Google leads big tech with accelerating growth

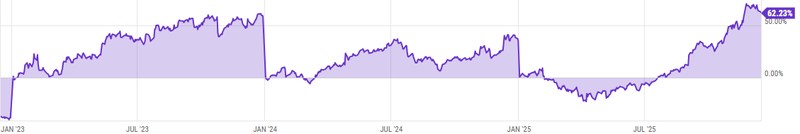

Alphabet Inc. (Google) has emerged as one of the standout performers in 2025, delivering a year-to-date total return of 62%, surpassing major peers like Apple, Amazon, and Microsoft. Its market capitalization reached a record $3.89 trillion in November, setting a new milestone for one of the world’s most valuable companies. Investors have rewarded Google’s consistent innovation, diversified revenue streams, and strategic positioning in artificial intelligence (AI).

Google is widely regarded as one of the least vulnerable companies in the event of an AI bubble.

Google’s outperformance other major tech companies.

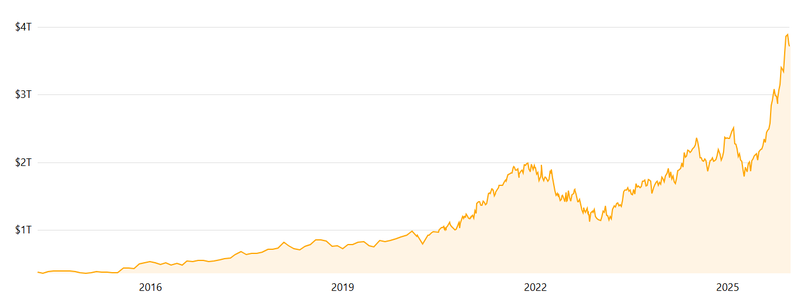

Google hits new record market capitalization of $3.89 trillion.

Google leading the AI landscape

One of the main reasons behind Google’s resilience in 2025 is its strong position in artificial intelligence. While the market has seen a lot of AI hype and speculative investment, Google is considered one of the least exposed companies if an AI bubble were to form. This is mainly because of its deep vertical integration. Google builds much of its technology in-house, including AI models, software platforms, cloud infrastructure, and even its own custom chips. Its Tensor Processing Units (TPUs) give the company better performance and cost control compared with firms that rely on external hardware, allowing Google to scale AI more efficiently and keep control over key technology. AI is also built into many of Google’s core services, such as search, advertising, YouTube, and cloud products. This broad use of AI spreads the benefits across different business lines, rather than relying on a single source of growth.

Google Outperforms Big Tech on Strong Growth

Google’s outperformance stands out when compared with other major technology companies such as Microsoft, Amazon, and Apple. This strong performance is driven by steady revenue growth and ongoing product innovation. Advertising from Search and YouTube continues to be a key source of strength, with AI-powered targeting helping improve monetization and boost returns. At the same time, Google Cloud is expanding steadily, attracting large businesses that are looking for advanced machine learning and cloud solutions. The close integration of hardware, software, cloud services, and AI creates a strong ecosystem that builds customer loyalty and opens multiple revenue streams. Together, these factors have helped Google achieve a 62% year-to-date return in 2025, up from 40% at the same point last year, showing faster growth and strong resilience even during periods of market volatility.

Source: Ycharts

Google’s Market Cap Reached a New High

Google’s record market value of $3.89 trillion shows strong investor confidence in the company’s long-term outlook. This achievement reflects not only solid earnings growth, but also the market’s trust in Google’s ability to innovate while maintaining financial discipline. The company’s strong balance sheet and steady cash flow give it the flexibility to keep investing in research and development, pursue strategic acquisitions, and return value to shareholders through stock buybacks. These strengths have helped to position Google as one of the leading companies in the technology sector, capable of sustaining growth even during uncertain market conditions. Overall, Google’s performance in 2025 highlights its ability to benefit from new technology trends while managing risk effectively. A 62% year-to-date return, a record market capitalization, and its in-house approach to AI and hardware development make Google one of the most stable and well-positioned companies in the market. While other tech stocks may face volatility from AI speculation or reliance on outside suppliers, Google’s diversified business model and continued focus on innovation supports its long-term growth and reinforces its role as a key driver of shareholder value.

Source: Companiesmarketcap