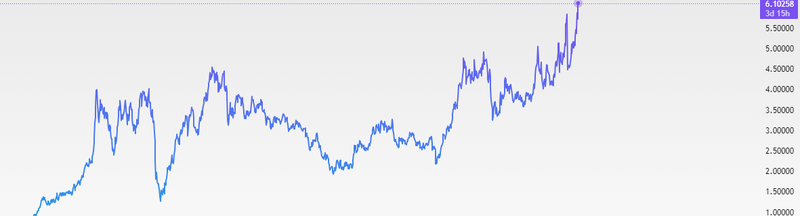

Copper hits fresh all-time high as supply fears and demand trends collide

Copper prices climbed to fresh record highs above $6 per pound as tightening global supply, and strong structural demand converged. Concerns over potential US tariffs on refined metals have disrupted trade flows, while low inventories across major exchanges have left the market vulnerable to shortages. At the same time, demand linked to energy transition projects, data center expansion, and China’s policy support continues to underpin prices.

Tightened spot supply and amplified upward price pressure.

Global copper ETF holdings have risen by an estimated 8–10%

Secondary supply and recycling of copper have also increased from 4,123 kt to 8,702 kt.

Supply constraints and inventory stress

The copper rally is being driven primarily by mounting supply concerns, now reinforced by prices pushing them to a fresh all-time high above $6 per pound. Traders are increasingly focused on the risk that new US tariffs on refined metals could alter global trade flows. Even the prospect of such measures has encouraged suppliers to redirect shipments toward the US market, reducing availability in traditional trading hubs such as London and Shanghai. This shift has tightened spot supply and amplified upward price pressure.

Visible copper stocks remain near multi-year lows, leaving the market with little room to absorb disruptions. Combined inventories held across the London Metal Exchange, Shanghai Futures Exchange, and COMEX are well below historical norms, underscoring how thin the supply buffer has become. At current record price levels, the market is reacting more sharply to policy signals, logistical bottlenecks, and production challenges at major mines, as even small supply shocks now carry outsized price impact.

Source: Trading View

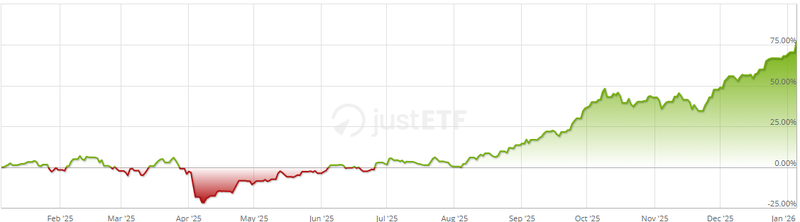

Investment flows and ETF demand

Investor positioning has reinforced the upward movement in copper prices. Copper-backed ETFs have recorded steady inflows in recent weeks, signaling growing institutional interest as prices pushed to new record highs. Global copper ETF holdings have risen by an estimated 8–10% since the start of the quarter, adding roughly 70,000–90,000 metric tons of copper exposure across major funds. Assets under management in leading copper ETFs are now at their highest levels on record, reflecting renewed confidence in the long-term supply-demand imbalance. These inflows are not purely driven.

Many funds are increasing strategic exposure to commodities linked to electrification, grid upgrades, and infrastructure spending, rather than chasing short-term price moves. This distinction matters because longer-term allocations tend to be more stable, helping to support prices even during broader market pullbacks. As long as supply constraints persist and structural demand remains intact, ETF flows are likely to continue acting as a stabilizing force for copper prices rather than a source of volatility.

Source: justetf.com

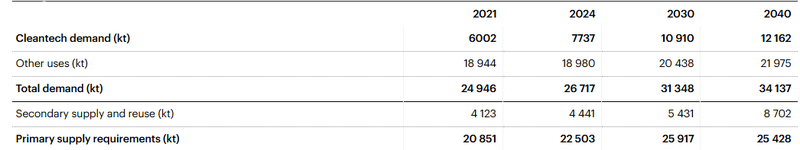

Copper demand and supply dynamics

The latest data show that total global copper demand is climbing steadily, from 24,946 kt in the earliest period to 34,137 kt in the latest year, reflecting robust industrial activity, infrastructure spending, and electrification trends. While demand is rising, the secondary supply and recycling of copper has also increased from 4,123 kt to 8,702 kt but this growth is not enough to fully offset the rising needs.

As a result, primary supply requirements, the copper that must come from mining remain tight, fluctuating between 20,851 kt and 25,917 kt, with the most recent period at 25,428 kt. This indicates that mining output must meet the bulk of growing demand, leaving the market sensitive to disruptions such as geopolitical trade restrictions, production delays, or logistical bottlenecks. When combined with low inventory levels, these supply-demand imbalances help explain why copper prices recently hit new all-time highs above $6 per pound.

Source: IEA.org