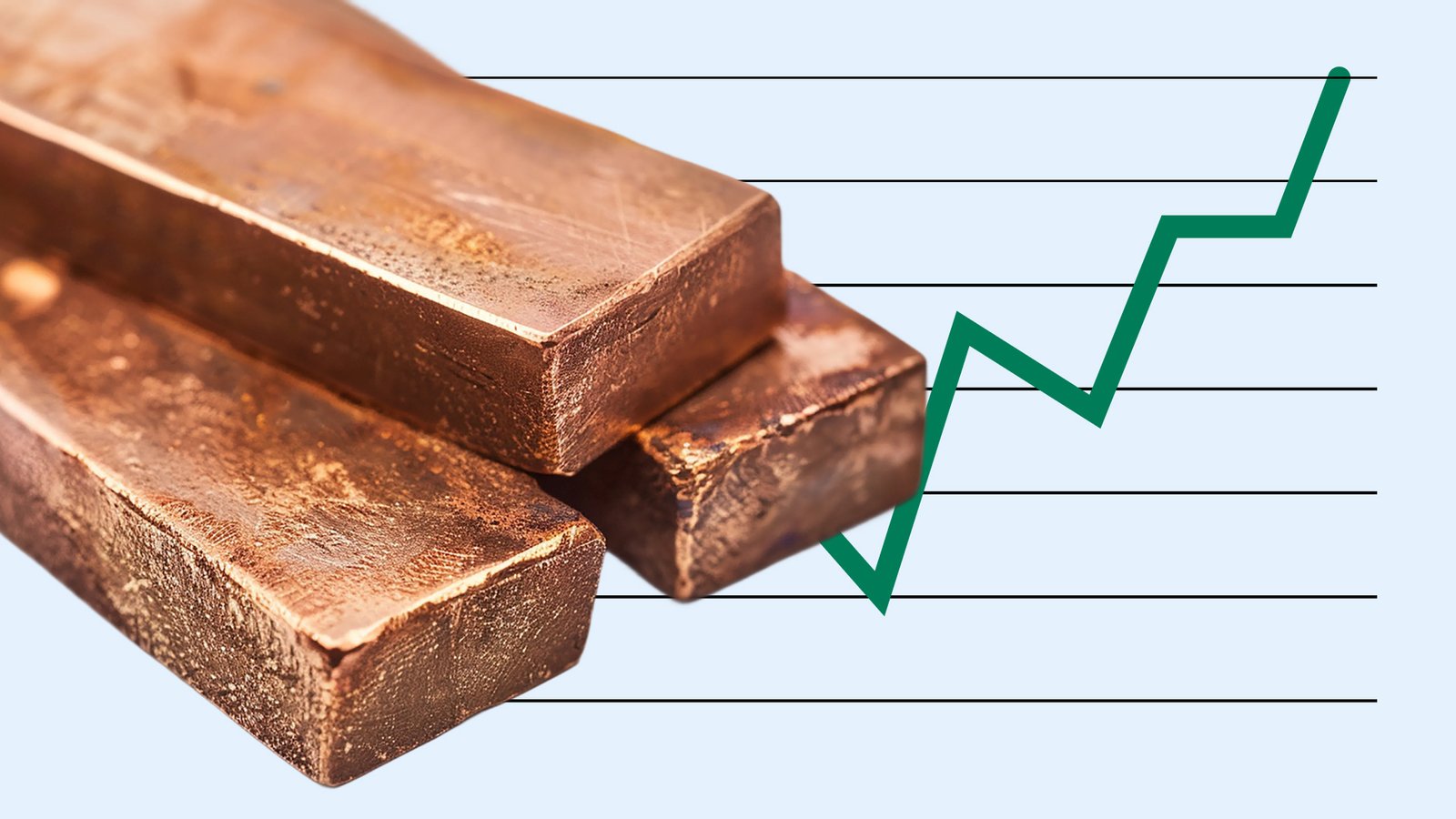

Copper from tariff fears to structural demand

US warehouses are overflowing with copper, and the world’s biggest buyer (China) is closing up shop for the holidays. In a normal cycle, prices would crash. Instead, mining stocks are ripping higher.

535,000 tons of copper sitting in US warehouses.

Global X Copper Miners ETF (COPX) is up 118% year-over-year.

$6.50 remain notable historical reference level.

Strategic stockpile

U.S. copper inventories have climbed to 535,000 tons the highest level since 2003. Under normal circumstances, a build of that size would signal oversupply and weakening demand. The increase reflects precautionary positioning rather than unwanted surplus. Amid uncertainty surrounding potential Section 232 trade measures tied to national security, traders and industrial buyers have accelerated imports to secure supply ahead of possible tariffs. The strategy is straightforward: lock in material now to avoid paying a premium later.

As a result, a significant portion of the metal sitting in warehouses is not freely circulating in the spot market. Some inventory is effectively pre-committed to industrial users, while other volumes are tied up in arbitrage strategies between London (LME) and New York (COMEX) pricing. If tariff uncertainty fades or if U.S. industrial demand strengthens inventories could decline quickly. What appears on the surface as excess supply may, in reality, represent strategic stockpiling awaiting clarity.

ETFs are outperforming the metal

Global X Copper Miners ETF (COPX) has risen 118% year-over-year and attracted roughly $2 billion in fresh inflows since January. That sharp outperformance relative to the underlying metal reflects the structural leverage embedded in mining equities.

Mining operations tend to have relatively fixed costs in the short to medium term. When copper prices move above key profitability thresholds, incremental price gains can translate into disproportionately stronger earnings. This operating leverage makes producers particularly sensitive to sustained shifts in the commodity cycle.

Investors positioning in the sector appear to be expressing a longer-term view rather than trading short-term price swings. The thesis centers on structural demand from electrification, renewable infrastructure, and AI-driven data center expansion, combined with limited near-term supply growth.

Developing a new copper mine typically requires a decade or more due to permitting, financing, and construction timelines. As a result, existing producers represent the bulk of available supply for the foreseeable future. Equity inflows suggest that investors see established miners as leveraged vehicles for potential multi-year demand trends, rather than simply proxies for spot copper prices.

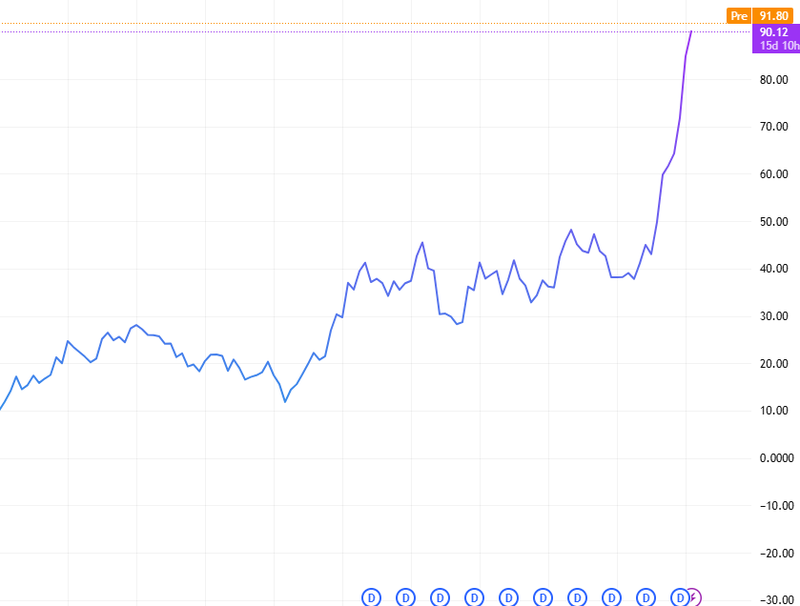

Source: Trading View

Technical outlook

Copper is currently trading within a consolidation range following its strong advance earlier this year. The Relative Strength Index (RSI) fluctuates between 45 and 52, indicating that the previously overbought conditions seen in January have largely eased. Momentum has moderated, but there are no clear technical signs suggesting a reversal in the broader trend at this stage.

From a technical perspective, the 50-day Exponential Moving Average (EMA), currently near $5.80, remains an important reference point for market participants. Throughout much of the 2025–2026 rally, price activity has tended to stabilize around this moving average during pullbacks. Sustained positioning relative to this level continues to shape short-term sentiment.

On the upside, previous highs near $6.20 and $6.50 remain notable historical reference levels. Market attention is also focused on supply dynamics, with industry projections pointing to a potential global copper deficit of approximately 330,000 tons in 2026. How these fundamental factors interact with broader macro conditions will likely influence price behavior in the months ahead.

Source: Trading View