DOJ subpoenas Fed, Powell says pressure campaign won’t sway rates

Federal Reserve Chair Jerome Powell said the central bank has been served with grand jury subpoenas from the US Justice Department that threaten a criminal indictment, casting the move as part of an escalating effort by President Donald Trump’s administration to pressure the Fed over interest-rate policy.

Powell says DOJ subpoenas tie to his June testimony on Fed HQ renovations.

He frames the threat as political pressure linked to rate decisions.

Markets react: US futures and the dollar slip; gold extends gains.

Focus shifts to Fed independence and Powell’s May chair-end date.

Subpoenas land as Powell draws a red line

In a written statement and accompanying video released Sunday evening, Powell said the subpoenas were delivered Friday and relate to his June congressional testimony on renovations to the Fed’s headquarters. But he said the action “should be seen in the broader context of the administration’s threats and ongoing pressure.”

Powell said the threat of criminal charges is a consequence of the Fed setting rates “based on evidence and economic conditions” rather than political preferences, warning the episode raises a basic question: whether monetary policy will be guided by data or intimidation.

White House denial, immediate market reaction

President Trump told NBC News on Sunday he had no knowledge of the DOJ investigation into the central bank. Markets moved quickly after Powell’s statement: US stock futures and the dollar weakened, while gold extended gains to a fresh record.

Rate-cut demands collide with a divided Fed

The subpoenas arrive against the backdrop of Trump’s renewed calls for aggressive easing, arguing lower rates would help housing affordability and reduce government borrowing costs. The Fed cut its benchmark rate last month to a 3.5%–3.75% target range — the third straight quarter-point move — while signaling it wants more clarity on inflation and the labour market before moving again.

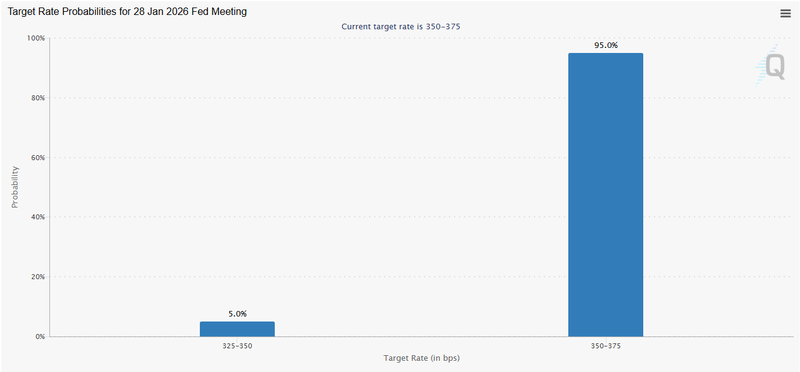

Policymakers meet next on Jan. 27–28, with futures pricing implying a low probability of another near-term cut.

Source: CME Group

The renovation fight: costs, claims, and the “cause” question

The administration’s scrutiny has centered on the renovation of two historic Fed buildings and the rise in projected costs. Fed budget documents show estimates increased to about $2.5 billion in 2025 from $1.9 billion in 2023, which the central bank has attributed to higher materials and labor costs and unforeseen issues such as toxic contamination.

In June testimony, Powell disputed claims that the project included lavish features and said some earlier elements were no longer in the plans. Since then, administration officials and some lawmakers have alleged — without publicly detailing proof — that Powell misled Congress, raising the politically charged question of whether the dispute could be used to argue “cause” for removal. Under the statute governing the Fed, governors can be removed only “for cause,” generally understood as inefficiency, malfeasance, or neglect of duty.

What it means for Powell’s future — and the next chair

Powell’s term as chair ends in May, though his term as a Fed governor runs until 2028. He said he intends to continue doing his job “with integrity” and has not said whether he will step down as chair in May or remain on the Board.

Trump said he has already chosen a nominee to replace Powell but has not named the pick publicly; White House economic adviser Kevin Hassett has been widely viewed as a leading contender.

Capitol Hill pushback adds a new constraint

Republican Senator Thom Tillis, a member of the Senate Banking Committee, defended the Fed and said he would oppose confirming any Fed nominee until the legal matter is resolved — a stance that could complicate the path for any chair pick if it hardens into a broader bloc.