Dollar gains as Fed signals conditional, not committed, easing

The U.S. dollar moved higher at the start of the week, with investors balancing fresh geopolitical developments, a heavy run of economic data, and growing questions around the future path of Federal Reserve policy. While global risks have increased, markets remain focused on whether U.S. data will justify rate cuts later this year or reinforce the Fed’s cautious stance.

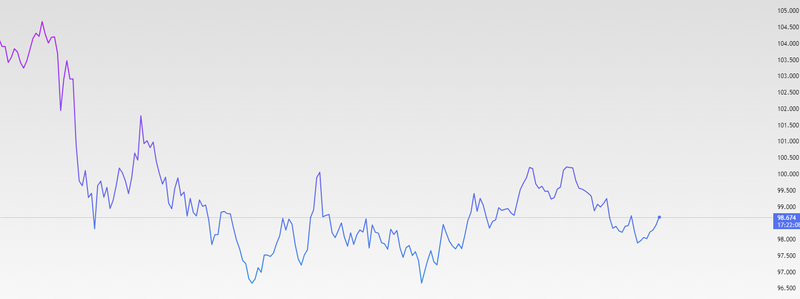

The dollar index climbed above 98.5, reaching a two-week high, as markets reacted to news of a U.S. military operation in Venezuela.

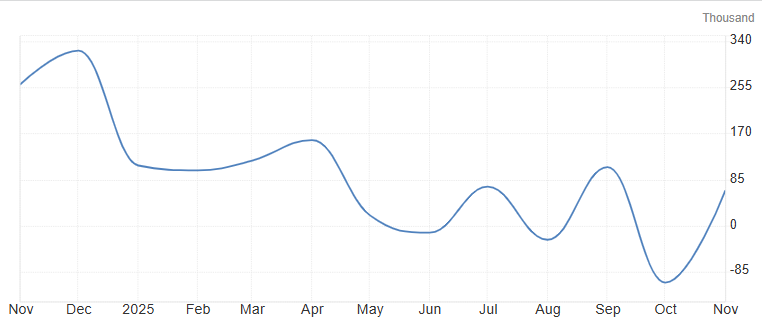

Markets are currently forecasting 57,000 new jobs for December, down from 64,000 previously.

Policy has become conditional. Further easing remains possible, but it will likely require clearer evidence on inflation, labor conditions, and growth.

Geopolitics and Risk Pricing

The dollar index climbed above 98.5, reaching a two-week high, as markets reacted to news of a U.S. military operation in Venezuela that resulted in the capture of President Nicolas Maduro. While such events would typically spark sharp risk-off moves, the market response has been relatively contained so far. This muted reaction suggests investors are still treating the situation as a regional shock rather than a global disruption, at least for now. That said, geopolitical risk has not been ignored. The dollar’s strength reflects its role as a liquidity and safety currency, especially when uncertainty rises. Energy markets and emerging-market currencies remain the most sensitive channels through which this event could spread, but until there is clarity on Venezuela’s political transition or any impact on oil supply flows, investors appear reluctant to make aggressive directional bets. For the dollar, even limited geopolitical tension can provide short-term support, especially in thin liquidity periods, as capital tends to flow into U.S. assets perceived as relatively stable.

Source: Trading View

Key U.S. data and labor market signals

Attention now shifts firmly to U.S. economic data, with the labor market taking center stage. This week includes releases for JOLTS job openings, ADP private payrolls, ISM manufacturing and services PMIs, and the University of Michigan consumer confidence survey. However, the main focus is Friday’s Non-Farm Payrolls (NFP) report. Markets are currently forecasting 57,000 new jobs for December, down from 64,000 previously, pointing to a gradual cooling in hiring momentum. A figure near or below expectations would reinforce the view that the labor market is slowing, though not collapsing. Wage growth and the unemployment rate will be just as important as the headline number, as they influence inflation dynamics and consumer spending. A softer jobs report could revive expectations for rate cuts later in the year, while a surprise to the upside would likely strengthen the dollar further by pushing back against easing expectations. For now, investors remain cautious, waiting for confirmation rather than reacting prematurely.

Source: U.S. Bureau of Labor Statistics

Fed policy outlook and dollar positioning

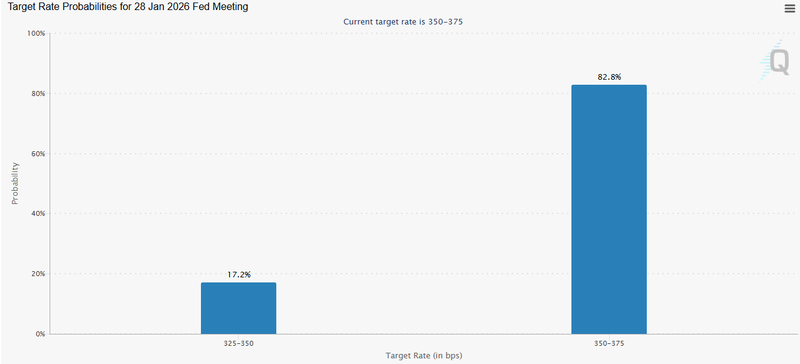

The Federal Reserve’s December rate cut initially appeared straightforward, but the minutes released Tuesday revealed a far more divided discussion beneath the surface. While the committee ultimately agreed on a quarter-point reduction, the debate showed that conviction was mixed, with several officials describing the decision as finely balanced. Some policymakers indicated that, under their own outlooks, it would be appropriate to hold rates steady for some time after the December cut, signaling resistance to the idea of an early-2026 easing cycle. Even among those who voted in favor, a few acknowledged they could have supported leaving policy unchanged. This growing caution has fed directly into market pricing. As a result, markets now assign roughly an 82% probability that the Fed will leave rates unchanged at the January meeting, reflecting expectations of a pause while officials assessing incoming data. This pricing aligns with the tone of the minutes, which suggest that further easing is possible but far from guaranteed. The core divide within the committee remains the balance of risks. Inflation is still viewed as carrying upside risk, while the labor market faces potential downside from slowing hiring. Several officials argued that progress toward the 2% inflation goal appeared uneven during 2025, reinforcing the need for clearer evidence before endorsing additional cuts. Others stressed that moving policy closer to neutral could help avoid a sharper slowdown in employment, especially if hiring continues to cool. The discussion also touched on the inflationary impact of President Donald Trump’s tariff measures, which most officials viewed as temporary and likely to fade into 2026. Still, the broader data backdrop remains difficult to read. Hiring has slowed without a surge in layoffs, inflation continues to ease for markets, the message is increasingly clear: policy is conditional, not committed. While further cuts remain on the table, the combination of internal division, lingering inflation concerns, and imperfect data has raised the likelihood of a pause and explains why January is now widely expected to pass without a rate move.

Source: CME Group