How to Trade Forex in the UAE: Laws, Brokers, and Strategies

The word ‘forex’ (aka FX) is a portmanteau of two words, ‘foreign’ and ‘exchange’. It refers to ‘foreign currency exchange’, the market for buying and selling (i.e., trading) currencies.

In this article, we discuss all things forex, including forex laws in the UAE, forex brokers, and trading styles you can use when forex trading in the UAE. Read on to learn how to trade forex in the UAE.

What is forex?

Forex is an over-the-counter (OTC) financial market that consists of electronically connected, globally distributed currency trading venues, including those in Dubai and Abu Dhabi in the United Arab Emirates.

The forex market is open 24 hours, five days a week, and is closed on weekends. Continuous, 24-hour trading is possible because of its decentralised structure which tracks, in particular, four major, overlapping trading sessions: those in Sydney, Tokyo, London, and New York.

When does the five-day FX trading week start? It opens at 10:00 p.m. Coordinated Universal Time (UTC) on Sunday. This corresponds to the start of the Sydney forex session: 8:00 a.m., Monday, Australian Eastern Standard Time.

When does the forex trading week close? Forex trading stops at 10:00 p.m. UTC on Friday. This corresponds to the close of the New York forex trading session: 5:00 p.m. on Friday, Eastern Time.

What is forex trading?

Forex trading involves buying and selling currencies, operationalised as converting one currency to another, for profit-generation purposes. It is typically done electronically over computer networks through a forex broker.

Forex trading entails purchasing one currency while simultaneously selling another. This is why forex trading involves trading currency pairs.

Currency pairs are composed of two currencies and expressed like so: EUR/USD. This particular example pertains to the Euro and U.S. dollar forex pair.

Every currency pair has a quote price or exchange rate, for instance, EUR/USD=1.1779. This is equivalent to how much of the quote currency it will cost you to buy one unit of the base currency. In this example, you will spend USD 1.1779 to buy EUR 1. Put another way, you must exchange USD 1.1779 for every euro acquired.

Is there forex trading in the UAE? Forex laws in the UAE

Yes, there is forex trading in the UAE. You do not need a license if you’re an individual trader engaging in forex trading on your own behalf.

However, forex laws in the UAE mandate that if you provide investment management services (and, thus, engage in forex trading for clients) or if you facilitate forex trading as an individual broker or a brokerage company, you must be a registered business and have the appropriate license from the relevant authority, such as the:

- Securities and Commodities Authority (SCA): UAE mainland brokerage companies that facilitate forex trading must be licensed by the SCA.

- Other financial services authorities: UAE forex brokers doing business in free zones obtain a license from their free zone’s designated authority on financial services. The Dubai Financial Services Authority (DFSA) has regulatory authority in the Dubai International Financial Centre. The Financial Services Regulatory Authority (FSRA), meanwhile, regulates financial services in Abu Dhabi Global Market (ADGM).

In the UAE, Equiti is a registered business and an SCA-licensed online broker authorised to facilitate forex contracts for difference trading (i.e., forex CFD trading).

UAE forex brokers

The law is clear. In the UAE, forex trading must be done through licensed brokers. Therefore, work only with UAE forex brokers with the required license.

Forex brokers are brokerage companies or individual brokers who buy and sell currency on behalf of forex traders and investors. Equiti is an example of a forex broker.

Costs incurred when trading through brokers

Forex brokers may charge service fees and earn commissions. Your choice of forex broker affects trade profitability. If a broker charges a high commission, trades will simply cost you more money.

At Equiti, you can maximise your earnings. We have no sign-up fees. Furthermore, we charge exceptionally low (or even zero) commissions.

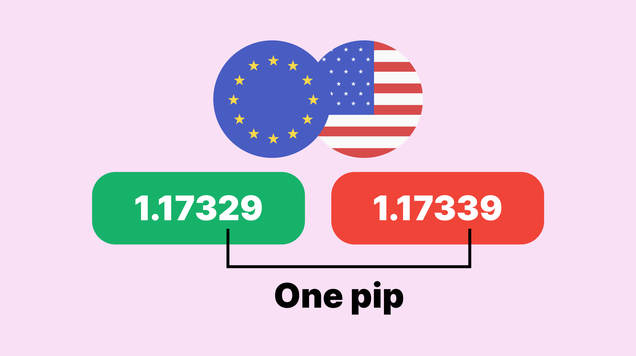

Like all forex brokers globally, UAE forex brokers earn revenue from the spread or the difference between the bid and ask prices.

- The bid price is the broker's preferred buying price, the price at which they are willing to purchase the base currency. This is your selling price.

- The ask price is the broker's preferred selling price or the price at which they're willing to sell you the base currency. This is your purchase price.

The spread is a built-in cost of forex trading. You incur it automatically with every trade. When you sell at the bid price, you lose the difference between your selling price and what you’ll pay if you were buying instead. Likewise, when you buy at the ask price, you also lose the difference between your purchase price and what you’ll get if you were selling instead.

The spread impact is clear if you buy a currency and then immediately sell it, or if you sell a currency and turn right around to buy it. In the first scenario, you’ll pay more than you can get from the subsequent sale. In the next case, you’ll get less than you’ll pay on the following purchase.

How to trade forex in the uae: Forex trading styles and strategies

Here are four common forex trading strategies:

- Scalping: Scalping involves quickly entering and exiting positions after realizing a small profit. The goal is to lock in (and cash in on) profits as soon as possible, so you exit a position as soon as you gain something. It usually takes only minutes from entry to exit.

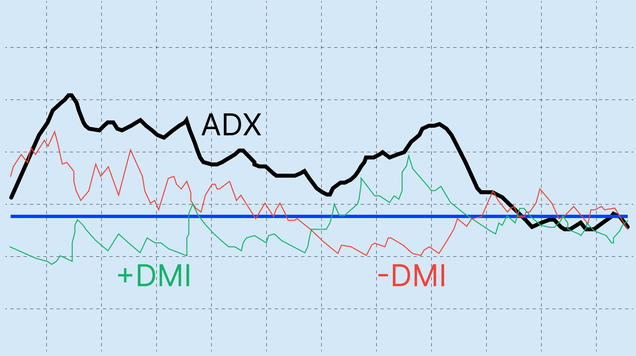

- Swing trading: Swing trading requires timing your position entry and exit according to your predicted exchange rate swings for a currency pair. If you believe the base currency will become stronger, you’ll identify a swing low (what you believe to be the lowest the quote price can fall before bouncing up) and go long on the currency pair. Next, you wait for the currency value to increase until it reaches your predicted swing high (the highest you think it will climb before falling again), exit your position, and then go short. Once it reaches an expected swing low, you exit that position and go long again. A swing trader can do this multiple times a day, or they can also wait overnight.

- Trend trading: Trend traders analyse the market and open positions based on their expected trends. They do not get swayed by short-term price swings. If they believe the price will go up, they go long, wait, and then exit when they think the uptrend is over. Likewise, if there is a downtrend, they go short, wait, and then exit when the downtrend is over.

- Position trading: Position trading involves opening positions and holding on to them for a while, which could be weeks, months or even longer, regardless of short-term price fluctuations.

Forex trading in the UAE

Forex trading in the UAE is legal. Doing it is as simple as registering with a broker and opening an account. You can learn how to trade forex in the UAE by opening a demo account with your choice of broker.

Remember to choose a licensed broker. Forex laws in the UAE require forex trading to be conducted only through licensed UAE forex brokers.

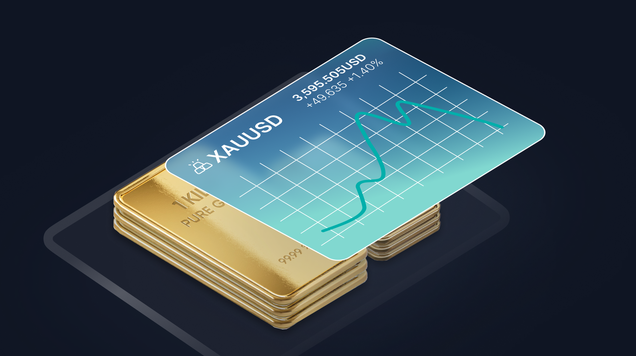

Equiti is a leading brokerage company that offers trading platforms you can use to trade CFDs on various assets, including forex, shares, indices, commodities, exchange-traded funds (ETFs), and futures. Open an Equiti standard trading account to buy and sell CFD products on more than 60 forex pairs at up to 1:500 leverage, and enjoy low to zero commissions and tight spreads.