Nikkei hits record high as LDP victory lifts growth outlook

The Nikkei 225 index achieved a historic milestone, surging to a record high and accumulating a return of over 6% in just two trading sessions. This rally follows a landslide victory for the Liberal Democratic Party (LDP) in the Japanese general election, where the party secured a commanding supermajority in the Lower House.

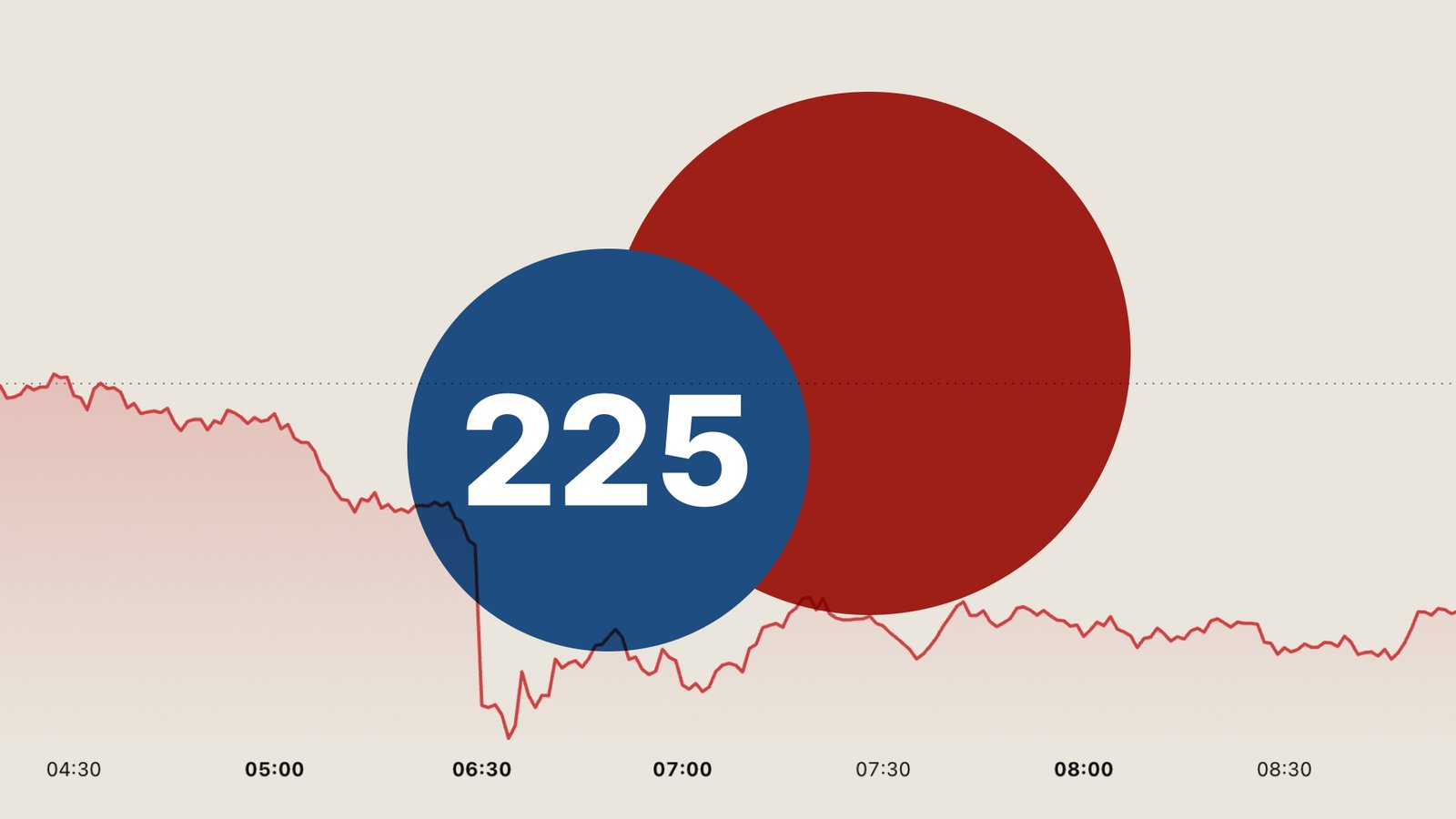

The Nikkei 225 surpassed the significant 57,000-point threshold for the first time, following the LDP’s successful acquisition of 316 seats in the 465-member Lower House.

Market participants anticipate that the LDP’s victory—securing a two-thirds supermajority alongside its coalition partner—will clear the legislative path for Prime Minister Sanae Takaichi’s ambitious economic agenda.

Investors are now pricing in a substantial economic stimulus package from the newly empowered government, which is expected to bolster domestic industry and consumer demand.

While the index maintains a robust long-term bullish trend, short-term momentum indicators suggest the market is entering overbought territory, warranting caution.

Japan’s LDP secures Lower House supermajority, raising expectations of economic stimulus

Japan’s Liberal Democratic Party (LDP) secured 316 of the 465 seats in the Lower House election, granting Prime Minister Sanae Takaichi—the nation’s first female leader—a decisive mandate. The administration now controls two-thirds of supermajority. This historic outcome has ignited expectations for the Prime Minister’s promised stimulus package and a proposed temporally suspension of the sales tax on food. Consequently, the Nikkei 225 index surged to an all-time high, touching 57,337 points during intraday trading on Tuesday, reflecting a gain of roughly 6.5% since the election results were confirmed.

Concurrently, the Japanese debt market is reflecting expectations of a more hawkish Bank of Japan (BoJ). The 10-year Japan Government Bond (JGB) yield climbed to 2.29%, its highest level in several years, as bond traders weighed the inflationary risks of massive fiscal expansion. Although the annual inflation rate moderated to 2.1% in December—aligning closely with the BoJ’s 2% target—a significant government spending surge could trigger an inflationary rebound. This complicates the central bank’s objective, potentially forcing a more aggressive tightening of monetary policy despite the 0.75% rate hold in December. Furthermore, the persistent weakness of the Japanese yen remains a critical concern for the BoJ, as it continues to import global inflationary pressures.

Figure 1. Japan Government Bonds 10Y Yield (2025–2026). Source: Data obtained from TradingView.

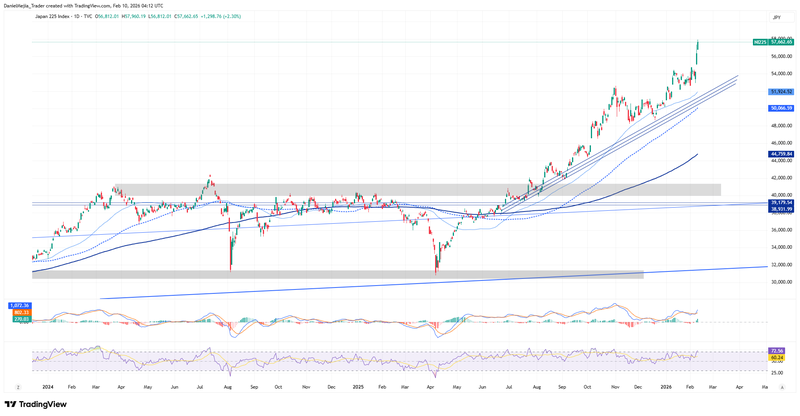

Technical analysis of the Nikkei 225 index

From a technical perspective, the Nikkei 225 index continues to exhibit a robust long-term bullish trajectory. Key observations include:

- Trend Context: On the long-term, the index remains in a clear uptrend, characterised by a structural sequence of "higher highs" and "higher lows". Prices are currently trading significantly above the primary 50, 100, and 200-period Simple Moving Averages (SMAs), confirming strong underlying momentum.

- Resistance Levels: Following the breach of the 57,000 barrier, the immediate psychological resistance is identified at 58,000. Should this level be surpassed, the next major technical ceiling is the 60,000 mark. A decisive close above this psychological threshold would signal an extension into uncharted price territory.

- Support Levels: In the event of a technical pullback, short-term support is established at 52,500—a critical zone where an ascending trend line, the 50-period SMA, and horizontal support levels converge. Should this fail, the next structural floor is located at 45,000, aligning with the 200-period SMA. A breach of the 45,000 zone would significantly increase the probability of a deeper market correction.

- Momentum Indicators: Both the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) are oscillating within overbought zones. Notably, the MACD is exhibiting a nascent bearish divergence that has yet to be confirmed, suggesting that while the trend is strong, the pace of the rally may face a near-term slowdown.

Figure 2. Nikkei 225 Index (2024–2026). Source: Own analysis conducted via TradingView.