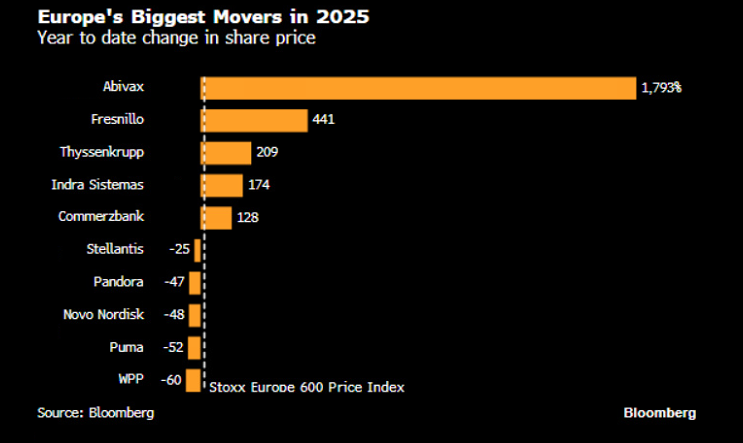

European banks powered a record year for stocks, while Novo and Puma lagged

Europe’s equity rally in 2025 was broad, but it was banks that did the heavy lifting, delivering their strongest run in decades as earnings held up and payouts surged. Not everyone joined the party: Novo Nordisk and Puma were among the headline laggards as sector-specific headwinds piled up.

The Stoxx Europe 600 is up 16% in 2025 and set new all-time highs.

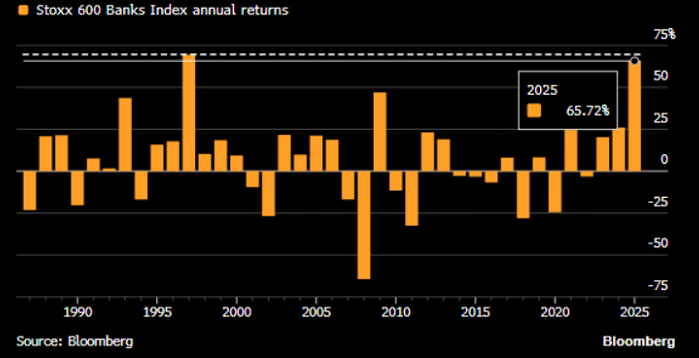

European bank shares have jumped about 65%, the best annual gain since 1997.

Defense and miners posted standout advances, helped by spending plans and metals strength.

Novo Nordisk and Puma sank amid competition, pricing pressure, and tariff-related risks.

A record year, with banks doing the starring

European stocks pushed to fresh highs in 2025, supported by a mix of stronger metals prices and expectations of heavier defense outlays. But the defining feature of the year was the bank rally. Lenders outperformed the rest of the market by a wide margin, helped by resilient profitability, robust fee and trading income, and aggressive shareholder returns through dividends and buybacks.

Source: Bloomberg

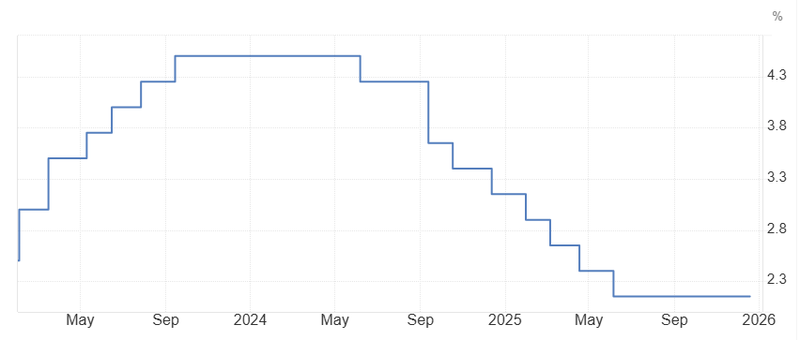

Why the bank trade worked even as rate cuts loomed

Banks were widely expected to face earnings pressure as interest rates drifted lower.

Source: TradingEconomics

Instead, many lenders absorbed that headwind better than feared, aided by cost discipline and healthier non-interest revenue. Big names such as Banco Santander, Societe Generale and Commerzbank stood out, with some heading for their best year on record. The message from bullish strategists is simple: the sector has been operating in unusually supportive conditions, and the market is increasingly willing to price that durability into 2026.

Source: Bloomberg

Defense and miners added fuel to the rally

Defense stocks surged through much of the year on expectations that European governments would lift military spending, a narrative reinforced by Washington’s pressure on allies to do more. Even with late-year wobble as diplomacy around the Russia-Ukraine war drew attention, the sector still finished as one of the year’s big winners.

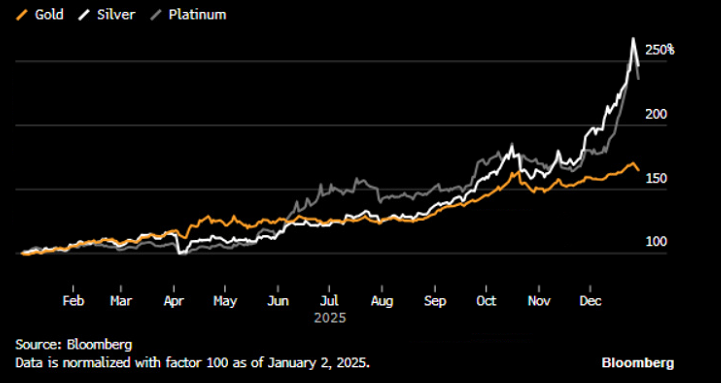

Miners also enjoyed strong momentum. Haven demand for precious metals supported gold-linked names, while copper benefited from electrification themes and heavy power needs tied to AI data centers. Fresnillo was among the most dramatic winners, while producers with copper and silver exposure also saw strong gains.

Source: Bloomberg

The laggards: cost shocks, competition, and tariff anxiety

Not all consumer-facing names coped well with 2025’s cross-currents. Pandora fell sharply as rising silver prices pushed costs higher, while tariff uncertainty around key production hubs weighed on sentiment and forecasts. Company-specific uncertainty, including management transition risk, compounded the pressure.

Puma had an especially rough year, hit by weak execution, profit warnings, and intensifying competition as rivals captured demand in fast-growing categories like running. Tariff risks around manufacturing hubs added another layer of discomfort for investors.

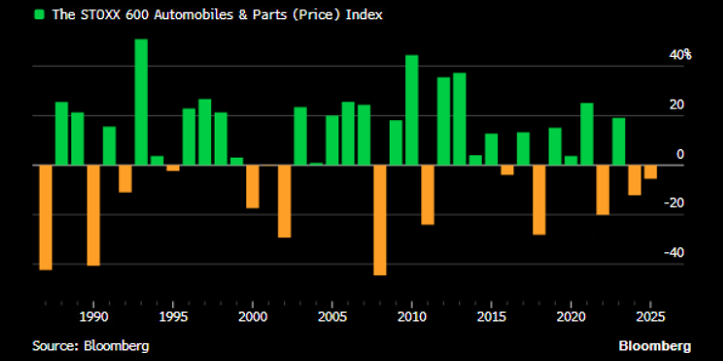

Autos, chemicals, and advertising struggled for different reasons

European automakers and parts suppliers logged another down year as demand stayed soft and competition from Chinese producers remained intense, even as the shift toward more affordable EV models offered pockets of relief. Chemicals and coatings firms also faced a weaker demand backdrop, with tariffs and slow activity squeezing client spending.

WPP, meanwhile, was dragged by a combination of leadership disruption, lost contracts, and investor anxiety that generative AI could reduce demand for traditional agency services.

Source: Bloomberg

Novo Nordisk’s rough stretch contrasts with biotech’s biggest winner

Novo Nordisk extended its slump as competition intensified in weight-loss drugs, including pressure from cheaper alternatives and strong rivalry from Eli Lilly. At the other end of the spectrum, Abivax surged after positive clinical data, making it one of Europe’s clearest “story stocks” of the year.

What 2026 needs to deliver

Strategists argue Europe enters 2026 with a valuation gap versus the US and less direct exposure to richly priced US tech leadership. The catch is earnings: for Europe to repeat 2025’s performance, profit growth has to broaden beyond banks and a handful of winners. Otherwise, the rally risks becoming a very stylish rerun with fewer new buyers.