US stocks mixed after retail sales miss expectations

US stock indices closed with mixed results following the release of lower-than-expected retail sales data. According to the US Census Bureau, several retail segments experienced contractions in December, a month typically characterised by robust seasonal consumption.

US stock indices closed mixed as concerns mounted regarding the consumption outlook for the current year, following a reported stagnation in retail sales for December.

The report suggests that aggregate consumption has been hampered by tariff-driven price increases and a continuing downward trend in the domestic saving rate.

The Coca-Cola Company recorded a year-on-year (YoY) revenue increase of 3.5%, whereas Ford Motor Company’s revenue declined by 4.7%, highlighting structural disparities within a complex economic environment.

US retail sales decelerate below analyst forecasts

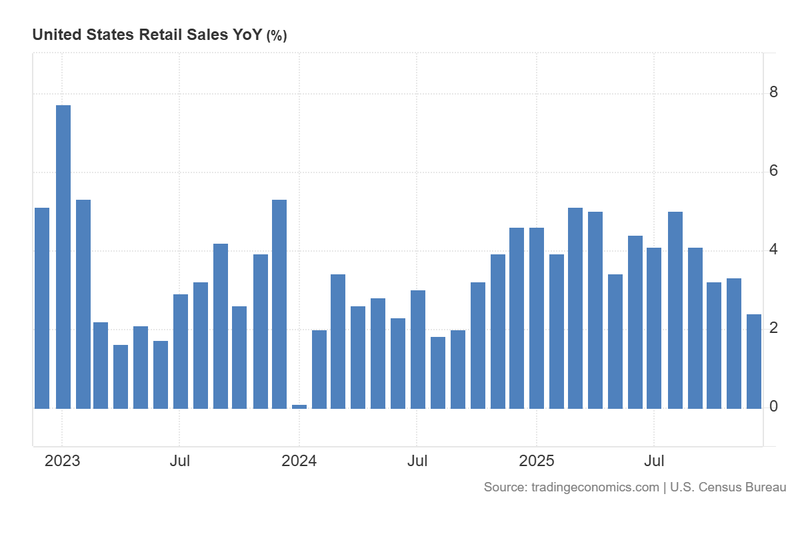

According to data from the US Census Bureau, month-on-month (MoM) retail sales growth fell from 0.6% in November to 0% in December, significantly missing the 0.4% increase anticipated by analysts. Consequently, the year-on-year (YoY) growth rate decelerated from 3.3% to 2.4%, marking its lowest level since October 2024. Data from Trading Economics indicates that the most pronounced declines occurred in miscellaneous store retailers (-0.9% MoM), furniture outlets (-0.9%), and clothing retailers (-0.7%). Other sectors, including motor vehicles and big-ticket items, also registered a contraction in consumption during the period. Conversely, sales at building material and garden equipment dealers rose by 1.2% MoM.

As reported by Reuters, the Census Bureau’s findings indicate a softening in consumption that has been attributed, in part, to higher prices stemming from recently applied import tariffs. Furthermore, the report highlights a marginal rise in business inventories, which may adversely affect economic forecasts for the remainder of the year. While domestic consumption has remained resilient over the last years despite waning consumer confidence, that strength was previously underpinned by an exceptionally high saving rate—which peaked at 31.8% in April 2020. However, the saving rate has since plummeted to 3.5% (as of the November release), raising critical questions regarding how long current levels of consumption can be sustained.

In response to the data, US stock indices finished the session mixed. The S&P 500 fell by 0.33% to 6,941 points, and the Nasdaq 100 decreased by 0.56% to 25,127. In contrast, the Dow Jones Industrial Average gained 0.10% to close at 50,188, remaining near its all-time high.

Figure 1. United States Retail Sales YoY (2023-2025). Source: Data from the US Census Bureau; Figure obtained from Trading Economics.

Coca-Cola and Ford slide amid mixed quarterly results

Industrial giants The Coca-Cola Company and Ford Motor Company both saw their share prices dip following the release of divergent fourth-quarter (Q4) results for 2025.

Coca-Cola surpassed analyst forecasts for earnings per share (EPS), yet total revenue fell short of market estimates. The company reported $11.8 billion in revenue, missing the projected $12.04 billion. Conversely, the firm achieved an EPS of $0.58, exceeding the $0.56 estimate. These results represent a YoY growth rate of 3.5% in revenue and 5.4% in earnings per share. Despite the underlying financial growth, Coca-Cola's shares fell by 1.49% to $76.81, though the stock remains near its record high.

Meanwhile, Ford Motor Company exceeded revenue expectations but failed to meet EPS estimates. The automotive firm reported total revenue of $45.9 billion, surpassing the $44.2 billion anticipated by analysts. However, the company’s EPS of $0.13 fell short of the $0.18 forecast. These figures represent YoY declines in revenue and earnings per share of 4.7% and 66%, respectively. Despite this marked downward trend, the shares saw only a marginal decrease of approximately 0.13% at $13.57 by the market close.