Nvidia reduces gaming GPUs while AI and Google shake investors

Nvidia shares fell 4% yesterday, as investors weighed growing concerns over the company’s funding for artificial intelligence projects versus short-term profits. The market is closely watching whether the planned AI investments will translate into solid, real-world projects or remain speculative initiatives.

Google’s move into AI chips.

Nvidia’s AI investments will deliver real-world applications.

Nvidia has announced plans to reduce gaming GPU production by 30–40%.

Google Emerges as a “Ghost” Competitor

A major factor contributing to investor nervousness is Google’s aggressive push into the AI chip market, which is increasingly seen as a direct challenge to Nvidia’s long-held dominance in AI hardware. Google’s custom Tensor Processing Units (TPUs), originally designed for internal use in powering services like Gemini AI, are now positioned as a viable alternative to Nvidia GPUs for external customers, including hyperscale AI developers, signaling that Google is serious about competing in the broader AI infrastructure market. This move threatens Nvidia’s historical advantage, not only in hardware performance but also in its software ecosystem, as initiatives like TorchTPU aim to improve TPU compatibility with PyTorch, potentially lowering switching costs for developers. Investor concern has intensified due to reports of potential multi-billion-dollar partnerships between Google and Meta for TPU deployment, suggesting that major AI customers may diversify away from Nvidia hardware. TPUs are also becoming more energy-efficient and cost-effective, narrowing performance gaps with GPUs in specific workloads. Even without an immediate loss of market share, the mere possibility of Google challenging Nvidia’s dominance has contributed to stock volatility, as investors weigh the risks of future competition, funding execution for AI projects, and Nvidia’s ability to maintain its edge in a rapidly evolving market.

Investor Concerns Over AI Project Funding

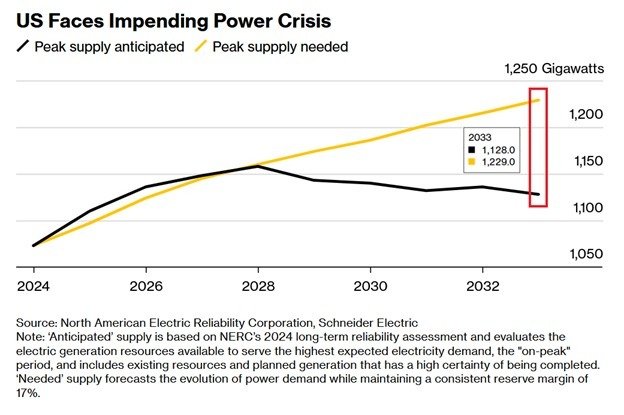

Another major concern for investors is how Nvidia is funding its AI projects, which are a key part of its long-term growth. While the company has big plans for AI model training, large data centers, and generative AI applications, investors are questioning whether these projects will actually generate profits or remain mostly speculative. Funding AI at this scale requires huge upfront costs, from making specialized GPUs to building infrastructure and supporting software and cloud systems. There’s also worry that these investments may not pay off quickly, especially with high borrowing costs and uncertain economic conditions. The AI sector moves fast, so what seems cutting-edge today can become outdated tomorrow. On top of that, there’s a practical limit: even if Nvidia produces enough GPUs, running massive AI workloads could soon demand more electricity than the power grid can provide. Around 2028, projections suggest that the peak power needed to run AI could surpass the peak power available, meaning energy availability not hardware supply could become the main bottleneck. Any delays in deployment, problems aligning software and hardware, or slow adoption by companies could hurt profitability and make investors cautious, even though the long-term potential is still strong.

Nvidia reduces gaming GPUs

Nvidia has announced plans to cut its gaming GPU production by 30–40%, reflecting weaker demand and changing market conditions in the consumer segment. Gaming has historically been a major source of revenue for the company, but sales of graphics cards for PCs have slowed due to a crowded market, reduced interest from gamers, and the lingering effects of high GPU prices during previous boom years. By reducing production, Nvidia aims to better align supply with current demand, avoid building up excess inventory, and lower operational costs. This move also allows the company to shift more resources and attention toward faster-growing areas, such as AI-focused GPUs and data center products, which are experiencing stronger adaptation and higher profit margins. While the cut in gaming GPU output may reduce short-term revenue from the consumer market, it positions Nvidia to focus on segments with more sustainable long-term growth. At the same time, the company can invest in innovation for AI and cloud computing, ensuring it stays competitive in markets that are expected to expand rapidly in the coming years.