Brent crude rises amid supply-chain disruption

Brent futures rose after reports of damage to a major Russian export terminal raised concerns about a temporary disruption to global crude flows. The move was compounded by the proximity of Western sanctions deadlines on Russian energy firms and lingering uncertainty over OPEC+ production intentions.

Reports of an attack on the Novorossiisk export terminal prompted a near-term risk premium, pushing Brent higher as traders re-assess seaborne supply.

Western sanctions and the approaching cut-off date for business with certain Russian entities (21 November 2025) amplify the short-term supply risk.

OPEC+ discussions of production increases for coming months counterbalance the disruption narrative, creating a tug-of-war between supply-side downside and upside risks.

Technically, Brent is consolidating in the short term but remains below its major moving averages and inside a longer-term bearish channel.

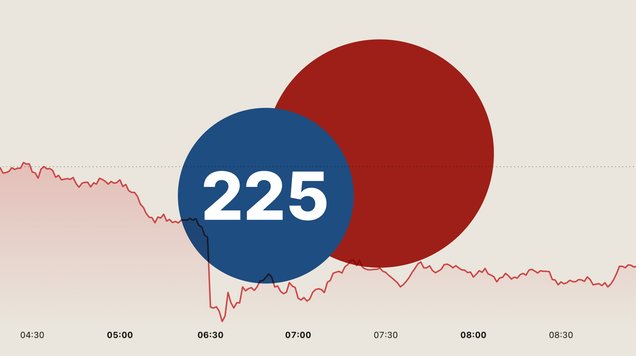

Brent future contract: current context

According to Reuters and market sources, the Novorossiisk terminal — a major Russian export hub — sustained damage to storage and loading facilities following a Ukrainian attack, interrupting shipments and prompting concerns about near-term seaborne crude availability. Given Novorossiisk’s role in Russia’s export capacity, the incident introduced an immediate geopolitical risk premium into the oil complex.

As markets re-priced the potential reduction in flows, the Brent futures contract (BRNF6) appreciated approximately 2.19 per cent to about US$64.39 per barrel. Participants are also weighing the cumulative effect of forthcoming Western sanctions and the US deadline of 21 November 2025 for winding down certain transactions with sanctioned Russian entities; these factors could further restrict available supply if they materially curtail exports.

At the same time, reports that OPEC+ may consider modest production increases for the coming months act as a countervailing influence. The result is a market grappling with two opposing forces: an immediate supply shock from the Novorossiisk disruption and the potential for additional output from OPEC+ members. That duality is contributing to elevated price volatility and a broader sense of uncertainty about where near-term equilibrium prices will settle.

Technical analysis on Brent futures

From a technical perspective, the price of Brent remains in a long-term bearish trend, trading below its key long-term moving averages. However, in the short term, the contract appears to be forming a consolidation phase. Key observations include:

- Trend context. In the long term, the price of Brent is trading below its 50, 100, and 200-day moving averages and is descending within a bearish channel. In the short term, the contract is consolidating in a range, primarily between $60 and $80 per barrel.

- Resistance levels. On the upside, relevant technical resistances are identified at: $68 (a structural level, coinciding with the 200-day moving average), $72 (short-term resistance), and $78 (the ceiling of the long-term bearish channel). A decisive break above these levels would signal further upside potential.

- Support levels. On the downside, important technical support levels are: $62.62 (short-term support) and $60 (a key short-term support and a relevant psychological level). A loss of the $60 zone would increase the probability of a deeper correction.

- Volume analysis. The volume profile indicates a significant distribution, with the Point of Control (POC) located near $66 per barrel. This suggests that this price zone represents a key area of interest for traders and hedgers. Trading volume has also been notable at these lower price levels, indicating that significant activity has taken place during the price decline.

Figure 1. Brent future contract BRNF26 (2024-2025). Source: Data from the ICE-EUR Exchange. Own analysis conducted via TradingView.