Fed’s Beige Book signals weak growth and potential rate cuts ahead

The Federal Reserve’s latest Beige Book paints a subdued picture of the U.S. economy, reinforcing expectations that policymakers will continue cutting rates in the months ahead. Despite the ongoing government shutdown limiting official data, the Fed’s regional survey suggests that business activity has stalled, labor demand remains muted, and inflation pressures are being absorbed by profit margins. With Chair Jerome Powell signaling concern over hiring and Fed officials calling for a faster mo

Beige Book shows “little change” in U.S. economic activity across most districts.

Labour demand muted; layoffs and attrition rise as AI adoption accelerates.

Input costs outpace selling prices, squeezing corporate profit margins.

Markets expect rate cuts in October and December, with more possible in 2026.

Fed sees limited momentum as regional data weakens

The Federal Reserve, operating independently from the government shutdown, released its Beige Book this week—a qualitative survey capturing feedback from businesses across the twelve regional Fed districts. The findings were sobering: economic activity has “changed little” since the previous report, with more regions now reporting stagnation or mild contraction.

Out of the twelve districts, three noted slight to modest growth, five saw no change, and four recorded mild softening in activity. This represents a deterioration from August, when a third of districts still reported “modest growth.” The trend confirms the loss of momentum that Chair Jerome Powell described earlier this week, when he warned that the economic situation has not improved since September’s rate cut.

The Beige Book remains one of the Fed’s most valuable tools during periods when official data is disrupted. It offers a real-time, anecdotal lens on how firms are responding to slowing demand, rising uncertainty, and structural change—particularly in the labor market.

Hiring freezes, layoffs, and the ai effect

Employment conditions have softened notably. The report found that “demand for labor was muted across districts and sectors,” while more employers have begun “lowering headcounts through layoffs and attrition.” Business contacts cited weaker sales, elevated uncertainty, and in several cases, increased investment in artificial intelligence as reasons for scaling back human labor.

This evolving dynamic—where firms automate amid slower growth—poses a new challenge for policymakers. Unlike past slowdowns driven solely by demand weakness, this one carries a technological undertone, where long-term efficiency gains come at the expense of short-term job stability.

In August, eleven of twelve districts reported flat employment, but the latest report signals a tilt toward outright declines. That shift strengthens the Fed’s case for continued easing to cushion the labor market and sustain consumer confidence.

Prices rising faster than profits

Inflation may be cooling in aggregate terms, but profit margins remain under pressure. According to the Beige Book, input costs—particularly for tariffs, insurance, health care, and technology—are rising faster than companies can adjust selling prices. Several districts reported squeezed margins as firms struggle to pass through higher costs to consumers already facing affordability fatigue.

This dynamic supports the Fed’s broader assessment that inflation risks are fading, but growth risks are intensifying. Powell and other policymakers have emphasized that corporate earnings are now absorbing much of the cost burden, which reduces inflationary persistence but also weakens business investment capacity.

Markets brace for back-to-back cuts

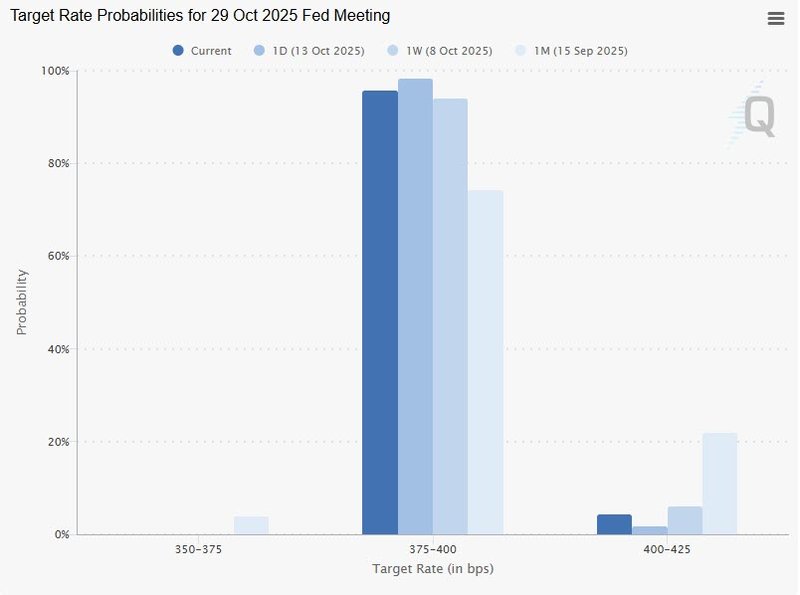

Financial markets have taken the message clearly: the Fed remains in easing mode. Futures now fully price in a 25-basis-point cut at both the October and December Federal Open Market Committee meetings, which would bring the federal funds range down to roughly 3.75–4.00%.

Source: CMEgroup

Governor Stephen Miran recently said the Fed must “get rates down to neutral quickly,” underscoring a growing sense of urgency within the institution. Still, the range of possible outcomes remains wide.

The 2026 outlook: Divided paths

Economists are increasingly split over the 2026 trajectory. Optimists argue that lower borrowing costs, looser financial conditions, and improved trade visibility could stabilize sentiment, encourage hiring, and prompt businesses to reaccelerate investment. In that case, the Fed might deliver only one more cut next year before pausing.

Pessimists, however, warn that rising tariffs, falling corporate profits, and a cooling housing market could push the economy into a deeper slowdown. That scenario could force the Fed to cut rates more aggressively, potentially moving into outright stimulative territory by early 2026.

A data-light, risk-heavy environment

The Beige Book confirms what many in the market already suspected: the U.S. economy is losing steam, not collapsing. But with official statistics delayed by the government shutdown, the Fed is navigating an unusually uncertain environment.

Until visibility improves, anecdotal evidence and private data will drive policy interpretation. For Powell, that means maintaining flexibility—easing just enough to support employment without reigniting inflation. In a data-light world, the Beige Book has once again become the Fed’s compass—and it’s pointing firmly toward more rate cuts ahead.