Natural gas under winter pressure

The winter storm knocked out about 12% of US natural gas production, limiting supplies to power plants and households. Average output in the Lower 48 has fallen to around 106.9 bcfd so far in January from a record 109.7 bcfd in December. Gas flow to US LNG export plants dropped to the lowest level in a year.

8.29% monthly decline and a 1.13% drop year on year.

US LNG export plants at their lowest level in a year.

Natural gas prices have surged by roughly 73%.

Moscow’s influence remains very real.

United States demand shifts

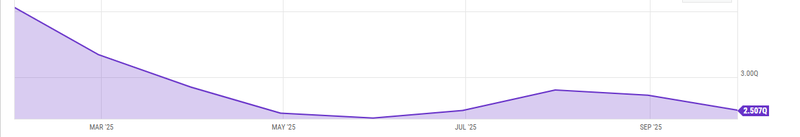

US natural gas consumption has begun to ease after the initial winter surge. Current consumption stands at 2.507 quadrillion BTUs, down from 2.733Q last month and slightly below 2.536Q a year ago. That represents an 8.29% monthly decline and a 1.13% drop year on year, signaling that peak winter demand may have already passed its most intense phase.

This pullback in consumption suggests that some of the emergency demand created by extreme cold is starting to normalize, even as weather risks persist. However, lower demand does not automatically translate into market relief. With supply still sensitive to weather disruptions and infrastructure strain, even modest consumption levels can keep the system tight during winter.

In other words, demand may be cooling at the margin, but the buffer remains thin. Any renewed cold wave or operational issue could quickly reverse this trend and reintroduce pressure across both gas and power markets.

Source: Ycharts

LNG exports at lowest level

One of the most important developments has been the sharp drop in gas flow to US LNG export plants, now at their lowest level in a year. This suggests domestic supply security has become the immediate priority, even as global buyers remain hungry for US gas.

In the short term, reduced LNG exports help ease pressure inside the US, but globally it tightens the market. The US has become the swing supplier for Europe since Russia’s pipeline gas collapsed, so any disruption or slowdown is quickly felt overseas.

A 73% rally sets the tone for winter

European gas prices have already sent a clear signal this winter. Since the beginning of January, benchmark European gas prices have surged by roughly 73%, a move that speaks less about immediate shortages and more about fear and fragility in the system.

This rally didn’t start with a single supply cut or dramatic headline. It built gradually, as traders reassessed winter risk, storage drawdowns, and the uncomfortable reality that Europe no longer has a stable fallback supplier. The price action itself is the warning.

Source: Trading economics

Russia’s leverage hasn’t disappeared

Although Russian pipeline flows to Europe are already minimal, Moscow’s influence remains very real. Russia no longer needs to turn off the tap to move prices. Uncertainty alone is enough.

The ongoing war in Ukraine, the security of remaining transit routes, and the possibility of infrastructure disruptions all sit in the background. Each headline reinforces the idea that supply security is conditional, not guaranteed. In winter, that is enough to push prices higher.

Stability with a hidden premium

Europe is not heading for an immediate gas crisis. The system is functioning. But it is operating with less slack, fewer guarantees, and greater exposure to geopolitics as long as Russia remains a hostile actor and LNG remains Europe’s primary lifeline, gas prices will carry a structural risk premium.

That means fewer collapses, sharper spikes, and a market that reacts more like a geopolitical asset than a simple energy commodity, Europe has escaped dependency, but not vulnerability. Russian influence over European gas has changed shape, not disappeared. In today’s market, pressure doesn’t come from shut valves it comes from uncertainty and uncertainty is something Russia still knows how to supply.