How to build a specialised trading strategy for different assets

Learn how to adapt your trading strategy to different asset classes and their specific characteristics.

Specialised trading requires a trader to understand the characteristics and technical details of an asset to form tailored trading techniques

Forex, commodities, shares and cryptocurrencies are popular asset classes offered by most of the online brokers

Your specialised trading approach should include strategies, analysis tools and risk management that are adjusted based on the asset class

Building a specialised strategy for each type of financial products can increase your chances for profit and help you limit losses

Building a specialised trading strategy

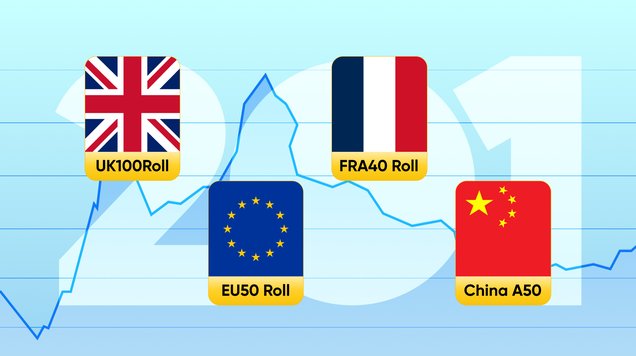

There are various assets that traders can choose to add to their portfolio. Financial assets are classified into different broad categories that have varied characteristics. Forex, shares, commodities and cryptocurrencies are examples of groups of financial assets.

Because of their different characteristics, different assets require specialised strategies, analysis tools and risk management. For example, cryptocurrencies are known to have higher volatility than major currency pairs, hence a more robust risk management is recommended for crypto traders.

Creating a specialised trading approach for specific assets helps a trader develop expertise in a particular sector, improving their chances to build long-term success in trading. It’s also important to understand the factors that influence changes in value for the chosen type of asset. This article explains the characteristics of different assets and things that traders should consider when form specialised trading methods.

Forex trading

Forex trading is the exchange of one currency for another, also known as currency trading. Forex market has the trading largest volumes globally, with over 6.5 trillion US dollars transacted daily.

Currencies can be traded 24 hours through the five weekdays across global exchanges like New York, London, Tokyo, and Sydney. Participants in the forex market include big global banks, multinational companies, retail traders and hedge fund companies.

Currencies are divided into major, minor, and exotic pairs. The spreads and liquidity vary between these categories. The major pairs attract traders that want lower spread charges and less volatility in the market.

Currencies allow the largest leverage across various asset types and traders need less initial capital to get started.

Strategies:

Strategies used to trade currencies are based on technical analysis of price charts, fundamental analysis from news reports, and sentiment analysis.

Technical analysis is very commonly used by forex traders with indicators that help analyse volumes, trend, volatility, and directional strength to get high probability opportunities.

Fundamental strategy entails mapping out trading opportunities based on market price changes influenced by economic reports, geopolitical dynamics, and natural disasters.

Risk management:

Currency trading is highly leveraged, making the level of risk higher. Volatility of currency pairs rise around release of high impact economic reports releases, affecting the respective countries for specific currencies.

Traders should use basic and advanced risk management practices, such as using stop loss orders, maintaining a reasonable risk-reward ratio with a low-risk amount and observing appropriate position size to reduce risk exposure. Long-term forex traders also use hedging to limit risk involved in their positions.

Commodities trading

Physical goods like gold, oil and agricultural products are called commodities. Commodities trading allows market participants to speculate on the price movements of these products without owning the physical assets.

Commodity markets and their value are mostly influenced by supply and demand dynamics, weather conditions and geopolitical events. For example, the industrial metals are affected by increased demand for industrial use in production of durable goods. Agricultural commodities are influenced by weather conditions that can reduce performance of crops at various stages based on the seasons. Geopolitical dynamics can alter supply routes and creating shortages and other supply chain problems.

Commodities are usually allocated lower leverage due to tendency of high volatility, meaning traders need more initial capital to enter the market through online trading platforms.

Strategies:

Traders in the online commodity markets usually speculate on the prices either to chase profit opportunities, hedge against price risk or diversify their portfolio. Traders can combine fundamental, technical and sentiment analysis tools to identify price trends, potential reversal points and overbought and oversold conditions.

Hedging strategy helps traders to cover for losses when prices are adversely changing against their commodity positions. Futures and options contracts are often used by traders choosing this strategy.

As commodities are highly impacted by supply and demand, it’s important for traders to understand these concepts and use several analysis tools and approaches to identify trade opportunities. Economic calendars are useful tools for commodity traders as reports related to production and consumption can provide useful insights.

Commodities have low correlation with the stock markets and fixed income securities, making them a good option for portfolio diversification. Trader mostly turns to commodities during times of high volatility and instability in the forex and stock markets.

Risk management:

Commodity trading involves risks as factors like market volatility, geopolitical events and weather conditions can cause sudden and significant price movements. To reduce risk, traders should use risk management strategies, such as diversification, position sizing and stop loss orders. It’s also important for commodity traders to keep updated about key data releases and maintain emotional discipline to make informed decisions in the market.

Shares trading

Trading stocks is an opportunity to speculate on the price moves of stock exchange listed companies without actually purchasing the underlying assets. Share prices are influenced by company performance, industry trends and broader economic factors.

Trading hours for shares vary depending on the location of the stock exchanges. Trading in shares is possible during the opening hours of the stock exchange where the company is listed, usually during the normal working hours of the weekdays.

Stock markets operate under very tight regulatory environment due to risk of manipulations and disorderly dealings like insider trading. Disclosure on the trading operations is essential in stock markets as well as protection of the investors from unfair trading deals.

Strategies:

Strategies often used in stock markets are value and growth investing and momentum and day trading. Traders can choose which strategy matches their financial objectives.

Value investing involves selecting stocks or other assets that appear to be trading at a price below their intrinsic value. The premise of value investing is based on the belief that markets can sometimes misprice assets, leading to opportunities for investors to buy undervalued securities and potentially profit as their prices move closer to their intrinsic value over time.

Growth investing is an investment strategy focused on identifying and investing in companies that show strong potential for above-average growth in their earnings, revenue, or market share. Unlike value investing, which seeks undervalued assets, growth investing prioritises companies with promising prospects for expansion and increasing profitability, even if their current stock prices may seem relatively high compared to traditional valuation metrics.

Momentum trading is a strategy that involves trading assets that have demonstrated strong recent performance and selling assets that have exhibited poor recent performance, with the expectation that the trend will continue in the short to medium term. This strategy is based on the belief that assets that have been performing well are more likely to continue performing well, and vice versa.

Risk management:

Shares traders should combine fundamental and technical analysis to spot opportunities and mitigate risk.

Fundamental analysis, using tools such as earnings reports, economic indicators and market news, will help traders to find potential profitable trade ideas. Technical analysis tools like support and resistance levels are useful in identifying entry, exit and stop loss points for those trades, helping to time the trades correctly and manage risk.

Diversification across different industries and geographical locations, position sizing and stop loss orders are popular risk management tools used in shares trading.

Crypto trading

Cryptocurrency trading involves buying or selling digital currencies on online trading platforms. The crypto market is open 24 hours a day for seven days of the week, however there are platforms that allow trading only during the weekdays.

There is a wide range of cryptocurrencies to choose from, with varying volumes and liquidity.

Strategies:

Trading strategies for crypto can be day trading to investing depending on the trader’s choice. Popular crypto trading strategies include short-term approaches like day and swing trading and scalping. However, some traders can choose to hold their crypto positions long-term, regardless of market volatility.

News trading is also a popular strategy as crypto prices are highly sensitive to news, regulatory updates and market sentiment. Traders using news trading typically open positions either when the news has been released or just before if they are confident in predicting the outcome. Using fundamental and sentiment analysis can help traders to plan their positions and risk management.

Crypto traders also rely on technical indicators and price charts.

Risk management:

With crypto trading, it’s important to highlight the element of risk because of, for example high volatility and uncertain regulatory framework. Therefore, it’s important for crypto traders to always use risk management and choose advanced strategies and tools to protect their capital against significant losses.

Stop loss orders are valuable tools for crypto traders as they instruct the broker to automatically close a position that takes an unfavourable move. Crypto traders should also consider diversifying their portfolio, including also products from other asset classes that tend to involve less risk.