Micron’s outperforming the titans of tech

Micron Technology is quietly redefining the semiconductor narrative. In its Q1 2026 earnings call last December, management revealed that the company’s high-bandwidth memory (HBM) for AI servers had already sold out before the year even began.

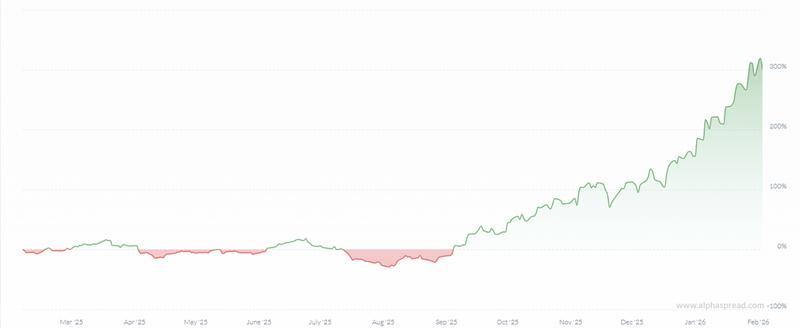

Micron outperformed Nvidia 301% over the past 12 months.

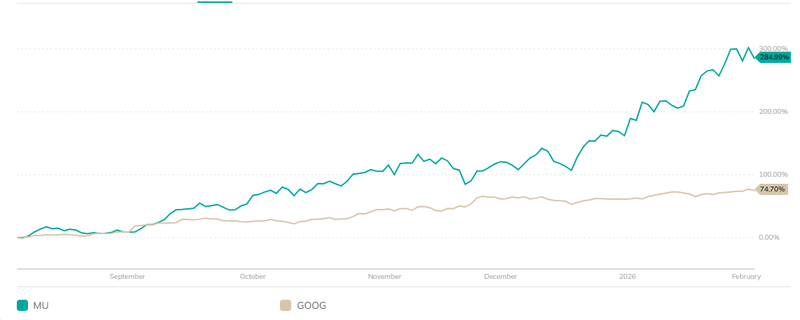

Micron surging roughly 284%, while Google has risen by a much more modest 74%.

Rally appears to be a fundamentally driven uptrend rather than an irrational bubble.

Micron outpaces Nvidia

Over the past year, the semiconductor world has witnessed a remarkable shift. While NVDA has long dominated headlines as the face of AI computing, Micron has quietly stolen the spotlight with a stunning 301% surge in its stock price over the past 12 months. In comparison, NVIDIA’s stock, though strong, has lagged behind, reflecting a market recalibration, it’s not just GPUs that power AI it’s the memory that fuels them.

Micron’s success is rooted in its leadership in high-bandwidth memory (HBM), the essential infrastructure for AI servers. HBM’s vertical stacking allows data to flow faster and more efficiently than traditional memory, precisely what AI accelerators demand when processing enormous datasets. During its Q1 2026 earnings call, Micron revealed that its entire HBM output for the year had sold out before the calendar even turned, highlighting explosive demand and near-term revenue visibility.

Source: Portfolios lab

Performance gap

While NVIDIA remains the go-to provider of AI GPUs, the performance gap tells an interesting story. Micron’s stock has more than tripled in the past year, whereas NVIDIA, despite strong adoption of AI, hasn’t matched this pace. Investors are recognizing that without memory, GPUs cannot perform at scale. Micron’s products sit at the core of AI infrastructure, and the market is rewarding this strategic advantage.

Analysts expect Micron’s earnings to quadruple next year, suggesting that today’s record profits are only a preview of what’s coming. Meanwhile, NVIDIA’s growth is tied more directly to AI software demand and GPU cycles, which face cyclical pressures and supply constraints. Micron’s focus on HBM, combined with expanding market share against South Korean rivals Samsung and SK Hynix, gives it a unique structural advantage that NVIDIA can’t easily replicate.

Memory outshines search and cloud

Over the past 12 months, Micron Technology has delivered a jaw-dropping performance, surging roughly 284%, while Google has risen by a much more modest 74%. This stark contrast highlights a broader trend in tech markets: the explosive demand for high-performance memory in AI and data-intensive applications is driving returns far beyond traditional software and cloud leaders.

Micron’s strength lies in its dominance of high-bandwidth memory (HBM), a critical component for AI servers. HBM allows faster data transfer while consuming less power, making it indispensable for the new generation of AI accelerators. In its Q1 2026 earnings call, Micron revealed that its entire HBM production for the year had already been sold out before January, underscoring the intense demand and giving investors’ confidence in near-term revenue and profitability.

Google, on the other hand, has benefited from its AI initiatives, cloud expansion, and advertising growth, but its stock growth has been constrained by multiple factors. Regulatory scrutiny, competition in AI services, and slower-than-expected monetization of certain AI tools have tempered its upside. While Google remains a dominant tech giant, the pace of investor enthusiasm has been far slower compared to Micron’s meteoric rise fueled by tangible hardware demand.

Source: Portfolios lab

Micron riding a healthy uptrend or inflated bubble

MU surge is largely grounded in tangible demand: its high-bandwidth memory (HBM) modules are crucial for AI servers, and the company already sold out its 2026 HBM supply before the year began. Unlike speculative frenzies, where prices soar without clear revenue backing, risks remain. The stock’s rapid climb means valuations are elevated, and any slowdown in AI adoption or supply chain disruptions could trigger sharp corrections. Profit-taking by short-term traders could also lead to temporary dips.

Overall, MU’s rally appears to be a fundamentally driven uptrend rather than an irrational bubble, fueled by real demand in a high-growth AI sector. Investors should remain mindful of volatility, but the market’s enthusiasm reflects actual business momentum, not just speculative euphoria.