EU industrial production and German GDP exhibit strength, but Euro declines

Year-on-year industrial production in the European Union (EU) surpassed analysts’ forecasts, while Germany’s Gross Domestic Product (GDP) returned to growth in 2025.

EU industrial production rose from 1.7% to 2.5%, exceeding market expectations.

German GDP closed 2025 in positive territory, ending a two-year period of economic contraction.

Currency markets saw the euro depreciate despite these robust indicators, driven by sustained strength in the US dollar.

EU industrial production accelerates as German GDP breaks two-year contraction

According to data from Eurostat, year-on-year industrial production accelerated from 1.7% in October to 2.5% in November, outperforming analysts’ expectations of a 2% increase. This updated figure represents the highest level since October 2022, signaling a recovery in an industrial sector that had faced significant deterioration in recent years.

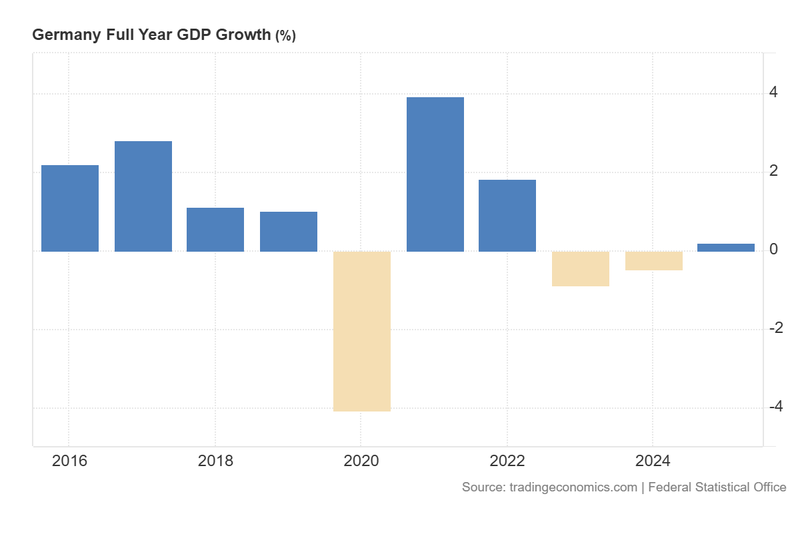

In tandem, data from the Federal Statistical Office of Germany indicates that the full-year GDP growth rate reached 0.2% in 2025. This result concludes two consecutive years of economic contraction. Collectively, the industrial production figures and German GDP growth provide a more optimistic outlook for a European economy that has recently struggled with sluggish growth.

Regarding the market reaction, the euro depreciated by 0.32% to $1.1606 against the US dollar. Although the economic indicators imply a potential recovery in production and consumption, the prevailing strength of the dollar continues to exert downward pressure on the European currency.

Figure 1. Germany full year GDP growth (2016-2025). Source: Data from the Federal Statistical Office; Figure obtained from Trading Economics.

Technical analysis of the EUR/USD pair

From a technical perspective, the EUR/USD pair remains within a broader bullish trend; however, in the short term, price action is forming a consolidation structure. Key observations include:

- Trend Context: In the long term, the EUR/USD pair has maintained a bullish structure characterized by higher highs and higher lows. Nevertheless, in the short term, the euro is trading within a consolidation range between $1.1470 and $1.1860.

- Resistance Levels: Should the short-term resistance at $1.1860 be breached to the upside, the next significant ceiling is the $1.2270 level—a long-term structural resistance. A decisive break above this zone would suggest potential for an extension toward higher price targets.

- Support Levels: If short-term support at $1.1470 is compromised, the next relevant floor is located at $1.1230 (a structural pivot point). A breach of the $1.1230 zone would increase the probability of a deeper market correction.

- Momentum Indicators: The MACD is currently crossing the zero line, suggesting a nascent bearish trend that could gain momentum. Additionally, the RSI oscillator exhibits a downward slope, indicating that bearish momentum is strengthening in the short term.

Figure 2. EUR/USD pair (2024-2025). Source: Data from the Intercontinental Exchange (ICE); own analysis conducted via TradingView.