Yen stabilizes amid intervention concerns, Dollar eases, Silver holds gains

Japanese yen stabilized around 156.6 per dollar on Friday after two consecutive sessions of losses, remaining near ten-month lows as market attention returns to potential government intervention. Meanwhile, the U.S. dollar eased to about 98.2 on the dollar index on the first trading day of 2026, extending last year’s steep decline of nearly 9%, while silver continued its strong start to the year, hovering near $73 per ounce. Traders are weighing a mix of currency policy, central bank guidance.

Stabilized near 156.6 per dollar after prior declines, amid renewed calls for intervention from the business community.

Slipped further as markets price in potential Fed rate cuts and watch upcoming economic data for hints on policy direction.

Built on record gains from 2025, supported by tight supply, rising industrial demand, and safe-haven interest.

Japanese yen pressure and policy signals

The yen’s recent stability follows verbal interventions from Tokyo in prior weeks, with Finance Minister Katayama emphasizing that Japan retains the ability to act against excessive currency moves. Despite these warnings, the yen remains near lows not seen in ten months, increasing speculation over potential official measures. Japan’s business lobby has now urged the government to support a stronger currency, citing concerns about import costs and market confidence. Fiscal policy also continues to weigh on sentiment. Japan’s public debt exceeds twice the size of its economy, and the government recently approved Prime Minister Takaichi’s record 122.3 trillion-yen budget, balancing aggressive spending with a plan to limit new bond issuance. Still, markets remain cautious, watching whether policy coordination can support the yen without stifling economic growth. The yen ended 2025 with a modest 0.3% gain, snapping a four-year losing streak, partly supported by two rate hikes this year.

U.S. dollar trends and Fed outlook

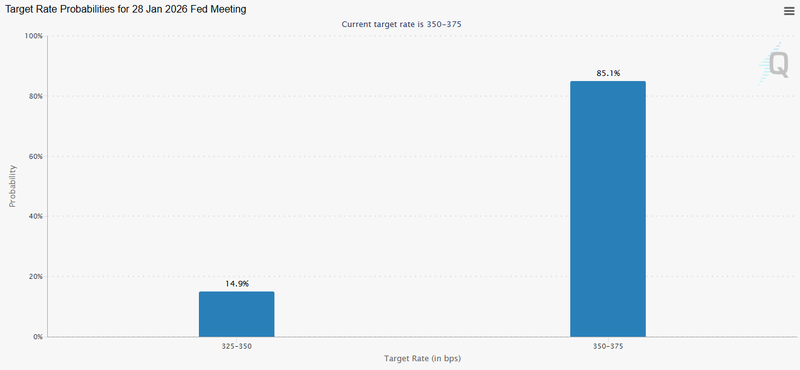

Greenback continues to digest the steepest annual loss in eight years, shedding about 9% in 2025. Factors include lingering policy uncertainty following previous tariff measures, expectations for Fed easing, narrowing interest rate advantages relative to peers, and concerns over the U.S. fiscal deficit. Traders now focus on upcoming economic data, including next week’s payroll report, which could influence expectations for interest rate policy. In addition, speculation over Fed leadership is rising, as President Donald Trump is expected to name a successor to Jerome Powell early this year, with markets anticipating a potentially more dovish appointment. Looking at probabilities for the January Fed decision, market pricing currently implies about an 85% chance that rates will remain unchanged, reflecting investor caution and the central bank’s recent messaging. While some rate cuts are expected later in the year, the near-term policy path is widely viewed as steady, keeping the dollar relatively anchored. Current pricing suggests two rate cuts over 2026, slightly above the Fed’s own projection of one, highlighting a market increasingly sensitive to inflation signals, employment trends, and policy guidance.

Source: CME Group

Silver climbs on tight supply and industrial demand

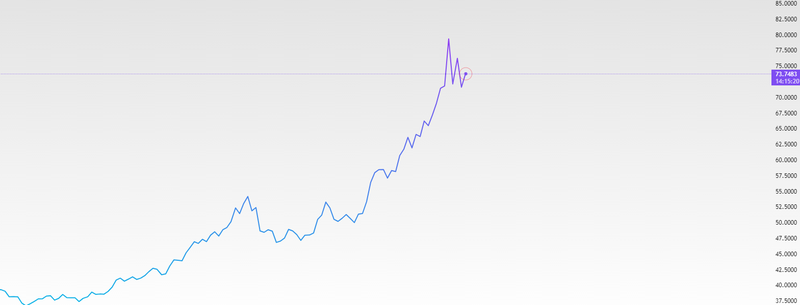

Silver started 2026 near $73 per ounce, extending the gains from its record-breaking 2025 rally, when it surged 148%, driven by low stockpiles, tight supply, and increased industrial and investment demand. The metal’s critical role in technology, solar panels, and electronics continues to support long-term interest, while its designation as a strategic U.S. mineral has reinforced bullish sentiment. Monetary policy expectations are also playing a role. FOMC minutes released earlier this week showed growing openness among policymakers to potential rate cuts if inflation eases, though members remain divided over timing and scale. Geopolitical tensions have added safe-haven support: U.S. restrictions on Venezuelan oil exports and renewed Russia-Ukraine attacks over the New Year have disrupted energy infrastructure, maintaining uncertainty in markets that often correlate with precious metal flows. Overall, silver’s momentum reflects a combination of supply constraints, industrial demand, monetary policy expectations, and geopolitical risk, while the broader dollar and currency environment continues to influence short-term positioning.

Source: Trading View