Unpacking the basis trade: How a quiet strategy stirred bond market turmoil

Basis trading—a leveraged arbitrage strategy involving Treasury bonds and futures—has returned to the spotlight as a key driver of volatility in the world’s most liquid bond market.

The basis trade exploits price discrepancies between Treasury bonds and their futures.

Hedge funds use extreme leverage (up to 50:1) via the repo market to profit from small spreads.

This strategy may exacerbate sell-offs when market conditions shift rapidly.

What is basis trading, and why is it relevant now?

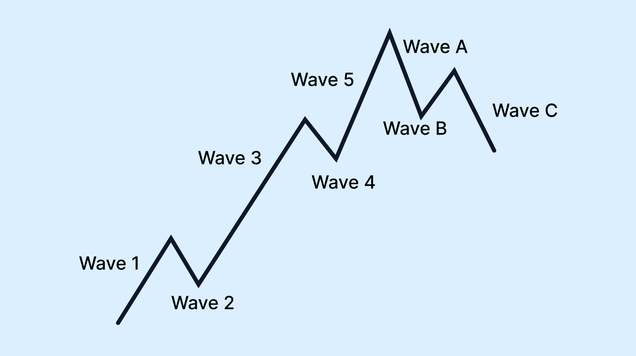

Basis trading refers to a strategy where investors buy cash Treasury bonds while simultaneously selling Treasury futures. The goal is to profit from price differences—known as the “basis”—between the two markets.

This strategy became increasingly attractive after large institutional buyers like pension funds and insurance companies began aggressively purchasing Treasury futures, which require far less upfront capital than buying the bonds directly. As futures prices rose above those of the underlying bonds, hedge funds stepped in to arbitrage the difference.

The mechanics:

- Buy low (cash bonds)

- Sell high (futures contracts)

- Profit when the prices converge

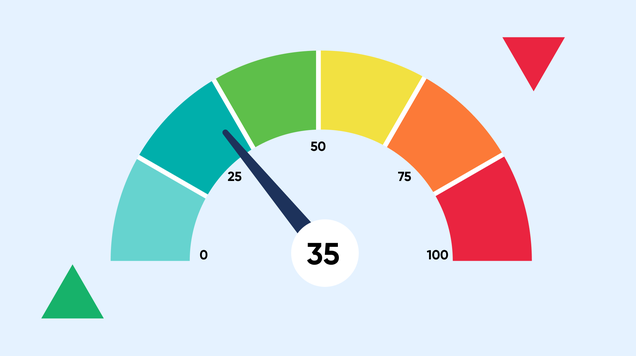

But the real edge comes not from the trade itself—but from the leverage used to magnify those tiny returns. Hedge funds often borrow through repo agreements, pledging their Treasuries as collateral and rolling over these loans daily. Some positions are leveraged up to 50:1, meaning $1 of capital controls $50 in exposure.

When things go wrong: A fragile structure

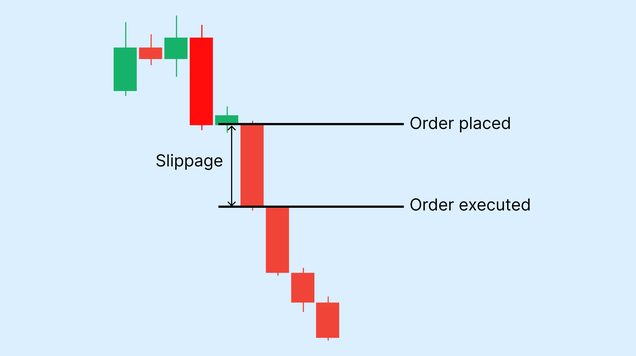

In calm markets, this arbitrage works smoothly. But in volatile conditions, the trade can backfire. If futures fall faster than expected or funding costs spike (e.g., in the repo market), the strategy becomes unprofitable.

This happened in:

- March 2020 (COVID shock): Futures prices diverged from bonds amid massive liquidations. Margin calls forced hedge funds to unwind, worsening Treasury illiquidity.

- April 2025 (Trump tariff shock): A similar divergence emerged when new tariffs disrupted global confidence. Treasuries, instead of acting as safe havens, sold off sharply—an unusual dynamic traced partly to the unwinding of basis trades.

In both cases, the forced selling added to volatility in an already stressed market. The feedback loop (selling begets more selling) can result in a sudden liquidity freeze, causing bond markets to “seize up”—a scenario the Federal Reserve is desperate to avoid.

Why is the basis trade making a comeback?

After cooling off post-2020, basis trading returned by early 2023. Several forces made the environment ripe again:

- The Federal Reserve’s aggressive tightening (11 rate hikes in 18 months) pushed 10-year yields to around 5%—the highest since 2007.

- This yield attracted institutional investors back into futures.

- Meanwhile, increased Treasury bond issuance to fund U.S. deficits drove cash bond prices lower, widening the basis.

This divergence—high futures, lower cash bonds—presented ideal conditions for hedge funds to restart basis trading at scale.

The funding engine: Repo markets and leverage

The repo market plays a central role in enabling basis trades. In a typical transaction:

- A hedge fund borrows cash from a dealer or money market fund

- It pledges Treasury securities as collateral

- It agrees to repurchase the bond at a set price

These short-term loans are rolled over daily, meaning any stress in repo funding can rapidly unwind highly leveraged positions. This is exactly what happened in March 2020—and could repeat in the future under similar stress.

Regulatory backlash: The system under scrutiny

What’s troubling regulators is the scale and invisibility of this trade:

- Hedge funds operate outside the traditional banking system, with far fewer disclosure requirements.

- Most basis trades are bilateral and opaque, making systemic risk harder to monitor.

In response:

- The Bank for International Settlements, Bank of England, and Federal Reserve have all called for greater oversight.

- In May 2024, the SEC finalized new rules requiring private funds to report large losses, margin spikes, and structural shifts starting June 2024.

The concern is not just financial—it’s institutional: Treasuries are considered the backbone of global credit markets. If their pricing or liquidity is destabilized, it could ripple into equity markets, currency flows, and central bank policy.

Is it all bad? Not quite. But it’s fragile.

To be fair, basis trading adds liquidity and price efficiency in normal times. But the trade’s reliance on leverage and short-term borrowing means it’s inherently brittle in a crisis.

The risk is that the next financial shock, geopolitical or monetary, could ignite another cascade of margin calls, with Treasury markets again caught in the crossfire—only this time with more participants, bigger positions, and thinner buffers.

Frequently asked questions (FAQs)

- What exactly is the “basis” in basis trading?

It’s the price difference between a Treasury bond and its corresponding futures contract. - Why do hedge funds love this strategy?

Because it offers predictable, low-risk returns—until it doesn’t. High leverage makes small spreads highly profitable. - What’s the role of the repo market in all this?

Hedge funds borrow heavily in the repo market to fund their bond purchases. Stress in repo funding can trigger mass unwinding. - What are regulators doing about it?

They’re pushing for more reporting and transparency, especially after past episodes where basis trades worsened liquidity crises.