped its authority by failing to secure congressional approval.

In response, President Trump announced plans to sign an executive order imposing a new 10% global tariff. During a White House press briefing, he described the ruling as "deeply disappointing" and asserted his resolve to find alternative legal mechanisms for tariff implementation without legislative intervention. This defiance has introduced significant political volatility and represents a clear setback for the administration’s trade agenda. According to reporting by CNBC, the President’s legal team may look to Section 122 of the Trade Act of 1974; however, tariffs under this statute are limited to a 150-day duration, with any extension requiring congressional consent.

Additionally, the President commented that tariffs maintained under Section 232 and Section 301—specifically those affecting steel, aluminium, and semiconductors—remain in full effect as they pertain to national security. Consequently, the automotive, pharmaceutical, and consumer packaged goods industries are expected to remain under pressure from these ongoing trade barriers.

Market sentiment reacted positively to the judicial ruling, as the reversal of broad tariffs is viewed as a potential disinflationary catalyst. Economists suggest that the removal of import taxes may alleviate the price pressures that have plagued the economy. The S&P 500 rose 0.69% to 6,909 points, the Dow Jones gained 0.47% to reach 49,625, and the Nasdaq 100 appreciated by 0.87% to 25,012 points.

US GDP and PCE Price Index signal divergent economic trends

Data from the Bureau of Economic Analysis (BEA) reveals that US GDP growth slowed to 1.4% in the fourth quarter, down from 4.4% in the third. This figure fell significantly short of the 3% growth forecast by analysts. The Department of Commerce cited the recent government shutdown—the longest in US history—as the primary factor behind the deceleration.

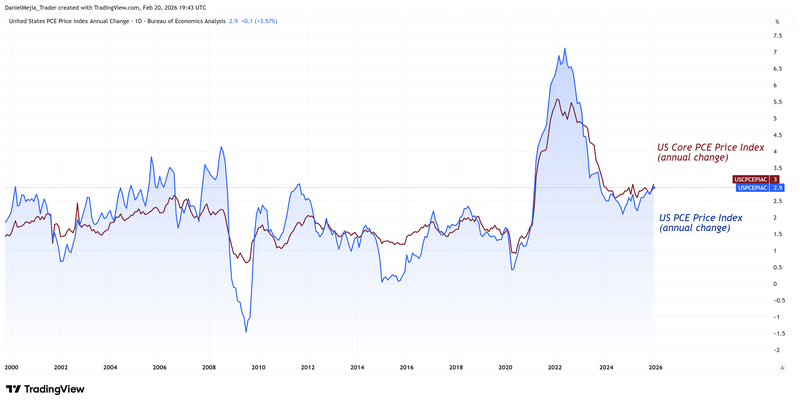

Simultaneously, the BEA released the December PCE Price Index, the Federal Reserve's preferred inflation gauge. The report indicated that the headline PCE accelerated from 2.8% to 2.9%, exceeding expectations. Similarly, the Core PCE Price Index—which excludes volatile food and energy costs—rose from 2.8% to 3%, surpassing the 2.9% forecast.

Despite this combination of stagnating growth and rising inflation, equity markets remained resilient. Investors appear to be prioritising the Supreme Court’s tariff ruling as a more significant factor for future price stability. Meanwhile, the US Dollar Index (DXY) recorded a marginal depreciation of 0.03%, closing at 97.79 points.

Figure 1. US PCE Price Index & Core PCE Price Index Comparison (2000-2025). Source: Data from the US Bureau of Economic Analysis; Own analysis conducted via TradingView.

Japanese inflation decelerates sharply, easing pressure on the BoJ

According to the Ministry of Internal Affairs and Communications, Japan’s annual inflation rate slowed considerably from 2.1% in December to 1.5% in January, marking its lowest level since April 2022. Core inflation also moderated, falling from 2.4% to 2.0% during the same period.

This disinflationary trend provides significant breathing room for the Bank of Japan (BoJ). The central bank has faced an escalating dilemma between its price stability mandate and the government’s efforts to stimulate the economy through increased public spending and tax reductions. The lower inflation data suggests the BoJ may delay further monetary tightening.

Following the release, the Japanese yen appreciated marginally by 0.02% against the US dollar to 154.98, while the Nikkei 225 declined by 1.12% to close at 56,825 points.