Fed delivers first rate cut since December, but divisions run deep

The Federal Reserve cut interest rates by 25 basis points at its September meeting, bringing the target range down to 4.0%–4.25%. While the move was widely expected, the accompanying forecasts revealed a divided committee.

Fed lowers rates 25 bps, first cut since December.

Dot plot split: some officials see more easing, others none.

GDP growth forecast raised, unemployment projections revised lower.

Inflation outlook remains elevated, signaling “higher-for-longer” risks.

Markets fluctuated as Powell avoided strong forward guidance.

A divided rate cut

The Federal Reserve’s September decision to lower its benchmark rate by 25 basis points marks a turning point after nine months of holding steady. Policymakers framed the move as a “recalibration,” designed to insure against rising risks to employment while maintaining vigilance on inflation.

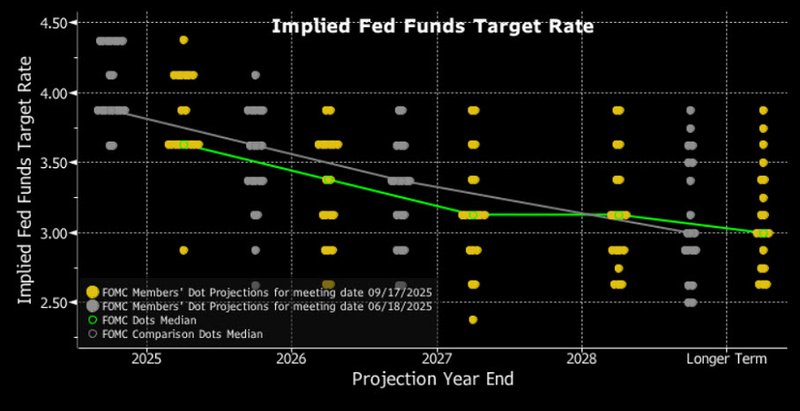

However, consensus within the Federal Open Market Committee (FOMC) was limited. The decision saw one open dissent from new Governor Stephen Miran, who argued for a bolder 50 bps cut. Meanwhile, the updated “dot plot” revealed that opinions diverge widely: while the median projection implies two more cuts this year, nearly half of participants expect just one additional reduction—or none at all.

The split underscores how fractured the Fed has become in its outlook. Some officials believe that weaker job data justify faster action, while others remain concerned that inflation, still above target, requires caution.

Economic projections: growth stronger, unemployment lower

The Fed’s Summary of Economic Projections (SEP) contained several noteworthy adjustments. Policymakers upgraded 2025 GDP growth expectations to 1.6% from 1.4% in June, signaling optimism that the economy can absorb current headwinds more resiliently. Growth for 2026 was also revised upward to 1.8%.

Unemployment forecasts were nudged lower, with the median projection at 4.4% in 2026 and 4.3% in 2027. These revisions suggest confidence that the labor market will stabilize after recent weakness, even if payroll growth remains subdued.

Inflation projections, however, paint a different picture. Core PCE inflation for 2025 was revised higher to 3.1%, while the headline figure remains at 3.0%. For 2026, both measures were marked up to 2.6%. These estimates suggest that inflationary pressures will take longer to ease, reinforcing the Fed’s cautious stance.

Dot plot reveals a split committee

The dot plot, which maps individual policymakers’ expectations for future interest rates, highlighted just how divided the Fed is.

- One dot stood above the post-meeting range, interpreted as a “silent dissent” from Cleveland Fed President Beth Hammack, signaling she believed rates should not have been cut at all.

- Six participants forecast no additional cuts this year.

- Two participants penciled in one more cut.

- Nine participants favored 50 bps of further easing by December.

- One dot showed as much as 125 bps of cuts this year, likely Miran, reflecting a view that at least one meeting should see an unusually large 75 bps reduction.

The wide distribution illustrates not only disagreement about near-term policy but also the uncertainty surrounding the path for 2026 and 2027.

Source: Bloomberg

Markets react cautiously

Financial markets initially responded with volatility. The US dollar index fell by 0.5% immediately after the decision, before recovering during Powell’s press conference. Treasury yields dipped across the curve but rebounded, with the two-year ending flat and the ten-year up slightly by 1.7 bps. The S&P 500 swung lower by nearly 0.8% before retracing much of its losses as Powell emphasized flexibility.

This pattern suggests investors are unsure whether the Fed’s cut represents the start of a deeper easing cycle or a one-off move to balance risks.

Powell’s message: caution and flexibility

In his press conference, Chair Jerome Powell acknowledged both sides of the Fed’s dilemma. He noted that job growth has slowed, with payroll revisions and rising jobless claims signaling that employment risks are mounting. At the same time, inflation is still above the 2% target, and tariffs are expected to keep price pressures elevated into next year.

Powell avoided strong forward guidance, stressing instead that policy remains “data dependent.” By framing the cut as a recalibration rather than a pivot, he sought to preserve flexibility for upcoming meetings.

Balancing labor risks with sticky inflation

The September decision reflects the Fed’s struggle to balance its dual mandate. On one side, labor-market indicators are flashing weakness: payroll growth has slowed to a crawl, and jobless claims recently hit their highest level in nearly four years. On the other side, inflation progress has stalled, with core inflation holding at 3.1% annually.

This combination raises the specter of stagflation—sluggish growth alongside persistent price pressures. For now, the Fed is trying to buy insurance against a deeper labor downturn without reigniting inflation expectations.

The Fed’s September cut is the first step in what could become a longer easing cycle, but the divisions on the committee make the path ahead uncertain. Some policymakers are pushing for aggressive cuts, while others prefer to hold rates steady until inflation shows clearer signs of retreat.

Markets, meanwhile, are left with a message of caution and patience: one cut now, no promises for what comes next.