Why the S&P 500 is lagging the Nikkei this year

This year the performance gap between the Japanese Nikkei and the US S&P 500 has become very clear. The Nikkei is up about 29% year over year, while the S&P 500 is up around 13.55%. The difference comes mainly from how each country deals with interest rates, currency movements, and business conditions.

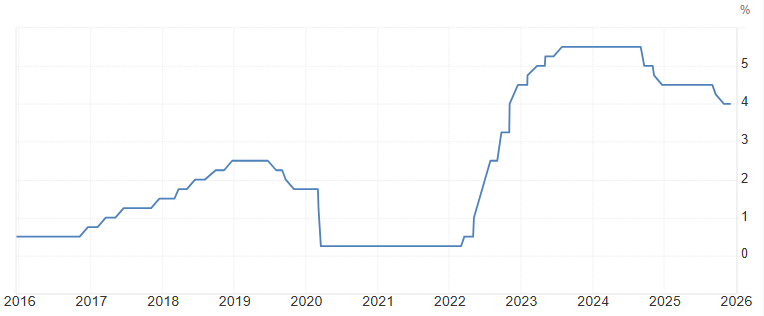

United States interest rates remain high.

Stocks look more attractive than savings or bonds.

Global investors borrow money in Japan at very low interest rates.

High interest rates and economic uncertainty

In the United States, interest rates remain high. This makes borrowing more expensive for both companies and consumers. Businesses are more careful with spending and expansion, and shoppers are paying more on loans, credit cards, and mortgages. This slows down growth and puts pressure on company earnings. When earnings grow more slowly, stock prices usually rise at a slower pace as well. This has helped keep the S&P 500’s gains limited compared to Japan, many US stocks were already expensive after strong gains in previous years, especially in the technology sector. When prices are already high, it becomes harder for the market to rise fast unless earnings grow strongly. Investors also become quicker to take profits when there is uncertainty about the economy or interest rates. This profit-taking has also slowed the rise of the S&P 500.

Source: Federal Reserve

Low interest rates

In Japan, the situation is very different from the United States. Interest rates remain very low, which makes borrowing cheap for businesses and households. Companies can invest more easily in new factories, equipment, and technology without high financing costs. This supports business growth and helps improve profits. At the same time, low interest rates make stocks more attractive than keeping money in savings accounts or low-yield bonds, so more investors choose to put their money into the stock market. Another important factor is the weak Japanese yen. When the yen is weak, Japanese products become cheaper for buyers in other countries. This helps large export companies such as car makers, electronics firms, and industrial manufacturers sell more goods overseas. When these companies earn money in foreign currencies like the US dollar or euro, those earnings increase in value when converted back into yen. This makes their profits look stronger in yen terms and improves their financial results.

Source: MacroMicro

Carry trade

strong performance of Nikkei is the carry trade. Many global investors borrow money in Japan at very low interest rates and then invest that money in higher-return assets, including Japanese stocks and foreign markets such as U.S. Stock market and Dollar. Because borrowing in yen is cheap, this strategy has been very popular. As more money flows into Japanese markets through carry trades, demand for Japanese shares increases. This extra demand has helped lift the Nikkei further this year. If Japan keeps interest rates low, the carry trade is likely to continue supporting its stock market.