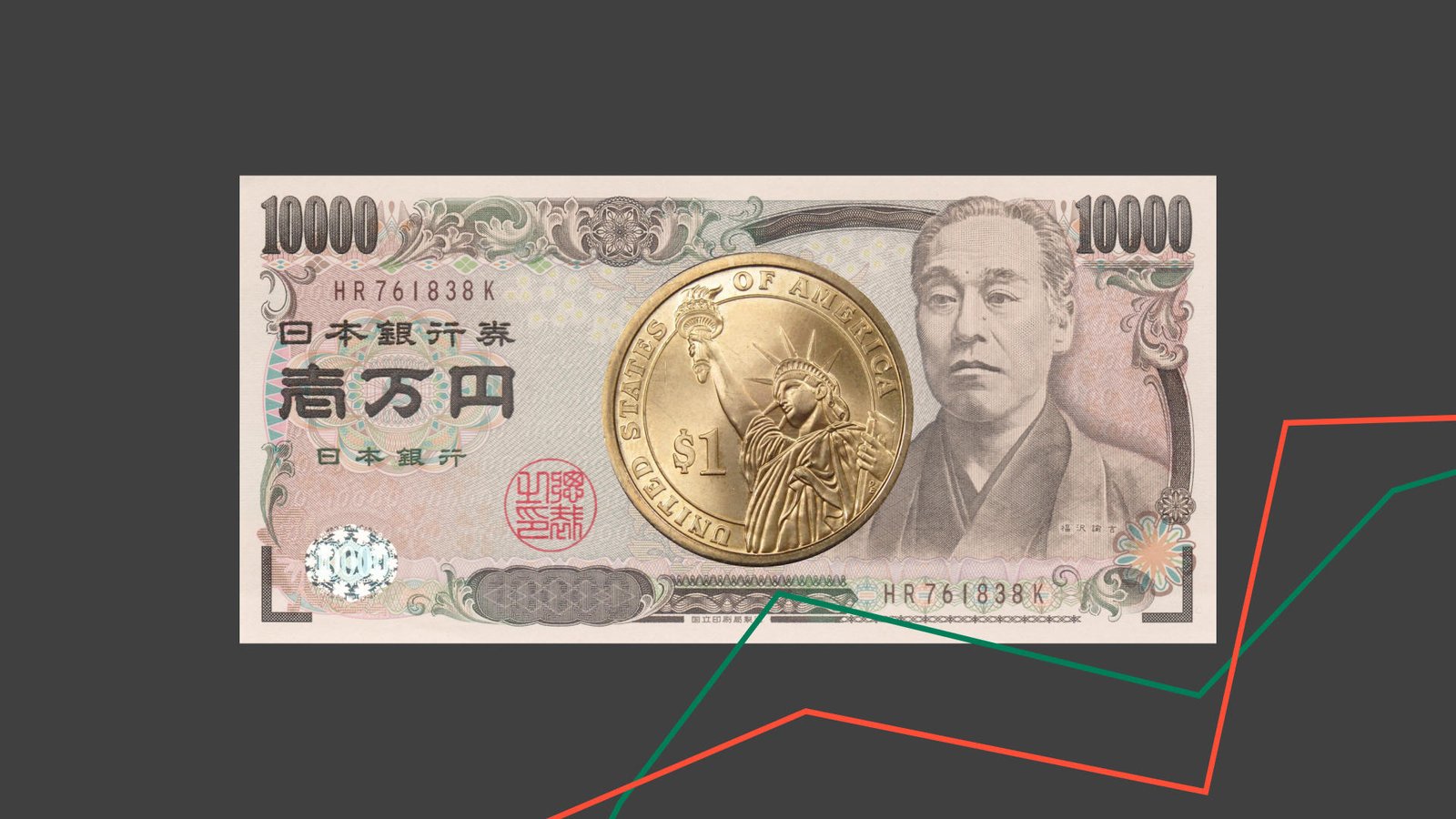

Japanese yen continues to weaken on expansionary expectations

The Japanese yen has continued to depreciate as markets price an increasingly expansionary fiscal and economic policy under the new administration of Prime Minister Sanae Takaichi. That government-led growth impetus — coupled with still-elevated inflation and mixed GDP readings — has weakened the case for a sharp near-term appreciation of the yen, even as the Bank of Japan (BoJ) signals its intention to manage price stability.

Political shift: Prime Minister Sanae Takaichi’s pro-growth agenda has increased market expectations of fiscal stimulus and looser domestic financial conditions, pressuring the yen.

Macro mix: Japan’s year-on-year GDP has risen modestly (c. 1.1%), yet Q3 GDP contracted by c. 0.4% quarter-on-quarter, underlining inconsistent growth dynamics.

Inflation vs policy: Headline inflation at c. 2.9% is above the BoJ’s target, creating a policy dilemma between price stability and the government’s growth priorities.

FX technicals: USD/JPY has broken short-term technical structures to the upside and is trading within a consolidation band; momentum indicators signal near-term bullish strength for the dollar against the yen.

Japanese economy: current context

The arrival of Prime Minister Sanae Takaichi has shifted Japan’s policy narrative towards a more expansionary stance, with the administration emphasising fiscal support and measures intended to stimulate growth after years of low dynamism. Markets have taken this as a signal that fiscal impulses — and potentially accommodative financial conditions — will be prioritised to reignite domestic demand.

The macro picture is mixed. On an annual basis, GDP growth stands at roughly 1.1 per cent, but the third-quarter reading showed a quarter-on-quarter contraction of around 0.4 per cent, highlighting weakness in short-term activity. At the same time, headline inflation has risen to about 2.9 per cent, exceeding the Bank of Japan’s target and complicating the policy trade-off between supporting growth and containing price pressures.

This combination — stronger political impetus for expansion alongside elevated inflation — has tilted market expectations towards a looser fiscal trajectory that could weigh on the yen. While the BoJ retains responsibility for monetary policy and has indicated willingness to tighten if inflation proves persistent, investors appear to be pricing the government’s growth orientation as the dominant near-term influence on exchange-rate dynamics.

Technical analysis of the USD/JPY pair

From a technical perspective, the USD/JPY pair has exhibited significant consolidation (range-bound trading), accompanied by an emerging short-term bullish trend. Key observations include:

Trend context

In the long term, the USD/JPY pair has demonstrated substantial consolidation between ¥140 and ¥158. In the short term, the exchange rate has trended higher, favouring the US Dollar following a breakout from a bullish triangle pattern to the upside.

Resistance levels

On the upside, key technical resistance levels are identified at: ¥158.50 (structural resistance) and ¥161.50 (a three-year high). A decisive break above these levels would suggest the potential for further appreciation to higher price zones.

Support levels

On the downside, critical technical supports are: ¥153.27 (short-term support) and ¥150.75 (medium-term support). A breach of the ¥150.75 zone would increase the probability of a deeper correction.

Momentum indicators

Both the MACD and RSI are currently situated in overbought territory; however, neither indicator displays bearish divergence. Consequently, short-term momentum remains predominantly bullish.

Figure 1. USD/JPY exchange rate (2024-2025). Source: Data from the Intercontinental Exchange (ICE); own analysis conducted via TradingView.