ESG standards overview and their market impact

Environmental, social and governance (ESG) standards comprise a set of criteria that companies adopt to manage their environmental footprint, social responsibilities and governance arrangements.

ESG standards are criteria covering environmental, social and governance practices that firms adopt to improve stakeholder outcomes and operational sustainability.

The regulatory and reporting landscape for ESG has expanded, including the EU’s CSRD and SFDR, SEC climate-disclosure guidance, and the IFRS Foundation’s ISSB (International Sustainability Standards Board).

Independent ESG rating agencies (MSCI, Sustainalytics, S&P Global ESG, Refinitiv ESG and LSEG ESG) and reporting standards (GRI, SASB, TCFD, CDP) provide investor transparency.

Implementing ESG standards can reduce financing costs and the company’s WACC, while potentially enhancing growth prospects and investor demand.

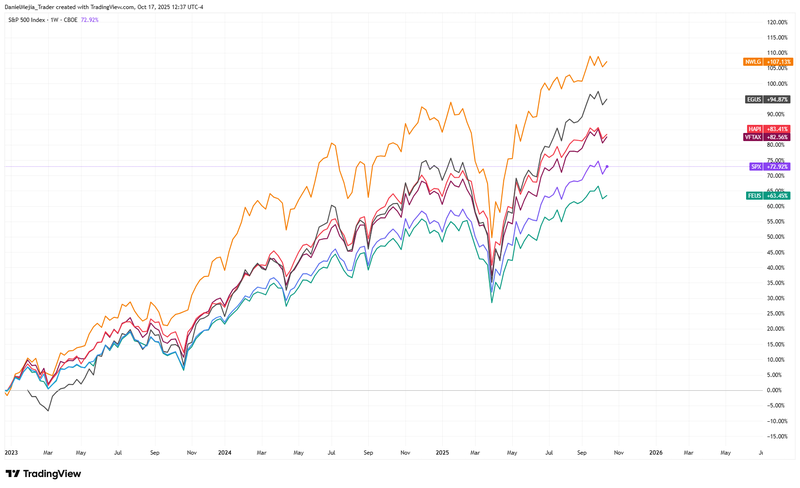

Several ESG-focused ETFs outperformed the S&P 500 in the 2023–2025 evaluation period, suggesting market recognition of ESG-related value drivers.

What are ESG standards?

ESG refers to the environmental (E), social (S) and governance (G) factors that companies integrate into their internal policies and external reporting to promote sustainable and ethical conduct. The framework aims to keep stakeholders — including investors, regulators, customers, employees and local communities — informed of corporate policies and actions designed to secure positive social and environmental outcomes.

ESG is distinctive because it links corporate growth to practices that are beneficial to a broad set of stakeholders. Firms that demonstrate credible ESG performance may obtain financial and regulatory incentives and attract capital from investors who increasingly prioritise sustainability.

Environmental principle

The environmental pillar addresses a company’s interaction with the natural environment. Relevant metrics typically include greenhouse-gas emissions, energy consumption, water usage, waste management, biodiversity impacts and the adoption of renewable energy sources. Companies facing high emissions or substantial waste streams are expected to implement mitigation and reporting measures that reduce environmental harm.

Social principle

The social pillar concerns relationships with stakeholders such as employees, customers, suppliers and the communities where a firm operates. This domain encompasses supply-chain standards, product safety, employee welfare, diversity and inclusion, and community engagement. Typical social metrics include employee turnover, customer-satisfaction scores, supplier assessments and the scope and effectiveness of social projects; specific metrics are selected according to a company’s sector and objectives.

Governance principle

Governance covers the policies, structures and processes by which a company is directed and controlled. Effective corporate governance promotes transparency, ethical conduct and alignment between boards, management and shareholders, thereby reducing agency frictions. While governance metrics are less standardised than environmental indicators, internal audit processes, board composition, executive-remuneration policies, and disclosure practices are commonly assessed against reporting standards.

ESG standards regulatory framework

The regulatory architecture for sustainable finance now comprises regional and global initiatives. Notable components include the European Union’s Corporate Sustainability Reporting Directive (CSRD), the Sustainable Finance Disclosure Regulation (SFDR) and the EU Taxonomy Regulation; the US Securities and Exchange Commission’s climate-risk disclosure measures; and the IFRS Foundation’s International Sustainability Standards Board (ISSB), which seeks to deliver globally consistent sustainability reporting standards.

Independent ESG rating agencies — including MSCI ESG Ratings, Sustainalytics, S&P Global ESG, Refinitiv ESG and LSEG ESG — provide assessments that assist investors in comparing firms on sustainability criteria. Reporting frameworks such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), the Task Force on Climate-related Financial Disclosures (TCFD) and the Carbon Disclosure Project (CDP) guide companies on disclosure and measurement practices.

Benefits of implementing ESG standards in public companies

Adoption of ESG practices yields a mixture of reputational, financial and valuation benefits. Below we emphasise two principal categories: financial advantages and effects on valuation.

Financial benefits

ESG adoption can improve access to finance and reduce borrowing costs. Lenders and institutional investors increasingly favour projects and issuers that meet recognised sustainability criteria, which can translate into more favourable loan terms and lower interest rates. In addition, ESG-oriented investors may increase demand for a company’s equity, supporting share price performance.

Benefits in price valuation

A firm perceived as lower risk because of strong ESG credentials may experience a decline in its cost of equity (Ke) and cost of debt (Kd), thereby reducing its weighted average cost of capital (WACC). A lower WACC increases the present value of projected cash flows and, other things equal, raises corporate valuation. Moreover, ESG practices can support more resilient operational performance and stronger sustainable growth (g), prompting some investors to pay a premium for anticipated higher and more stable future cash flows.

Performance of composite ETFs of ESG companies

A practical way to observe the market impact of ESG adoption is through the performance of Exchange-Traded Funds composed of ESG companies or ESG-weighted indices. The following comparative returns (2023–2025) illustrate that several ESG-focused funds outperformed the S&P 500 benchmark during the evaluation period:

- Nuveen Winslow Large-Cap Growth ESG ETF (NWLG): +107%

- iShares ESG Aware MSCI USA Growth ETF (EGUS): +95%

- Harbor Human Capital Factor US Large Cap ETF (HAPI): +83%

- Vanguard FTSE Social Index Fund Admiral Shares (VFTAX): +82%

- S&P500 Index (SPX): +73%

- FlexShares ESG & Climate US Large Cap Core Index Fund (FEUS): +63%

Figure 1. ESG ETFs and S&P500 index comparison (2023-2025). Source: data from CBOE Global Markets, NYSE Exchange, and Nasdaq Exchange. Own analysis conducted via TradingView

While past performance is not indicative of future returns, these results suggest that markets have, in certain periods, rewarded companies exhibiting stronger ESG characteristics.

Frequently Asked Questions about ESG Standards

1. What are ESG standards and what is their main purpose?

ESG standards are criteria and best practices adopted by companies, voluntarily or under regulatory compulsion, to manage and disclose their environmental, social and governance impacts. Their principal purpose is to improve corporate conduct in ways that protect stakeholders and promote sustainable value creation.

2. What are the main benefits for a company when implementing ESG standards?

Companies that implement ESG frameworks can benefit from improved access to capital at lower cost, attraction of sustainability-focused investors, and potentially higher valuations due to a reduced perceived risk profile and stronger growth prospects.

3. How is companies’ ESG information regulated and standardised?

ESG information is governed by a combination of regulations (for example, the EU’s CSRD), voluntary reporting standards (such as GRI or SASB) and independent rating agencies (for example, MSCI and Sustainalytics), which together provide structure, comparability and transparency for investors.

Conclusion

ESG standards constitute an increasingly important dimension of corporate strategy and investor analysis. A maturing regulatory framework, a suite of reporting standards and the proliferation of rating agencies have raised the transparency and comparability of ESG disclosures.

For listed companies, credible implementation of ESG practices can yield tangible financial benefits — notably improved financing conditions and potential valuation uplifts — while helping firms to manage environmental and social risks. The superior performance of several ESG-oriented ETFs over the 2023–2025 period indicates market recognition of these dynamics; nevertheless, investors should assess ESG claims critically and consider both the sectoral context and the quality of disclosures.

If you are interested in trading through ETF CFDs, you can analyse the contracts offered by Equiti Group. Remember that trading in leveraged derivatives carries risk.