Market Analysis 101

What is market analysis? This beginner’s guide explains the basics of market analysis and how you can use it to upgrade your trades.

Conducting market analysis helps traders to understand market conditions and forecast price movements by analysing past data and economic factors

Technical, fundamental and sentiment analysis are the most commonly used methods for market analysis

Technical analysis uses tools such as charts to learn from patterns that can help identify how prices are likely to move next

Market analysis is a crucial part of trading as it allows traders to make better informed decisions and increase the possibility of successful trades

What is market analysis?

Market analysis means collecting and analysing data to understand how the markets behave. This information is used to predict how markets will behave in the future. As market analysis provides insights on the price movements of an asset, it’s an important tool for traders to forecast future price changes and try to benefit from them.

There are different types of market analysing methods that use various data, tools and indicators to build an understanding of the current situation in financial markets, or how to predict how markets will evolve. The three main types of market analysis are technical, fundamental and sentiment analysis.

How to use market analysis for your trades

Market analysis can be applied to all financial markets and products including stocks, bonds, forex, commodities, ETFs and cryptocurrencies. If your trading portfolio includes several asset classes, market analysis should be conducted in all those markets. For example, if you are trading shares and forex, you should analyse both stock and forex markets separately.

Some analytical methods are more suitable to support trading with certain products or strategies. Technical analysis is usually favoured by traders looking for quick profits from short-term trading strategies, and fundamental analysis can be more beneficial for long-term trading strategies.

You can choose one type of market analyse or combine several of them to get a more complete view of the market and prices. Technical and fundamental analysis can be effective together; for example, using fundamental analysis to determine what to buy or sell and technical analysis to identify when to open a position.

Common types of market analysis

Technical and fundamental analyses are the most used methods to read financial markets, followed by sentiment and trend analysis.

Here's how some common methods differ from each other:

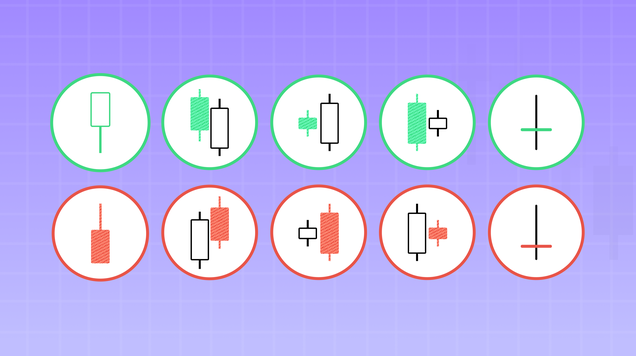

Technical analysis uses past data on price movements when trying to forecast future price behaviour. In other words, looking for patterns and deciding if they are likely to happen again. Technical analysts utilise tools like chart patterns and mathematical indicators to try to identify price movements and trends, which helps traders determine when to open or close positions.

Fundamental analysis studies external factors, like economic, political and social events, and their impact on the price and supply and demand of a financial asset. Whereas technical analysts focus on determining when the prices will change, fundamental analysts try to find out why the prices are moving. Fundamental analysis can be split into quantitative and qualitative analysis, and many analysts will use tools like economic calendars to strengthen their reports. Quantitative analysis focuses on numeric data, whereas qualitative analysis uses other material like reports and publications by the company.

Sentiment analysis focuses on analysing the attitudes, moods and sentiments of the traders as these will affect how market participants buy and sell assets. It can be used to figure out if a market is currently driven more by emotions than rational decisions. Market sentiment is often described as either bullish or bearish. When the sentiment is bullish the prices are rising, and bearish sentiment refers to when prices are falling.

Trend analysis tries to identify patterns and help traders to enter the market at the right time. Trend analysis is built on the idea that what has happened in the market in the past, can provide insight into what will happen in the future. Information such as previous price movements and trade volumes are used in trend analysis, and it can be used to predict short, medium or long-term trends.

Why should you use market analysis?

Market analysis is beneficial and crucial for all traders. It increases the possibility of success as your trades are based on informed and considered decisions.

Analysing the market helps traders to identify opportunities quicker, invest smarter and take advantage of right products at the right time. Following the insights gained through market analysis gives your trading discipline, helping you to avoid impulsive decisions and have greater control over your trades.

Conducting market analysis is especially important for beginners to navigate in a new market, as being aware of past price data, how prices might move and of any external factors affecting the market will create a better understanding of the risks that you may face.

Technical analysis tools, like charts, are usually relatively easy to read for beginners and they are a great tool for understanding when to take action. As fundamental analysis focuses on other data, like financial reports and external factors, it can provide guidance on what products you should be trading at the given moment.

Find market analysis tools on your online trading platform

Powerful online trading platforms will conveniently offer in one place all the tools needed to analyse financial markets effectively. These tools include trend lines, pattern charts, economic calendars and market data and news.

To get access to an online trading platform, you will need to open a trading account with an online broker. Before choosing a broker, it pays to research the kind of tools and extra perks they offer that may increase your chances of success. The more information and tools you can access, the better analysis you are able to conduct and the more it benefits your trades.

Opening an account on an online trading platform is easy and can be done in minutes. If you are a beginner in trading and market analysis, we recommend opening a risk-free demo account, so you have the chance to improve your trading skills and test your market analysis before you make real trades.

Combine several types of market analysis for a more complete view of markets and price actions.