Determinants of volatility in the cryptocurrency market

This article examines the multifaceted drivers of volatility within the cryptocurrency ecosystem. It provides an analytical overview of the factors that precipitate price fluctuations and evaluates key statistical metrics—including standard deviation, return distribution, and maximum drawdown—essential for quantifying market risk.

Volatility serves as a statistical measure of price dispersion. In the crypto-asset market, this is commonly assessed through standard deviation and maximum drawdown.

Historically, the cryptocurrency market has exhibited extreme volatility, largely driven by its significant speculative component, leading institutional and retail participants to classify it as a high-risk environment.

Market turbulence is fostered by several systemic factors, including the continuous integration of global information, fragmented liquidity across various platforms, and a pronounced sensitivity to psychological and behavioural biases.

Understanding volatility in the cryptocurrency market

In financial terms, volatility is a statistical metric used to assess the degree of variation in the trading price of an asset or market over time. Higher dispersion or more frequent price swings indicate elevated volatility, whereas lower fluctuations suggest a more stable asset. Within the cryptocurrency sector, volatility remains chronically high, categorising the asset class as a high-risk investment vehicle.

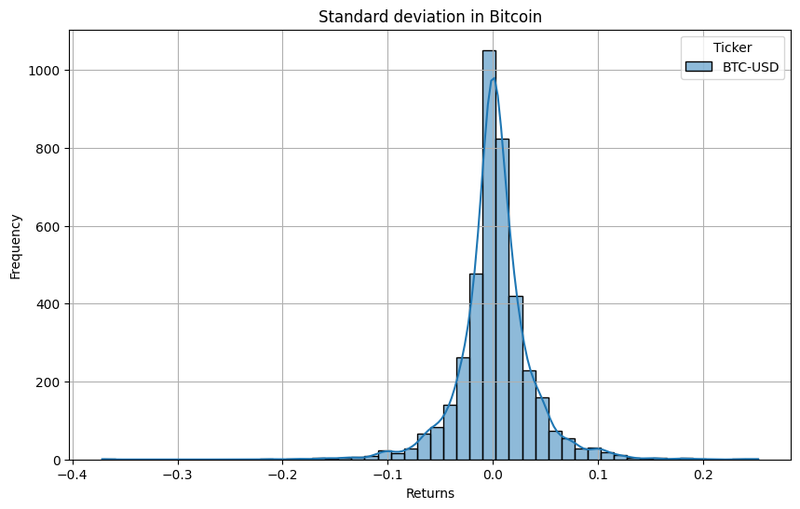

One effective method of interpreting this volatility is through the analysis of return distributions. As illustrated in Figure 1, the return distribution for Bitcoin—the market’s primary benchmark—exhibits "fat tails," with frequent occurrences of daily price movements exceeding +/- 10%. Between 2015 and 2025, Bitcoin’s daily standard deviation—a measure of data dispersion relative to its mean—has averaged approximately 3.5%, underscoring a significant degree of price instability compared to traditional asset classes.

Figure 1. Distribution of Bitcoin price returns (2015–2025). Source: Own analysis based on data from Yahoo Finance.

Historical drawdown analysis: the case of Bitcoin

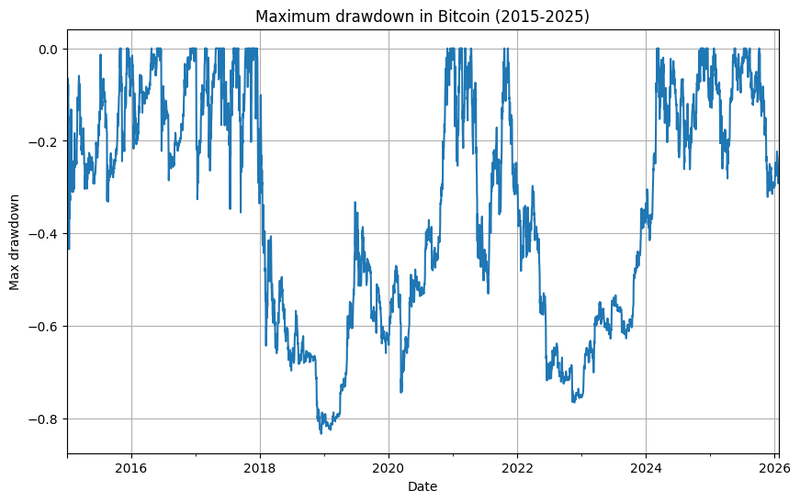

Beyond variance and dispersion, "maximum drawdown" is a critical metric for understanding market risk. This refers to the maximum peak-to-trough decline of an asset before a new peak is achieved, expressed as a percentage.

Assets characterised by high volatility typically exhibit severe maximum drawdown metrics. Figure 2 demonstrates that Bitcoin’s price contractions frequently exceed 20%, with cyclical downturns surpassing 70% in specific periods. Such figures highlight the periodic capital erosions that define the cryptocurrency volatile landscape.

Figure 2. Maximum drawdown in Bitcoin (2015–2025). Source: Own analysis based on data from Yahoo Finance.

Factors precipitating volatility in the cryptocurrency market

Unlike equities, bonds, or fiat currencies—whose valuations are anchored in cash flows, interest rates, or macroeconomic fundamentals—most cryptocurrencies lack conventional valuation anchors. As a result, price fluctuations are largely driven by speculative dynamics that shape short-term supply and demand conditions. The following factors are particularly relevant to these price movements:

Continuous adaptation to market information

While the cryptocurrency market was initially uncorrelated with traditional finance, its correlation with risk-on assets (such as equities) has strengthened. Consequently, digital assets are increasingly sensitive to macroeconomic data, such as inflation prints and monetary policy shifts, as well as geopolitical developments including trade disputes and international conflicts. Furthermore, because these markets operate 24/7, they are perpetually exposed to new information, leading to instantaneous and often aggressive price adjustments.

Liquidity fragmentation

Unlike centralised stock or derivatives exchanges, cryptocurrency liquidity is fragmented across numerous Centralised (CEX) and Decentralised (DEX) exchanges. This lack of consolidation impacts price stability; an asset may possess deep liquidity on a major CEX but remain "thin" on a DEX. This fragmentation leads to "price slippage," where large trades trigger disproportionate price movements due to insufficient market depth, resulting in varying levels of volatility across different platforms.

The regulatory environment

The global regulatory landscape for digital assets is a patchwork of differing national frameworks. Government interventions and policy shifts can trigger significant market turbulence. Notable examples include the 2021 Chinese regulatory crackdown on mining and trading, and the US Securities and Exchange Commission’s (SEC) legal actions against major exchanges such as Coinbase and Binance. These events underscore the market's acute sensitivity to legal and oversight developments.

Impact of behavioural finance

As a highly speculative market, cryptocurrency is exceptionally susceptible to emotional triggers studied in behavioural finance, specifically FOMO (Fear of Missing Out) and FUD (Fear, Uncertainty, and Doubt).

- FOMO: This cognitive bias drives investors to purchase assets after significant price appreciation, often inflating speculative bubbles that eventually collapse, causing substantial losses mainly for retail participants.

- FUD: Conversely, FUD leads to irrational panic selling in response to negative news or aggressive downtrends, resulting in the crystallisation of losses driven by emotion rather than strategy.

Use of financial leverage

Derivative markets in crypto can amplify short-term price movements during stressed conditions, particularly through leveraged liquidations. However, the overall impact of derivatives on long-term volatility remains ambiguous.

Conclusion

The cryptocurrency market is historically defined by extreme volatility, a byproduct of its deeply speculative nature and the absence of traditional fundamental anchors. The market’s increasing correlation with global equities has rendered it sensitive to a broad spectrum of economic and geopolitical factors. Additionally, the interplay of fragmented liquidity, regulatory uncertainty, and psychological biases imply that digital assets remain a high-volatility environment requiring sophisticated risk management.

Frequently Asked Questions (FAQs)

Which statistical metrics are essential for understanding crypto volatility?

Standard deviation and maximum drawdown are relevant metrics used to quantify risk. Standard deviation measures how much returns deviate from the average, while maximum drawdown identifies the most severe peak-to-trough decline. Given the frequency of large percentage contractions in this market, these metrics are vital for assessing potential capital risk.

Why is the cryptocurrency market more volatile than stocks or bonds?

Cryptocurrencies lack the cash flows and macroeconomic support that provide foundations for traditional assets. Speculative demand plays a dominant role in price formation, particularly in the short-term. Furthermore, the 24/7 nature of the market ensures constant exposure to news without the cooling-off periods or regulatory pauses that characterise mature financial markets.

How do psychological biases like FOMO and FUD influence prices?

In speculative markets, emotions often override rational strategy. FOMO creates buying frenzies that drive prices far beyond their logical value, while FUD triggers mass liquidations based on negative sentiment. These emotional cycles magnify volatility, causing prices to move more extremely and irrationally than in traditional sectors.

What role does liquidity fragmentation play in price stability?

Because liquidity is split across many different exchanges, the "depth" of the market is inconsistent. A large trade on a platform with low liquidity can cause significant price slippage, creating local volatility that often spreads to other exchanges through arbitrage and panic, thereby destabilising the broader market.