Alphabet balancing historic premiums against a surge in leverage

Alphabet is currently undergoing a fundamental shift in its financial profile. For years, the search giant was defined by a fortress balance sheet and conservative valuations. However, the latest financial data reveals a company that is aggressively leveraging its capital structure and commanding a significant market premium.

Price-to-Earnings (P/E) ratio currently stands 38%.

The company’s debt has surged by 163% year-on-year.

Return on Equity (ROE) increased by 8%.

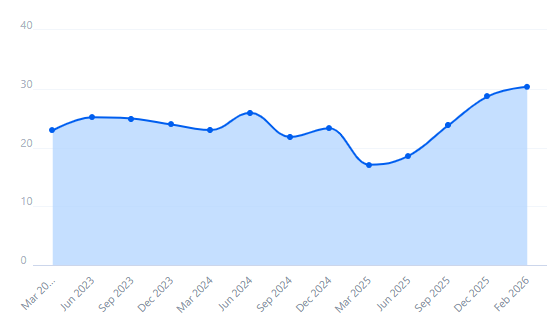

Valuation Premium, pricing for perfection

The market is currently pricing Alphabet not on its present reality, but on a highly optimistic future. The company’s Price-to-Earnings (P/E) ratio currently stands 38% higher than the average of its last four quarters (22.0) and 30% above its five-year quarterly average (23.3).

This expansion in multiples is significant. When a mature mega-cap stock trades at such a steep premium relative to its historical norms, it indicates that investors have disregarded traditional valuation ceilings. The market is effectively paying a "growth tax," betting that future earnings will accelerate rapidly enough to justify paying nearly a third more for every dollar of profit than was required on average over the last five years.

Source: Fullratio

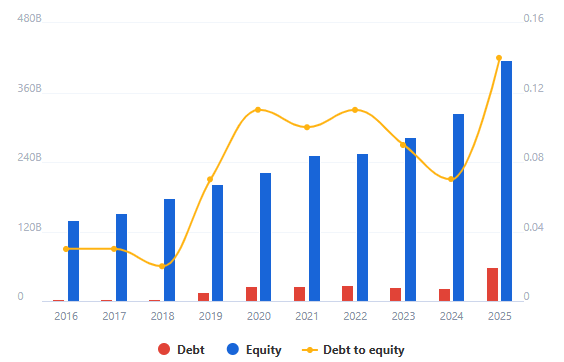

Capital structure, a departure from conservatism

The most startling development in Alphabet’s profile is the aggressive accumulation of liability. The company’s debt has surged by 163% year-on-year and 76% from the previous quarter alone. Total liabilities have followed suit, rising 44% year-on-year.

For a company historically averse to debt, this is a distinct change in philosophy. However, context is vital. While the percentage growth is jarring, including a 100% year-on-year surge in the Debt-to-Equity ratio, the absolute leverage remains conservative. The debt load remains 86% smaller than the equity.

Alphabet is not in financial distress but is instead taking advantage of its massive balance sheet to borrow heavily. This liquidity is likely being funneled into hardware and data center expansion (Capex), a necessary move to defend its moat in an era of generative AI.

Source: Fullratio

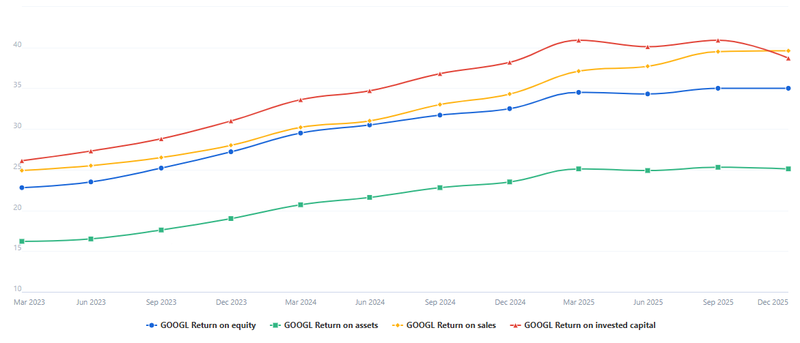

Operational efficiency and the divergence of returns

The internal efficiency metrics paint a picture of a company that is optimizing its core while struggling to monetize its new investments immediately.

On one hand, Alphabet has become more streamlined. Return on Sales rose by 15% year on year and return on assets is up 7%. Furthermore, return on equity increased by 8%. These metrics confirm that management has successfully trimmed fat from its legacy operations (Search and YouTube), squeezing more profit out of every dollar of revenue and shareholder capital.

On the other hand, the return on invested capital has declined by 5% since the previous quarter. This decline is the "smoking gun" of heavy infrastructure spending. While the core business is more profitable, the massive influx of new capital (from the surging debt) has not yet generated a return. Alphabet is deploying cash faster than that cash can generate new profit, a classic symptom of an intense investment cycle.

Source: Fullratio