Trading Psychology: Fear and Greed Index

Trading is driven by emotion as well as analysis, with fear and greed often in control. The Fear and Greed Index offers a clear snapshot of market sentiment.

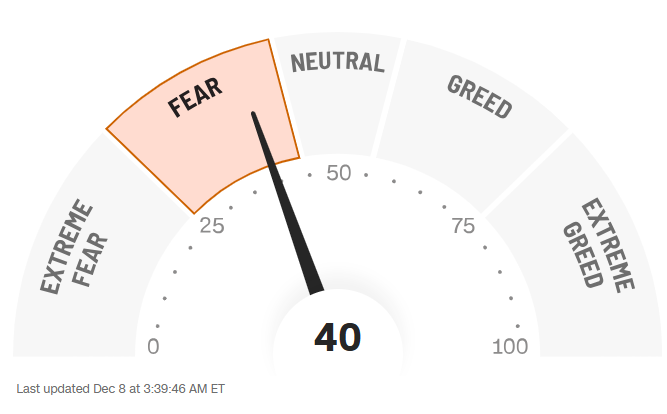

The Fear and Greed Index is not just a figure but a real-time snapshot of market psychology.

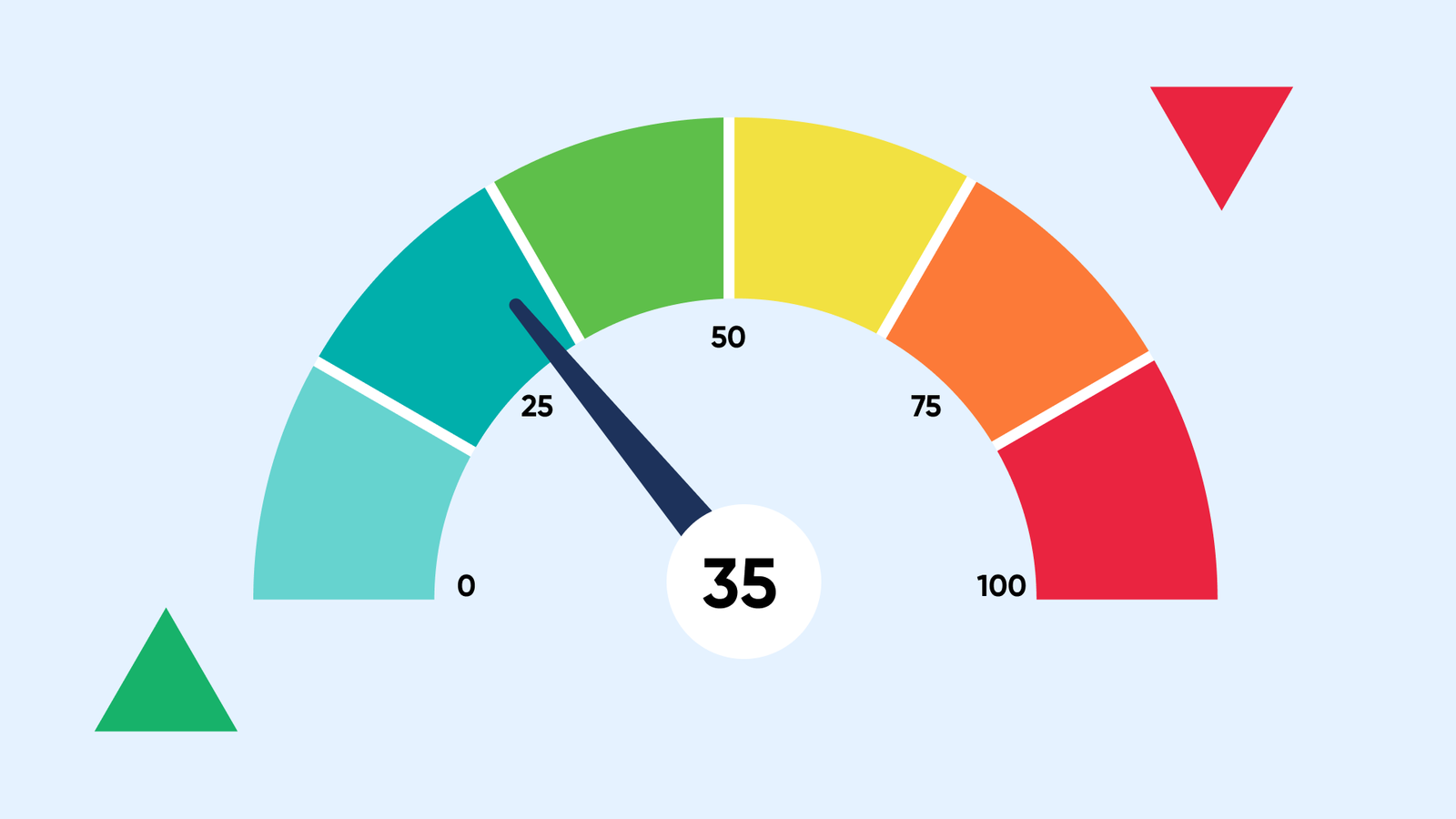

Extreme Fear (0–25) reflects panic and can point to buying chances, while Extreme Greed (76–100) signals overconfidence and bubble risk.

Ignoring these emotional extremes can lead to traders to buy tops and sell bottoms.

What makes the index tick

The Fear and Greed Index condense market behavior into a single number ranging from 0 to 100. Extreme Fear (0–25) signals panic and potential buying opportunities, while Extreme Greed (76–100) hints at overconfidence and potential bubbles forming. This index measures psychology: it tells us how traders feel, not just what they do. The index factors in several market elements: volatility spikes, momentum swings, trading volumes, and the demand for safe assets versus risky assets. It helps determine whether optimism or worry is dominating the trading floor. Each market has its own version of the index.

Source: CNN

Why these numbers matter

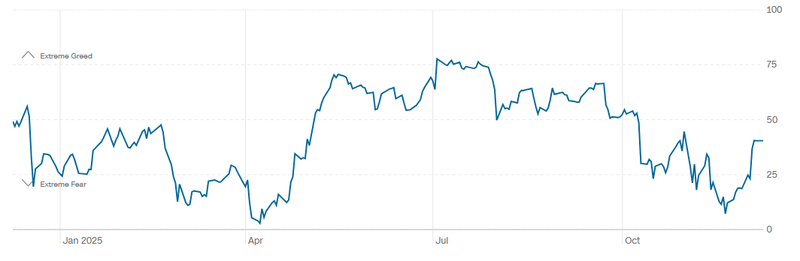

The index isn’t just a curiosity; it’s a compass. Global events, corporate earnings, or sudden geopolitical tensions can quickly shift sentiment. Traders who ignore these emotional signals may find themselves buying at the top or selling at the bottom. By checking today’s Fear and Greed Index, investors can sense when the crowd is panicking or getting carried away, allowing for smarter, calmer decisions. Professional traders use the index as a contrarian tool. Extreme fear might indicate undervalued assets ready for the taking, while extreme greed can serve as a warning to lock in profits or reduce exposure. The most creative use comes when pairing the index with personal discipline: journaling emotional reactions, setting entry and exit points, and using the index as a reminder to separate emotions from strategy. For example, this chart shows how fear surged in April when Trump announced tariffs, causing the stock market to dip and panic selling to dominate.

Source: CNN

Warren buffet simple rule

The index is a mirror reflecting the collective emotions of market participants. Every spike of fear or wave of greed tells a story about how investors perceive risk, opportunity, and value in real time. In practice, the index provides a lens to see beyond surface-level price movements. It helps traders recognize when the crowd is panicking, potentially selling undervalued assets at a loss, or when excessive optimism has driven prices into unsustainable territory. By paying attention to these emotional undercurrents, disciplined traders can position themselves strategically buying when others are fearful and considering protective measures when greed dominates sentiment.

As Warren Buffett said, “Be fearful when others are greedy and greedy when others are fearful.”

FQAs

What is the fear and greed index?

Measures overall market sentiment. 0 = extreme fear (investors very cautious), 100 = extreme greed (investors overly optimistic). Often used as a contrarian signal.

What is the Crypto fear and greed index?

Applies the same idea to cryptocurrencies, using factors like price volatility, trading volume, social media sentiment, Bitcoin dominance, and Google search trends.

What is a good fear and greed score?

Extreme fear (<25) can indicate a potential buying opportunity; extreme greed (>75) may signal the market is overheated and caution is advised.