Takaichi’s win sets stage for BOJ policy battles

The Bank of Japan faces a tougher political environment after ruling party leader Sanae Takaichi’s victory, raising questions about whether Governor Kazuo Ueda can proceed with another rate increase without jeopardizing the central bank’s independence. Markets had been preparing for an October hike following stronger data and hawkish signals, but expectations collapsed after Takaichi — a known critic of higher rates — secured her win.

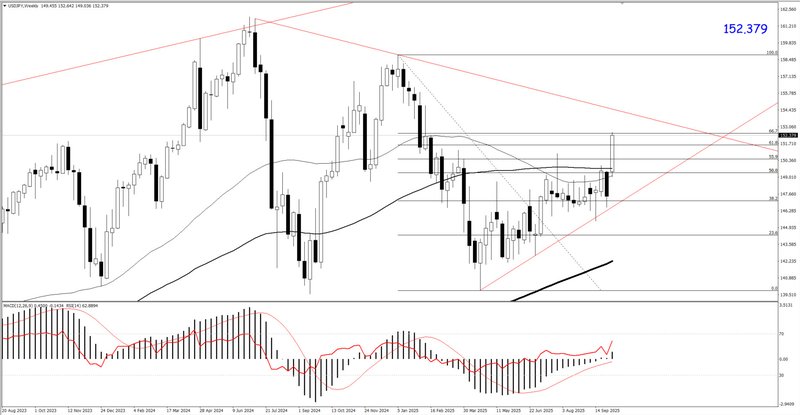

Market odds for an October rate hike fell from 68% to near 20% after Takaichi’s win.

Political pressure raises questions about BOJ independence in policy decisions.

A weaker yen and rising inflation complicate Ueda’s next move.

Investors fear delayed tightening could fuel further currency volatility.

Takaichi victory reshapes the policy backdrop

The leadership win of Sanae Takaichi, who has openly criticized interest-rate increases, has thrown Japan’s monetary outlook into flux. Governor Kazuo Ueda, midway through his five-year term, now faces a political landscape less tolerant of aggressive normalization. Markets had been leaning toward an October move after a string of firm economic readings and hawkish BOJ commentary. Yet sentiment shifted abruptly after Takaichi’s victory, which reduced market-implied odds of a near-term hike to roughly one in five.

Ueda’s challenge now lies in balancing political sensitivities with macro fundamentals. A decision to raise rates could be viewed as defiance of the new leadership, while holding steady risks deepening yen weakness and fueling imported inflation — a trade-off that threatens both the central bank’s credibility and its independence.

Independence under scrutiny

The BOJ’s gradual exit from decades of extraordinary stimulus has, until now, been marked by careful communication and limited interference from policymakers. But the new political alignment may alter that balance. The prospect of government influence over rate decisions — especially after Takaichi’s camp signaled caution on further tightening — has sparked debate over how much freedom Ueda retains.

It could be noted that any hesitation in policy shifts could reinforce perceptions that political priorities outweigh economic data. A weaker yen, already trading near multi-month lows, amplifies the stakes. The longer rates remain unchanged, the more pressure builds on the currency, heightening the risk of imported inflation and potentially forcing the government itself to step in with verbal or fiscal support.

What’s at stake for ueda

Ueda’s first two years were defined by steady dismantling of the BOJ’s ultra-easy framework — scrapping yield-curve controls, scaling back bond purchases, and halting equity buying. His strategy had restored some confidence that the central bank could eventually normalize policy without market shock. Now, that path is clouded by uncertainty.

If the BOJ delays hikes until December or beyond, investors may interpret it as political accommodation rather than economic prudence. That perception could weaken trust in Japan’s commitment to containing inflation, especially as wage growth and core prices remain elevated. For Ueda, preserving autonomy may prove as important as adjusting rates themselves.

The broader market equation

The yen’s latest slump underscores how politics and monetary policy remain tightly intertwined. A continued slide risks reigniting tensions with Washington, where officials have long accused Tokyo of currency manipulation. Meanwhile, rising U.S. yields and the prospect of sustained Fed policy divergence add further strain.

Japan’s economic story has evolved — inflation is back, labor shortages are entrenched, and the world’s most indebted nation can no longer rely solely on ultra-cheap money. Yet the next move may depend less on macro data and more on whether the BOJ can navigate a newly assertive political leadership without losing its hard-won independence.