Fed split exposes fragility beneath the recent market rally

The Federal Reserve’s latest policy decision exposed a growing divide within the committee, as a hawkish dissent signaled hesitation over the pace of future rate cuts. While the Fed confirmed it will end quantitative tightening in December, Chair Jerome Powell emphasized that another cut this year is far from guaranteed. The announcement comes at a time when market breadth remains unusually thin — with a handful of AI-driven giants dominating equity returns — and investors now balancing monetar

The Fed held rates steady but revealed internal divisions over future cuts.

Quantitative tightening to end in December, not November as some expected.

Market breadth remains at historic lows — fewer than one-third of S&P 500 stocks outperform the index.

AI Mega caps continue to drive most of 2025’s equity gains.

Policy divide deepens as quantitative tightening ends

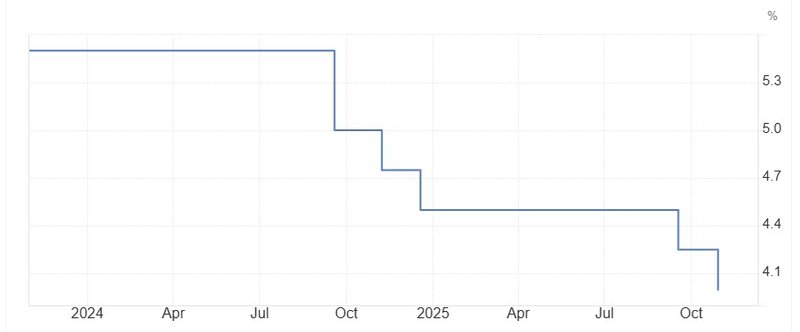

The Federal Reserve lowered the federal funds rate by 25 bps to a target range of 3.75%–4.00% at its October 2025 meeting, in line with market expectations, but the decision was far from unanimous. A hawkish dissent — advocating against keeping policy steady — revealed growing divisions within the committee. Powell’s accompanying statement made it clear that a rate cut in December is not a foregone conclusion, suggesting the central bank wants more data before committing to additional easing.

Source: TradingEconomics

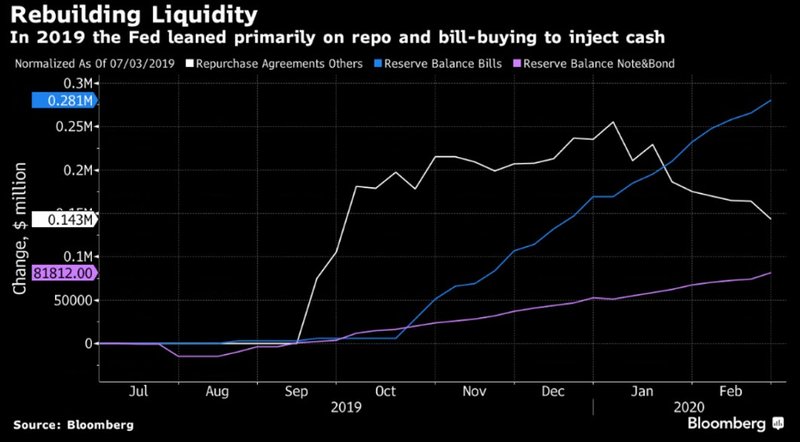

The Fed also confirmed that quantitative tightening (QT) — its multi-year effort to shrink the balance sheet — will end in December. While markets widely expected the move, the delayed timeline surprised some traders given recent volatility in short-term funding markets. Overnight repo rates have been climbing against the Fed’s administered rates, and usage of the central bank’s standing repo facility has become increasingly routine.

Analysts argue this dynamic implies that the Fed may already have over-tightened liquidity. With bank reserves shrinking and money-market stress emerging, the central bank could soon need to allow the balance sheet to expand again — either through securities purchases or increased repo operations.

Source: Bloomberg

No guarantee of December cuts

Powell’s cautious tone served as a reminder that the path toward lower rates remains uncertain. While market pricing had fully anticipated another 25-basis-point cut by year-end, the Fed chair’s comments encouraged investors to reprice expectations toward a more balanced outlook.

In essence, the committee’s message was that policy should respond to fundamentals — and with economic data limited due to the ongoing government shutdown, the evidence remains incomplete. The day’s policy outcome matched expectations, allowing investors to quickly pivot their focus toward corporate earnings, especially from the artificial intelligence sector that has been the driving force of this year’s equity rally.

AI earnings steal the spotlight

As monetary debates continue, the center of gravity for markets has shifted decisively toward technology. This week’s lineup of AI-related earnings — from Microsoft, Alphabet, and Meta to Apple and Amazon — could prove more influential for asset prices than the Fed’s own announcement.

The so-called “AI Ouroboros” — a feedback loop of massive reinvestment within the AI ecosystem — continues to propel valuations. Companies are funding each other’s growth, creating a self-reinforcing cycle that has become the dominant force behind 2025’s equity rally. While such virtuous circles can quickly turn vicious, momentum remains strong, pending confirmation from this week’s results.

A market rally built on narrow foundations

The remarkable rise of U.S. equities this year conceals a deeper imbalance beneath the surface. Only about 30% of S&P 500 constituents have outperformed the index on a year-over-year basis — one of the lowest breadth readings in decades. This pattern echoes previous market extremes, including the late-1990s tech bubble, when concentrated leadership masked underlying fragility.

The equal-weighted version of the S&P 500 is up roughly 8% this year, far behind the capitalization-weighted benchmark driven by mega-cap tech stocks. Tuesday marked one of the worst days on record for market breadth during a session when the headline index still rallied — a sign that gains are increasingly dependent on a small cluster of names.

Historically, periods of low breadth do not necessarily predict imminent declines. However, when market participation eventually broadens, it often does so because the leaders falter. In that sense, investors may need to be careful what they wish for.

Fed caution meets AI exuberance

The Fed’s reluctance to pre-commit to further rate cuts adds a layer of restraint to markets that have grown comfortable with easy policy. Yet this restraint is competing with extraordinary optimism surrounding the AI boom — a phenomenon that has fueled both corporate profits and investor euphoria.

While monetary policy shapes the cost of capital, it is technological disruption that continues to shape market sentiment. For now, Powell’s message of patience may temper rate-cut expectations, but the true driver of near-term volatility will likely come not from the Fed’s statement — but from Silicon Valley’s earnings calls.