Markets await labour data to define Q1 direction

U.S. Treasury yields and the dollar have remained unusually stable over the past two weeks, reflecting a market that has largely converged on the Federal Reserve’s near-term policy path but is increasingly divided on the outlook for growth and inflation in early 2026. Recent data confirm a gradual cooling in labour demand without signaling a sharp economic downturn, creating a narrow window where neither bullish nor bearish rate narratives dominate.

Yields are consolidating as markets pricing a policy hold but remain uncertain about the timing of the first cut.

U.S. Dollar has lost some of its cyclical momentum but remains supported by relatively high real yields.

Non-Farm Payrolls is the critical catalyst for market repricing.

Treasury yields and market expectations for monetary policy

U.S. Treasury yields have edged lower this week, with the 10-year yield trading near 4.1–4.2%, extending a controlled decline that has unfolded since late December. This move reflects growing confidence that the Federal Reserve has completed its tightening phase, rather than an abrupt shift toward growth pessimism. Investors continue to demand a meaningful term premium, reflecting heavy Treasury issuance and lingering inflation uncertainty, which explains why yields have not fallen more sharply.

From a forward-looking perspective, the bond market is pricing a gradual easing cycle rather than aggressive or front-loaded cuts. The most likely Q1 outcome is continued range trading, with yields biased modestly lower if labor data soften further. A sustained move below 4% would likely require clear evidence of slowing wage growth and rising unemployment, while a return toward recent highs would require stronger-than-expected labour or inflation data. At this stage, risks appear asymmetrically tilted toward slightly lower yields, but with volatility expected to rise around key data releases.

Source: Tradingeconomics

The U.S. Dollar and relative growth dynamics

The U.S. dollar has mirrored the Treasury market’s behavior, trading in a narrow range against major currencies. This reflects a convergence in expectations around U.S. monetary policy, rather than a decisive shift in global risk sentiment. While the Fed is no longer expected to tighten further, U.S. yields remain high relative to peers, preserving the dollar’s carry advantage and preventing a sharp selloff.

Looking ahead, the dollar’s trajectory in Q1 will largely depend on whether U.S. data confirm a gradual slowdown or reassert economic resilience. If labour market data continue to soften, rate differentials are likely to compress further, putting mild downward pressure on the dollar. However, absent a clear deterioration in growth, any dollar weakness is likely to be orderly and incremental rather than structural. A stronger labor print would quickly restore dollar support by pushing back expectations for rate cuts.

Labour market signals and defining data for Q1

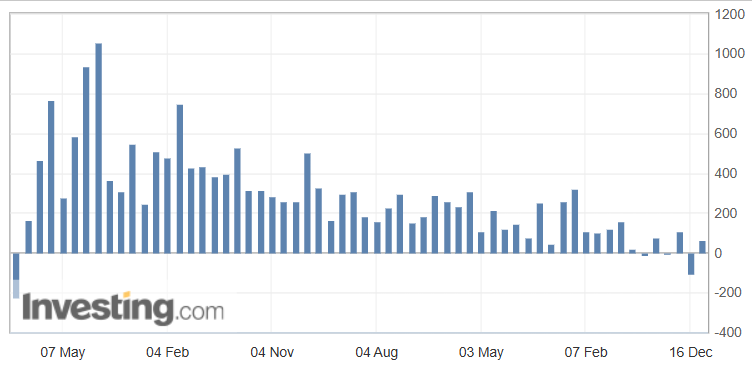

Tomorrow’s Non-Farm Payrolls report is the key test for both markets and the Federal Reserve. The previous print of 64k jobs already signaled a clear cooling in labour demand, and the current 57k forecast points to further moderation rather than contraction. At these low levels, even a modest surprise will carry outsized policy implications.

A result near or slightly below 57k, especially with softer wage growth, would reinforce the Fed’s view that restrictive policy is working as intended. This would support the soft-landing narrative, keep the Fed on hold in the near term, and strengthen expectations for rate cuts later in 2026, likely pushing yields slightly lower and the dollar modestly weaker.

A stronger-than-expected print, particularly above the prior 64k with firm wages, would challenge current market pricing. It would suggest labour conditions remain tighter than desired, prompting the Fed to maintain a more restrictive stance for longer. In this case, yields and the dollar would move higher as rate-cut expectations are pushed back.

Overall, the report is less about whether the labour market is cooling and more about how fast it is cooling—an assessment that will directly shape the Fed’s policy outlook in the months ahead.

Source: Investing.com