Micron’s rally may still have room to run

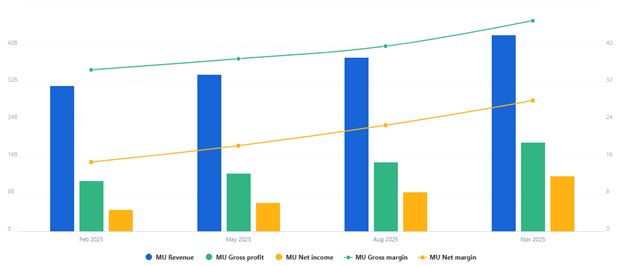

Micron’s recent surge looks less like a short-term spike and more like the early stages of a longer move. The company’s fundamentals are lining up at the right time, and the broader memory market is working strongly in its favor. In fiscal Q1 2026, Micron delivered record results.

Revenue projected at $18.7 billion and gross margin forecast at 68%.

Cloud computing continues to absorb available supply faster than it can be replaced.

Micron’s operating income surged by 198% year over year and 41% quarter over quarter.

Gross profit jumped 113% year over year and 29% from the previous quarter.

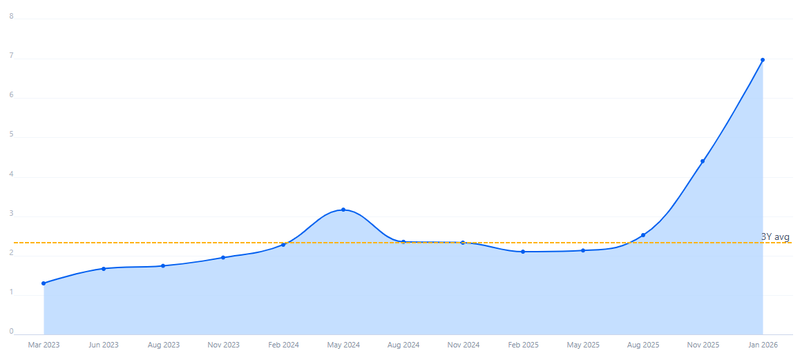

Micron’s P/E ratio now sits 79% above its four-quarter average of 19.2.

Strong fundamentals and market dynamics

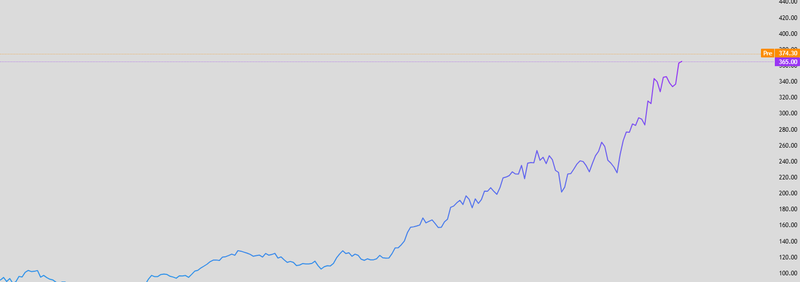

Micron’s rally is being supported by real business performance, not speculation. In fiscal Q1 2026, the company delivered record results, showing that demand for memory remains strong. More importantly, Micron’s outlook for the second quarter exceeded expectations, with revenue projected at $18.7 billion and gross margin forecast at 68%. These numbers suggest that pricing power is improving and that Micron is entering a more profitable phase of the cycle. Reflecting this momentum, Micron’s stock surged to a new all-time high of $381.60, signaling growing investor confidence that the current upcycle may extend further.

Source: Trading View

Market dynamics

The structure of the memory industry has shifted in favor of large, established producers like Micron. With only a limited number of global suppliers and tight control over capacity expansion, manufacturers now hold the upper hand in pricing negotiations. Unlike past cycles, companies are cautious about adding supply, which reduces the risk of oversupply and price collapses. The structure of the memory industry has shifted in favor of large, established producers like Micron. With only a limited number of global suppliers and tight control over capacity expansion, manufacturers now hold the upper hand in pricing negotiations. Unlike past cycles, companies are cautious about adding supply, which reduces the risk of oversupply and price collapses.

Supply shortages and cloud giants

Large cloud service providers are increasingly likely to sign multi-year supply agreements to secure memory access. This reduces uncertainty for Micron and could stabilize revenue over time. Long-term contracts would also limit downside risk during future market slowdowns, making Micron’s earnings more predictable than in previous cycles.

Cloud giants

While memory producers benefit from tight supply, semiconductor equipment firms face growing constraints. Expanding cleanroom capacity is costly and time-consuming, which limits how quickly new supplies can come online. This bottleneck strengthens Micron’s position and reduces the risk of sudden supply surges that could pressure prices.

Operating income and gross profit

Micron’s operating income surged by 198% year over year and 41% quarter over quarter. This sharp increase suggests the company is not only selling more chips but doing so at much higher margins. If pricing remains strong, operating income could continue to grow at a rapid pace. Gross profit jumped 113% year over year and 29% from the previous quarter. This indicates that Micron is successfully passing higher prices through to customers. Sustained strength here would further support margin expansion in the coming quarters.

Source Full ratio

Margins and valuation are rising

Net margin rose 111% year over year and 23% quarter over quarter, while operating margin climbed 106% annually and 25% sequentially. These gains show that Micron is becoming structurally more profitable, not just benefiting from a short-term spike in demand.

Micron’s P/E ratio now sits 79% above its four-quarter average of 19.2. While this suggests the stock is no longer cheap, earnings growth is helping justify the higher multiple. EPS grew 39% from the previous quarter, signaling that profits are catching up with the stock’s price.

Source: Full ratio

Book value and revenue growth

MU’s price-to-book ratio is 149% above its recent average, reflecting investor confidence in future returns. At the same time, equity is up 26% year over year and 9% quarter over quarter, strengthening the balance sheet and supporting long-term growth.

Micron’s price-to-sales ratio has expanded sharply, but revenue growth remains strong—up 45% year over year and 13% quarter over quarter. If demand from AI and cloud computing continues to accelerate, revenue growth could remain robust, helping sustain the higher valuation.

Source: Full ratio