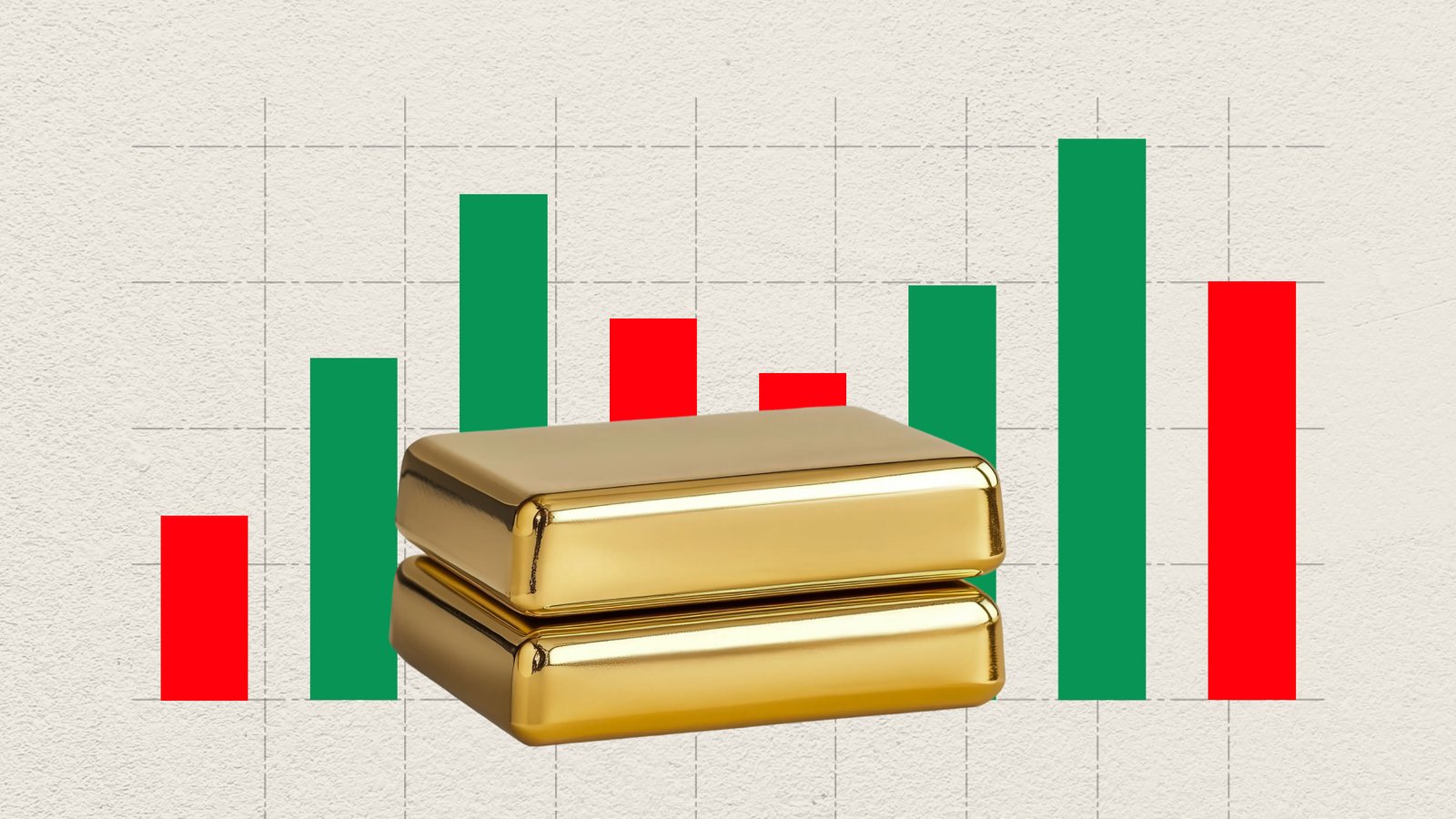

Gold breaks $5,000 as policy shock and debt fears ignite haven rush

Gold vaulted through the $5,000-an-ounce mark and kept climbing as investors fled currencies, bonds, and sovereign risk, turning to bullion as global policy uncertainty and debt anxiety reshaped market behaviour.

Gold surged beyond $5,000, extending its fastest rally in decades.

Dollar weakness and bond selloffs reinforced the flight into bullion.

Silver spiked to a fresh record above $110 an ounce.

Options markets and positioning point to expectations of further upside.

A psychological barrier gives way

Gold’s leap through $5,000 marked more than just another record. It underscored bullion’s role as the market’s stress barometer at a time when confidence in currencies and government debt is visibly fraying. Prices climbed as much as 2.5% to above $5,110, building on momentum driven by policy volatility and a broad retreat from sovereign assets.

The move coincided with renewed weakness in the dollar, amplifying demand for precious metals. A broad dollar gauge has fallen sharply over recent sessions, adding fuel to a rally already powered by haven demand and investor unease. As well potentially new US government shutdown at the end of this month.

Source: TruthSocial-Trump

Policy shocks revive the debasement trade

Markets have been rattled by an intensifying mix of geopolitical and institutional uncertainty tied to Donald Trump’s foreign-policy and economic posture. From escalating trade threats to renewed pressure on the Federal Reserve, investors are increasingly pricing in a world where policy risk is no longer peripheral but central.

This backdrop has revived the so-called debasement trade, as investors rotate away from fiat currencies and government bonds. A sharp selloff in Japanese sovereign debt last week served as another reminder that heavy fiscal burdens are testing the limits of investor tolerance.

Gold’s dramatic gains drives home bullion’s historic role as a gauge of fear in markets. Fresh from its best annual performance since 1979, it’s risen nearly 18% so far this year due largely to the so-called debasement trade, whereby investors retreat from currencies and Treasuries. A massive selloff in the Japanese bond market last week is the latest example of investors rejecting heavy fiscal spending.

Source: TradingView

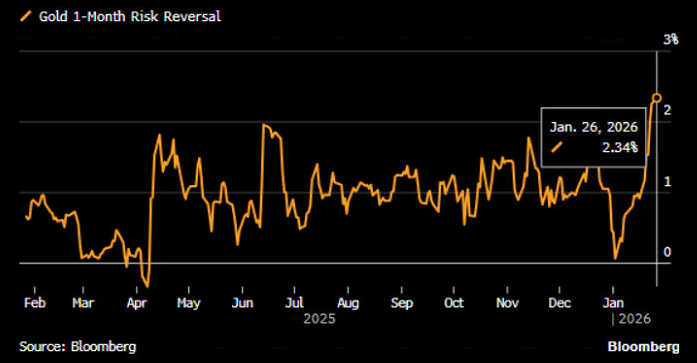

Options markets signal conviction, not euphoria

Unlike past spikes driven by short-term fear, the latest surge shows signs of deeper conviction. Gold risk reversals — a key options metric — have jumped to their highest level since 2024, signaling strong demand for upside protection.

This positioning reflects expectations of sustained strength rather than a fleeting surge, suggesting that gold is carrying a lasting geopolitical and confidence premium rather than a purely speculative bid.

Source: Bloomberg

Central banks and long-term capital stay the course

Gold’s ascent is also anchored by steady official-sector buying. Central banks continue to diversify reserves away from Treasuries, pushing the value of global gold holdings above that of US government bonds in official portfolios.

Source: Bloomberg

According to the World Gold Council, long-term investors such as family offices are increasingly framing gold as generational insurance — a hedge against rising debt loads and the erosion of purchasing power over time.

Silver joins the frenzy

The rally has not been confined to gold. Silver surged above $110 an ounce, buoyed by robust investment demand from retail buyers across Asia and the Middle East. The metal’s dual role as both a precious and industrial asset has amplified inflows, especially amid lingering uncertainty over global trade and tariffs.

Source: TradingView

A market defined by uncertainty

As investors await clarity on the next leadership of the Federal Reserve and the direction of US fiscal and trade policy, bullion’s appeal continues to strengthen. With confidence in traditional anchors eroding, gold’s breakout above $5,000 looks less like an endpoint and more like a signal: in an unsettled world, the ultimate non-sovereign asset is back at the center of global portfolios.