Western central banks adjust stance amid rising uncertainty

Prominent Western central banks have signalled a convergence towards more neutral policy stances for 2026 as economic and geopolitical uncertainty has risen. The Bank of Japan has moved in the opposite direction — tightening policy in response to persistent domestic inflation — while German consumer confidence weakened to its lowest level since April 2024.

Most major central banks emphasise a meeting-by-meeting, data-dependent approach as downside and upside risks persist.

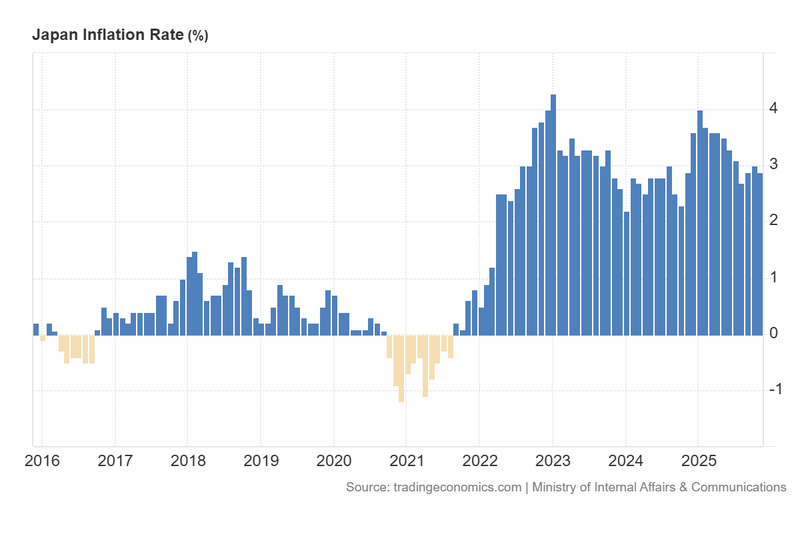

The Bank of Japan raised its policy rate to 0.75 per cent, the highest level in three decades, reflecting persistent inflationary pressure.

Other central banks (Fed, ECB, BoE, BoC, RBA) signalled more neutral stances or held rates, leaving future moves conditional on incoming data.

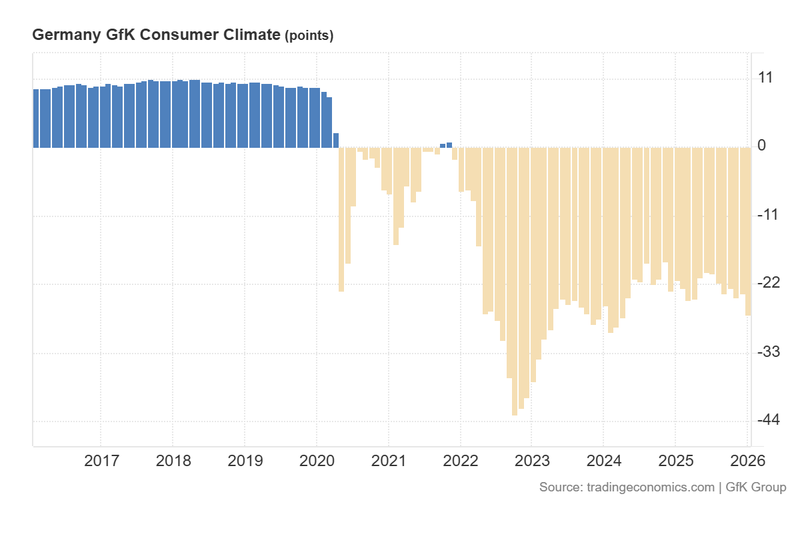

Germany’s GfK consumer confidence fell to -26.9, driven by weaker income expectations and bigger propensity to save.

Prominent Western central banks change tack as uncertainty mounts

Over the last two weeks, several major central banks have announced policy decisions and published outlooks for 2026 that emphasise caution. A common thread is an explicit shift to a neutral, data-dependent framework: policy committees are no longer signalling mechanical paths for easing or tightening but are instead stressing that each meeting will be judged on fresh economic information.

The Reserve Bank of Australia left its fund rate at 3.6 per cent, noting elevated uncertainty around inflation dynamics and signalling a wait-and-see approach for 2026. The Bank of Canada likewise held its policy rate at 2.25 per cent, indicating that rates are likely to remain on hold into next year unless conditions change materially.

By contrast, the Federal Reserve implemented a modest cut to 3.75 per cent while presenting a cautiously improved growth outlook for 2026 — but Fed officials underscored the divergence between still-elevated inflation and weakening labour market indicators. The Bank of England also trimmed policy to 3.75 per cent, describing further easing as possible but contingent on data.

Meanwhile, the European Central Bank kept interest rates unchanged at 2.15%, citing a neutral policy stance amid heightened global uncertainty and emphasizing a “meeting-by-meeting” approach to decision-making. Additionally, today the Bank of Japan raised its policy rate by 25 basis points to 0.75 per cent, citing persistent inflation pressures and the need to preserve price stability. This move has left the BoJ as the only major central bank in a clearly restrictive posture among its Western peers.

Across these jurisdictions, policymakers emphasised that geopolitical risks, trade tensions and uneven post-pandemic recoveries mean that forecasts are subject to unusually large uncertainty.

BoJ raises rates as inflation persists

The Bank of Japan increased its policy rate from 0.50 per cent to 0.75 per cent, closely matching market expectations. The decision marks the highest official rate in roughly thirty years and reflects the BoJ’s judgement that price pressures have become persistent: the headline rate stood at 2.9 per cent in November, comfortably above the 2 per cent target.

The BoJ stressed that it remains attentive to financial stability and will react to evolving data. The move has already fed through to market yields: the 10-year JGB yield rose, reaching levels not seen in two decades (2.018 per cent). Nonetheless, the yen initially depreciated against the dollar (trading near ¥157.50), as global dollar strength and cross-border capital flows weighed on the currency despite the BoJ’s tightening.

Figure 1. Japan inflation rate (2016–2025). Source: Ministry of Internal Affairs & Communications of Japan; chart obtained from Trading Economics.

German consumer confidence softens further

Germany’s GfK consumer climate index fell to -26.9, down from -23.4 and below consensus expectations. The report identified several drivers of the weakness: buying willingness declined (–6 in December), propensity to save rose materially (from 13.7 to 18.7), and income expectations deteriorated sharply (from -0.1 to -6.9). By contrast, short-term economic expectations edged slightly higher, suggesting households remain ambivalent about the near-term outlook.

Germany’s underlying economic picture remains fragile — Q3 GDP was stagnant and industrial activity has been subdued — making consumer confidence particularly sensitive to inflation and wage developments. Policymakers in the euro area have reiterated they will monitor labour market and price indicators closely; any material deterioration in domestic demand could weigh on the ECB’s policy calculus.

Figure 2. Germany GfK Consumer Climate (2016–2025). Source: GfK Group; chart obtained from Trading Economics.