Gold and silver hit fresh records as geopolitics and a weaker dollar fuel the rally

Gold and silver climbed to new all-time highs as geopolitical tensions lifted haven demand and a broad pullback in the US dollar extended what is already a standout year for precious metals.

Spot gold briefly topped $4,530 as haven flows strengthened.

Spot silver surged above $75 for the first time after a fifth straight gain.

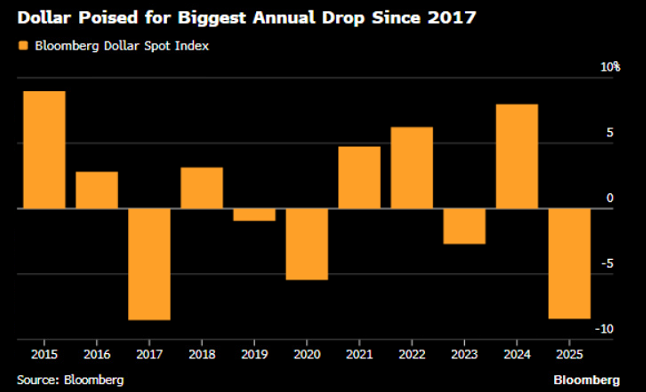

The Dollar Spot Index fell 0.8% for the week, its biggest drop since June.

Platinum also set a record, supported by tight supply and strong demand.

A weaker dollar gives metals an extra push

Gold and silver found additional lift from a softer greenback. The Dollar Spot Index was down 0.8% on the week, which typically supports metals priced in dollars by making them cheaper for non-US buyers and improving broad risk-adjusted demand. Dollar poised for biggest annual drop since 2017.

Source: Bloomberg

Geopolitics rebuilds the haven bid

Gold’s haven appeal strengthened as tensions rose on multiple fronts. Frictions involving Venezuela intensified after the US blockaded oil tankers and stepped up pressure on President Nicolás Maduro’s government. Separately, the US said it carried out a major strike in Nigeria, adding another layer of geopolitical risk that tends to buoy defensive assets.

Silver extends a squeeze-driven rally

Silver jumped for a fifth consecutive session, rising as much as 4.6% to break above $75. The move has been reinforced by speculative inflows and lingering supply dislocations across major trading hubs after October’s historic short squeeze, keeping the market unusually sensitive to incremental buying.

Source: Bloomberg

A historic year, backed by flows and policy expectations

Gold is up roughly 70% this year and silver more than 150%, putting both on track for their strongest annual performance since 1979. The run has been supported by strong central-bank buying, sustained ETF inflows, and the Federal Reserve’s string of rate cuts. With markets leaning toward further easing in 2026, the macro backdrop has remained supportive for non-yielding metals.

Source: Bloomberg

Platinum joins the breakout as supply stays tight

Platinum also hit a record, extending a sharp upswing that has accelerated in recent weeks. Beyond demand, the market has been supported by expectations of a third annual supply deficit, with disruptions in major producing regions such as South Africa tightening availability.