IonQ rally cools as shares approach key pivot zone

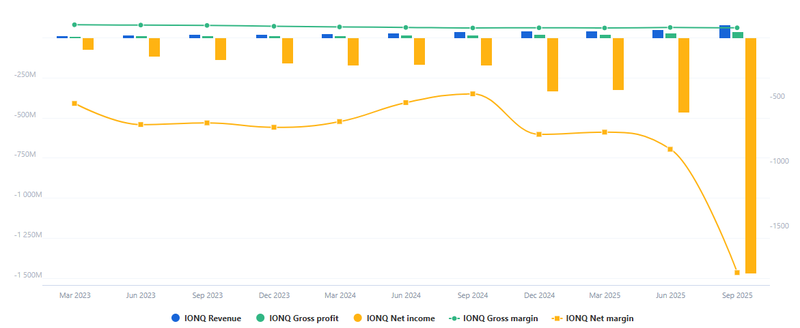

IonQ has delivered explosive top-line growth over the past year, but the financial picture beneath the surface reflects a company still deep in expansion mode and still unprofitable.

Gross profit rose 118% YoY and 45% QoQ.

IonQ has accelerated its strategy to build a vertically integrated quantum ecosystem.

The stock recently formed a lower high near $55.65.

Revenue growth meets margin pressure

IonQ continues to demonstrate extraordinary top-line acceleration, but its latest financial profile shows that aggressive expansion is still weighing heavily on profitability. Revenue has surged 113% year-on-year and 52% quarter-over-quarter, reflecting strong commercial momentum and increasing adoption of quantum computing services. Gross profit has also expanded sharply, rising 118% compared to last year and 45% from the previous quarter, signaling improving core unit economics as scale increases.

However, beneath that impressive growth, profitability metrics tell a more complex story. Operating income has contracted by 130% year-over-year and 32% sequentially, while net margin has dropped 107% quarter-over-quarter. The company remains firmly in investment mode, prioritizing infrastructure, research, and acquisitions over near-term earnings stability.

Source: Full ratio

Vertical integration at a cost

Beneath that impressive growth, profitability metrics tell a more complex story. Operating income has contracted by 130% year-over-year and 32% sequentially, while net margin has dropped 107% quarter-over-quarter. The company remains firmly in investment mode, prioritizing infrastructure, research, and acquisitions over near-term earnings stability.

IonQ has accelerated its push to build a vertically integrated quantum platform through multiple acquisitions. The strategy aims to control more of the quantum computing stack, strengthening long-term competitive positioning. Yet this expansion has been funded in part through new share issuances, diluting existing shareholders. Investors are therefore weighing whether the long-term strategic moat being constructed will ultimately justify the short-term financial strain.

Technical outlook

After a powerful rally in late 2024 and early 2025, IonQ has shifted technically. The stock formed a Lower High near $55.65 and broke below its primary uptrend line, signaling a move from strong momentum into consolidation or correction.

Shares are trading around $35.73 and testing a key pivot near $31.30, a level that previously acted as support. The break below a major moving average suggests the prior “buy-the-dip” dynamic may be fading. Momentum sits near 35, approaching oversold territory, which could indicate stretched selling pressure but does not confirm a rebound.

If $31.30 holds, stabilization could develop. A sustained break below it would increase the likelihood of a deeper move toward $18.18. To restore a stronger medium-term structure, the stock would need to reclaim $55.65. Until then, the trend remains cautious.

Source: Trading View