Micron enters a structural growth phase as AI redefines memory demand

Micron Technology delivered one of the most extraordinary equity performances of 2025, with its stock rising more than 239%, far outpacing the broader market and cementing its position as a core beneficiary of the artificial intelligence cycle. But after such a powerful move, the market is no longer focused on what Micron has done. The focus has shifted to whether earnings, pricing power, and demand visibility can justify the next phase of gains.

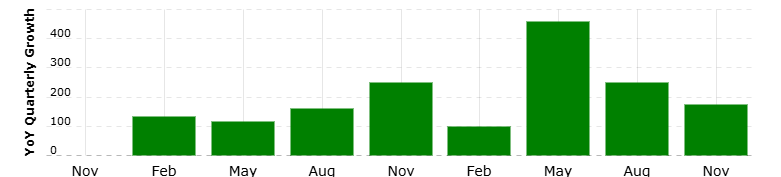

Micron’s earnings were dominated by spot pricing volatility.

Industry forecasts call for another 40% increase in memory prices in 2026.

Revenue rose 69%, and management’s guidance for Q2 EPS near $8.42.

The memory cycle has shifted from spot-driven to contract-driven

Historically, Micron’s earnings were dominated by spot pricing volatility. DRAM and NAND cycles were short, oversupply arrived quickly, and margins collapsed just as fast as they expanded. That framework no longer fits today’s data. AI workloads require high-bandwidth, low-latency memory that cannot be easily substituted or stockpiled. HBM, in particular, is no longer a commodity product; it is a capacity-constrained infrastructure input tied directly to GPU and accelerator deployment schedules.

The most critical data point is that Micron’s entire HBM output for calendar 2026 is already fully allocated under long-term supply agreements. These contracts lock in both volumes and pricing, effectively removing a large portion of revenue from spot market volatility. This alone explains why analysts are now modeling structurally higher margins rather than a typical boom-bust pattern. When supply is pre-sold and demand is linked to multi-year AI infrastructure buildouts, the cycle length extends significantly.

Supply constraints are persistent, not temporary

Micron’s latest financials already show extreme operating leverage. Revenue grew 56.7% year-on-year, but EPS surged 175%, highlighting how aggressive pricing and mixed improvements are flowing through to the bottom line. Industry forecasts calling for another 40% increase in memory prices in 2026 are not driven by speculation, but by physical limitations. Advanced memory manufacturing is capital-intensive, technologically complex, and slow to scale. Even with Micron increasing capital expenditure to $20 billion, production will only partially close the demand gap. Current output meets just 50% to 66% of customer needs, meaning undersupply persists even after expansion.

Importantly, Micron’s capex is not broad-based. The majority is directed toward HBM and leading-edge DRAM nodes, where pricing power is strongest. This targeted investment reduces the risk of flooding lower-margin segments and reinforces pricing discipline across the industry. Unlike previous cycles, competitors are also showing restraint, limiting the chance of a rapid supply glut.

Source: macrotrends

Margins still have room to expand

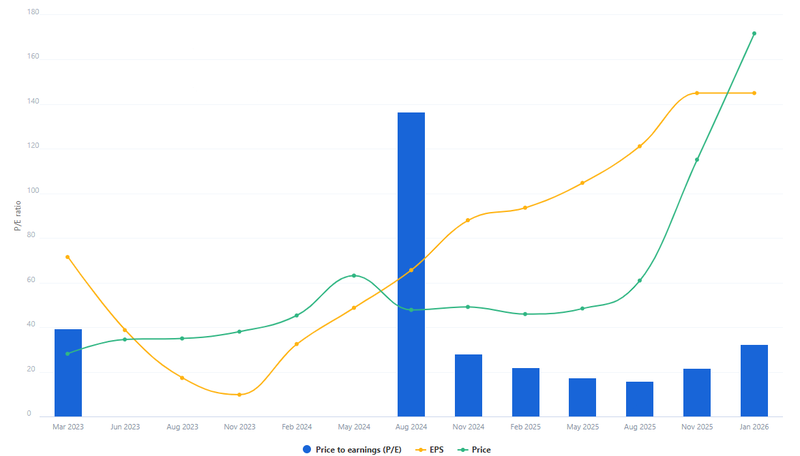

DRAM revenue rose 69%, reflecting both higher volumes and sharply improved pricing, while the company’s growing exposure to high-bandwidth memory continues to lift blended margins. Management’s guidance for second-quarter EPS near $8.42 implies operating margins are still expanding rather than plateauing, a notable signal this late in a traditional semiconductor upcycle. That projection would represent nearly a five-fold increase versus the same period last year, underscoring how different this cycle looks from prior memory booms.

What matters going forward is not whether margins peak in a single quarter, but whether they reset structurally higher over multiple years. With HBM pricing locked under long-term agreements through 2026 and DRAM prices expected to continue rising into next year, analysts are increasingly modeling a higher sustainable margin floor. This shift is already visible in valuation, with Micron trading at a forward P/E near 32. While elevated relative to past memory cycles, the multiple reflects expectations of more durable earnings, longer contract visibility, and reduced cyclicality driven by AI-linked demand. The market is increasingly valuing Micron not as a purely cyclical memory supplier, but as a company with recurring, contract-backed earnings power tied to long-duration AI infrastructure spending.

Source: fullratio