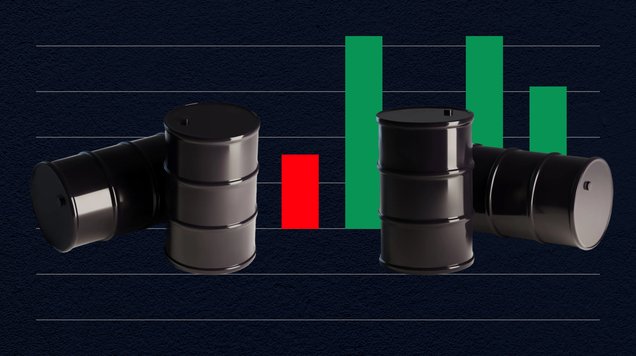

Brent prices hit lowest level since March 2021 amid demand fears

Updated employment data in the United States has signalled that Non-Farm Payrolls (NFP) and unemployment rate indicators have been negatively impacted by a combination of factors, including immigration challenges, increasing AI automation, and reduced government spending. Consequently, concerns over global oil demand have intensified.

Brent prices fell by approximately 2.7 per cent to their lowest level since March 2021 ($58.92 per barrel), amidst concerns regarding global demand.

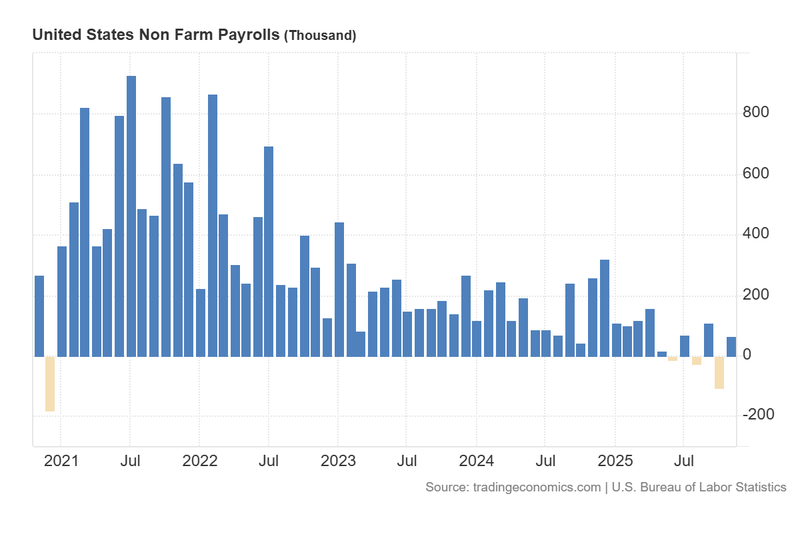

US Non-Farm Payrolls contracted by 105,000 job positions in October, followed by a modest recovery of 64,000 in November; the slope over the last four years remains negative.

The unemployment rate climbed to its highest level in four years, exceeding analysts' estimates and surpassing the Federal Reserve’s outlook, which projects a rate of 4.5 per cent in 2025.

At the beginning of this week, Chinese industrial production and retail sales decelerated, adding to concerns regarding domestic consumption, one of the most affected factors in the Asian economy.

US employment data reveals deeper-than-expected weakness, adding uncertainty to global oil demand

The Brent future contract declined by 2.71 per cent to its lowest level since March 2021 ($58.92 per barrel) amidst mounting concerns regarding the US economy. Employment data from the United States signalled a marked deterioration in both the NFP and unemployment rate indicators.

According to data from the US Bureau of Labour Statistics, Non-Farm Payrolls (NFP) contracted sharply in October with a loss of 105,000 jobs (the worst level since January 2021). In November, the indicator posted a modest recovery of 64,000 new positions, slightly above the analyst forecast of 50,000.

Concurrently, the unemployment rate in November rose from 4.4 per cent to 4.6 per cent, exceeding the analyst estimate of 4.4 per cent and surpassing the Federal Reserve’s latest outlook for 2025, which projects a rate of 4.5 per cent. The current level is the highest recorded since October 2021 and represents a bullish trend over the last four years. It is important to note that the October unemployment rate reading was not published due to data collection gaps resulting from the government shutdown.

The US employment indicators exhibit a significant deterioration that even exceeds the Fed’s outlook for the current year. The trajectory of the NFP index is clearly negative, reaching a gradual contraction in job positions. Furthermore, the unemployment rate is rising in both the private and public sectors, which have been affected by a combination of factors such as high immigration issues, increased automation through the use of artificial intelligence, and a reduction in government expenditure amidst federal spending challenges.

The weakness exhibited in US labour data is compounded by the softness observed in Chinese readings at the beginning of this week. On Monday, the National Bureau of Statistics of China reported that industrial production and retail sales decelerated, falling below analysts’ estimates.

The US and Chinese economies are the two most significant globally; therefore, any indication of a negative impact on their economies generally affects the expected demand for key commodities such as oil. Nevertheless, oil prices are being influenced by mixed factors, including the Russian-Ukrainian and US-Venezuelan conflicts, which could drive demand if petroleum supply chains are disrupted.

Figure 1. United States Non-Farm Payrolls (2021-2025). Source: Data from the US Bureau of Labor Statistics; figure obtained from Trading Economics.

Technical analysis of the Brent futures contract

From a technical perspective, the Brent futures contract remains confined within a bearish channel pattern and is trading below its long-term moving averages. Key observations include:

- Trend context. In the long term, the Brent futures contract maintains its position within a bearish channel and trades below its 50, 100, and 200-period moving averages. In the short term, a key support level is being tested to the downside amidst demand concerns.

- Resistance levels. Should the resistance at $67 per barrel (a structural resistance coinciding with the 200-day moving average) be breached to the upside, the next significant ceiling is $77 (the upper boundary of the bearish channel). A decisive break above these levels would suggest the potential for an extension into higher price zones.

- Support levels. Should the support at $60 per barrel (short-term support and a relevant psychological level) be breached to the downside, the next relevant floor is $55 (the lower boundary of the bearish channel). A loss of the $55 zone would increase the probability of a deeper correction.

- Momentum indicators. The MACD is exhibiting neutral momentum, hovering close to the zero line. However, the RSI indicator is approaching the oversold zone, which could suggest a possible reaction from buyers.

Figure 2. Brent futures contract BRNG26 (2024-2025). Source: Data from the ICE-EUR Exchange; own analysis conducted via TradingView.