Micron stock rises as growth catalysts, new highs, and AI funding concerns emerge

Micron Technology’s (MU) stock has been in focus this week as fresh company developments, strong price momentum, and broader investor debates on AI funding continue to shape market expectations. New product progress and demand signals from several key segments have lifted sentiment, pushing MU to recent highs. At the same time, some investors are cautious, pointing out that profits relative to large AI-focused funds and competitors may not yet justify overly optimistic valuations.

Company recently announced progress in its advanced DRAM and next-generation memory node development.

Micron’s share price recently climbed to new all-time high.

Profits and cash flow remain modest compared with the scale of investment money.

What’s new at Micron

Micron has been rolling out updates on both its memory technology and customer wins that have helped lift investor attention. The company recently announced progress in its advanced DRAM and next-generation memory node development, with stronger-than-expected yields and production timelines. These improvements help Micron compete more effectively with peers in the DRAM market, where capacity and performance are central to pricing power. In addition, Micron reported better demand signals from data center and cloud customers in the latest industry surveys. While consumer PC demand remains mixed, enterprise spending on high-bandwidth memory for servers and virtualization has shown expanding momentum. That shift matters because data centers account for a growing share of Micron’s revenue and tend to drive higher-margin sales compared with commodity memory. Analysts have also pointed to inventory normalization in the broader semiconductor supply chain. After years of swings between oversupply and shortages, channel inventories are returning to healthier levels, reducing sharp price collapses and supporting order visibility. This backdrop gives Micron more clarity on production and sales forecasts as it heads into 2026.

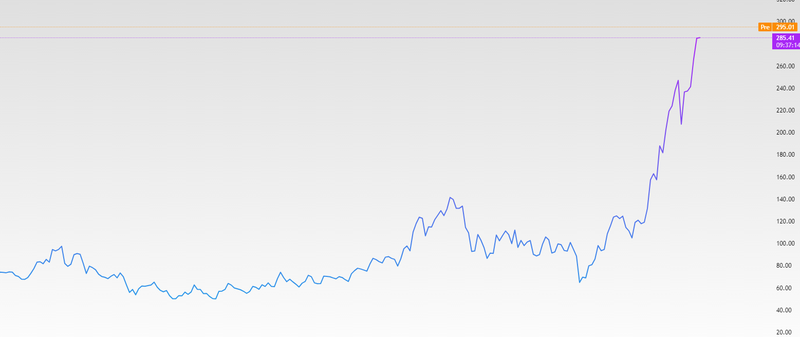

Micron hit new highs

Micron’s share price recently climbed to new all-time high $298.88, driven by a combination of strong earnings revisions, improving demand signals, and broader industry strength. After several analysts raised their earnings estimates for full-year 2026, MU broke through psychological resistance levels that had capped gains earlier in the year. A key factor supporting the rally has been improving memory pricing trends. After prolonged downward pressure on DRAM and NAND prices, quarterly industry reports indicated slower declines and signs of stabilization, which suggests better revenue outlooks for the coming quarters. Investors interpreted these trends as evidence that the painful memory price cycles of prior years may be moderating. Additionally, the broader semiconductor sector has benefited from renewed interest in capital expenditure growth from cloud providers and AI infrastructure builders. Even though memory is often a smaller piece of overall AI hardware spending compared with GPUs and custom silicon, stronger server demand still feeds into Micron’s top line, especially in high-performance segments like HBM (high-bandwidth memory). Finally, technical momentum played a role. Breakouts above key moving averages and volume increases after positive earnings revisions helped attract rotation from discretionary traders and institutional flows, reinforcing the upward trend.

Source: Trading View

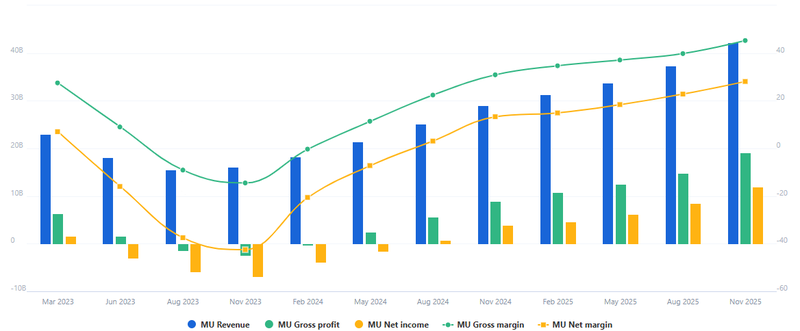

Profit growth brings a shift in the Micron story

Micron’s earnings profile has improved sharply, helping explain why investor sentiment has strengthened despite ongoing concerns about AI funding concentration. Operating income surged 198% year over year and rose 41% quarter over quarter, reflecting both higher memory prices and tighter cost control after a long downturn in the cycle. This rebound highlights how sensitive Micron’s business is to pricing conditions, with even modest improvements in demand translating into significant earnings gains. At the same time, gross profit jumped 113% year over year and increased 29% from the previous quarter, signaling that margins are recovering as production efficiency improves and inventory pressures ease. This suggests that Micron is now benefiting from a healthier supply-demand balance across DRAM and NAND markets, after several quarters of margin compression. Profitability at the bottom line has also strengthened. Net margin climbed 111% compared with a year ago and rose 23% quarter over quarter, showing that higher revenues are increasingly flowing through to earnings rather than being absorbed by costs. Operating margin followed a similar path, rising 106% year over year and 25% from the prior quarter, reinforcing the idea that Micron’s recovery is not just revenue-driven but structurally improving. These numbers matter because they shift the discussion around Micron’s role in the AI and data-center cycle. While its profits may still be smaller than the capital flowing into large AI-focused names and mega-funds, the pace of improvement is accelerating. Investors are now watching whether this margin expansion can be sustained as AI-related memory demand grows, or whether competitive pressures and future capital spending will slow down the momentum.

Source: fullratio.com