Best swing trading forex pairs: a practical guide

This article explores how fundamental analysis supports swing trading, helping traders use liquidity, stability and macro trends to guide asset selection.

Effective swing trading depends on combining fundamental insight, technical analysis and disciplined risk management.

Long-term movements in currency markets are largely driven by interest rate outlooks, geopolitical events and trade dynamics.

Selecting between major, minor or exotic pairs should reflect a trader’s comfort with volatility and liquidity needs.

Differences in central bank policy and economic stability often trigger sustained directional price trends.

The relevance of macroeconomic fundamentals in swing trading

Fundamental analysis is a cornerstone of the swing trading methodology. Unlike intraday strategies, Forex swing trading necessitates the forecasting of sustainable trends that persist over extended horizons. These trends are frequently the manifestation of consistent capital flows, driven by shifting expectations regarding interest rates and a nation’s broader macroeconomic stability.

While the yield premium offered by government bonds is a significant draw for investors, institutional confidence is ultimately rooted in macroeconomic stability. Although a high country-risk premium may offer attractive nominal returns, the inherent risks often deter capital; consequently, seasoned swing traders evaluate these underlying fiscal and political conditions with elevated rigour.

Monetary policy divergences and convergences

A primary method for assessing opportunity cost between sovereign yield premiums is the analysis of convergences or divergences in central bank policies.

Divergence

This occurs when two central banks pursue opposing interest rate trajectories. For instance, if one central bank adopts a hawkish (restrictive) stance while another remains dovish (accommodative), the currency of the former typically appreciates against the latter. This appreciation is driven by the widening yield differential and the subsequent demand for the higher-yielding currency.

Convergence

When central banks adopt similar policy stances, the focus shifts toward relative economic growth prospects. In such environments, in-depth fundamental research becomes paramount to identifying the subtle patterns that will dictate the next directional move.

Impact of geopolitical and trade tensions

Geopolitical and commercial frictions exert a profound influence on the foreign exchange market. Swing traders remain vigilant regarding these phenomena, as they can abruptly alter the medium-to-long-term trajectory of a currency pair.

For example, the outbreak of armed conflict can trigger aggressive capital flight, leading to rapid currency depreciation. Alternatively, disruptions to key raw material supply chains can fundamentally weaken a nation's economic outlook. Similarly, trade tensions—often manifesting as reciprocal tariffs or "trade wars"—modify the perceived risk of an economy and impact the underlying trade balances, directly influencing exchange rate valuations.

Asset selection criteria: liquidity, stability, and trend

Asset selection is governed by the trader’s operational requirements, risk management protocols, and overarching strategy.

Liquidity

Traders seeking to minimise transactional friction often gravitate towards major pairs. High liquidity results in tighter bid-ask spreads, which implicitly reduces costs—a factor that becomes increasingly significant when managing a diversified portfolio of numerous positions.

Stability

For those prioritising capital preservation and lower volatility, major and minor pairs representing developed economies are preferable. These assets tend to exhibit more predictable price action, which is conducive to a conservative risk profile.

Trend

If the primary objective is capturing sustained directional moves, traders may look across major, minor, and exotic pairs. Here, the application of technical analysis is critical, as it provides the necessary framework for identifying optimal entry and exit levels, regardless of the asset class.

Selecting currency pairs according to objectives

The selection of a specific pair must be an intentional reflection of the trader's goals and market expertise.

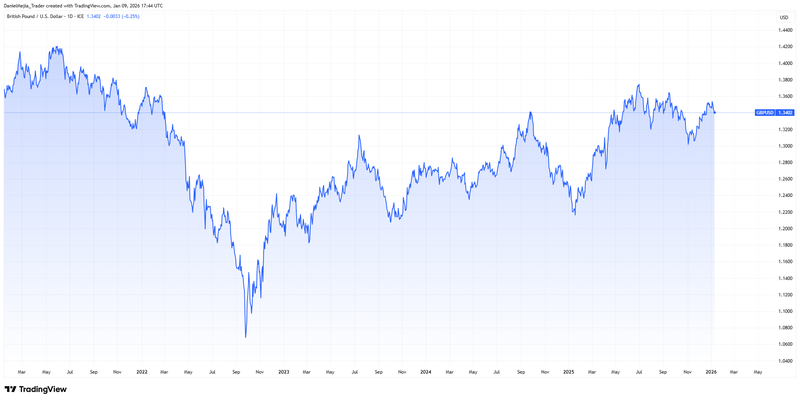

Seeking stability and trend: GBP/USD example

For a measurable trend combined with high liquidity, the British pound vs US dollar is a primary example. As a major pair, it offers low volatility and ample liquidity, allowing medium-term trends to be identified and executed with high technical precision.

Figure 1. GBP/USD Pair. Source: Data from the Intercontinental Exchange (ICE); Figure obtained from TradingView.

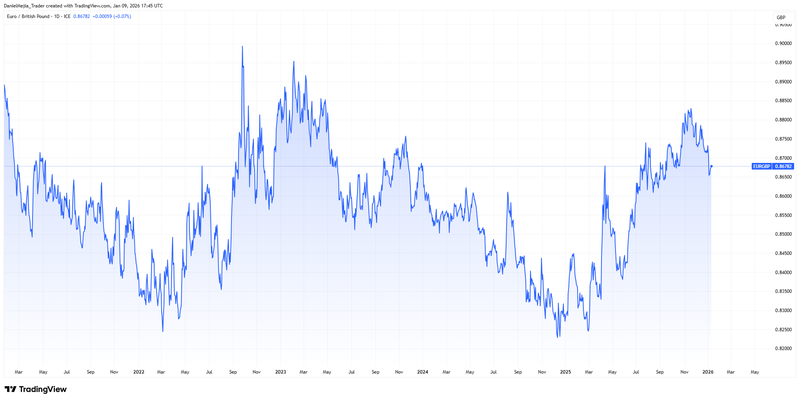

Mean reversion strategy: EUR/GBP example

The euro vs British pound is often ideal for mean reversion. Due to the high degree of economic interdependence within Europe, these currencies frequently move in tandem, causing the pair to oscillate within established ranges. Traders often utilise oscillators such as the Relative Strength Index (RSI), Stochastics, or Bollinger Bands to exploit these consolidations.

Figure 2. EUR/GBP Pair. Source: Data from the Intercontinental Exchange (ICE); Figure obtained from TradingView.

Volatility search: USD/MXN example

Traders seeking rapid price movements to avoid prolonged "Swap" (overnight financing) costs may turn to exotic pairs like the US dollar vs Mexican peso. These pairs are highly sensitive to geopolitical developments and trade policy shifts, often resulting in abrupt, high-percentage movements that can reach targets within a shorter timeframe.

Figure 3. USD/MXN Pair. Source: Data from the Intercontinental Exchange (ICE); Figure obtained from TradingView.

Conclusion

Ultimately, the selection of Forex pairs for swing trading is a function of the individual’s psychological profile, time availability, and risk tolerance. Additionally, a sophisticated understanding of the macroeconomic, geopolitical, and commercial landscape is required to provide the necessary context for informed decision-making and long-term profitability.

Frequently Asked Questions (FAQs)

Why is fundamental analysis more critical in swing trading than in day trading?

In swing trading, positions are held over horizons where intraday technical "noise" is superseded by macroeconomic forces. While day traders capitalise on temporary volatility, swing traders rely on sustained trends fuelled by institutional capital. These movements are the direct result of interest rate cycles and sovereign economic health; ignoring these drivers leaves a trader blind to the forces sustaining the price.

How does monetary policy divergence influence a currency pair?

Divergence creates a "yield gap" between two nations. When one country raises rates (hawkish) while another cuts them (dovish), capital flows toward the higher return, seeking better opportunity costs. For a swing trader, identifying this divergence early is a potent signal of a potential multi-week or multi-month trend.

What are the risks and benefits of trading exotic pairs?

The primary benefit is heightened volatility, which can allow a trader to hit profit targets faster and reduce exposure to daily swap fees. However, the trade-off is significant: exotic pairs suffer from lower liquidity and wider spreads. They are best suited for experienced traders with a higher risk tolerance who can navigate the sensitivities of emerging market uncertainty.