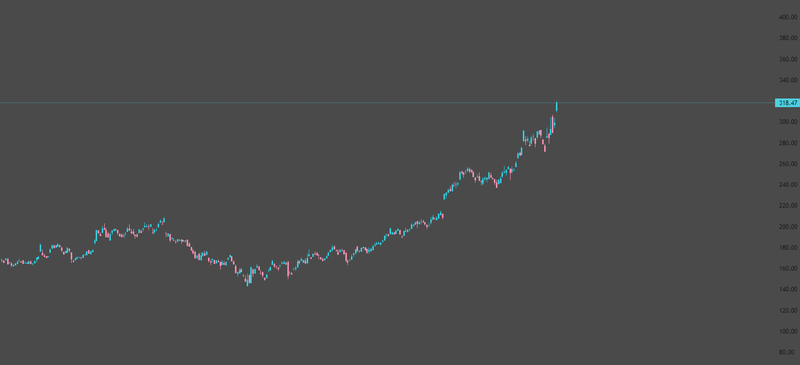

S&P 500 and tech rise as Fed cut expectations improve

The U.S equity market started the week with a powerful rebound, led again by the big tech companies, after couple of weeks of correction and cautious trading. Investors rotated back to reignite risk appetite, and amid confidence in the AI sector and improving expectations for a December rate cut. S&P 500 jumped from October low as traders repositioned ahead of economic data due throughout the week.

Nvidia, Google, and several tech companies bounced on yesterday’s sessions.

John Williams delivered conflicting message about December rate cuts.

Trump accepted China president invite next year.

Market searching for directions.

AI mega caps reclaim leadership

Tech stocks staged a strong comeback, with the market showing a clear appetite to re-enter AI trade. Unlike the steep bid-chasing rallies seen earlier in the year, Monday move looked more like recalibration of positioning after a period of profit-taking.

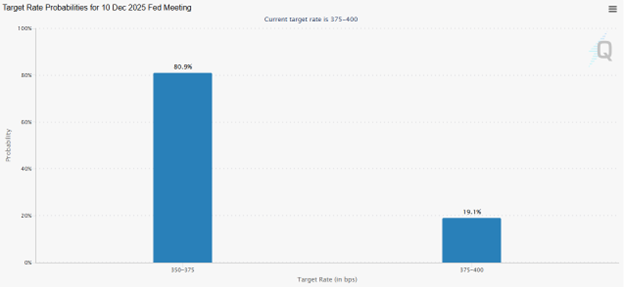

Investors were encouraged by cut rate probability rise to 81% and fresh development across AI ecosystem, new partnerships.

Nvidia, Google, Tesla, and several heavy names bounced on yesterday session as traders confident into companies that are set to benefit from long-term AI infrastructure spending. Regaining confidence helped S&P 500 and Nasdaq to stabilize. Which had been one of the weakest performances in November.

Source: Trading View

Rate cut expectations bounce back to 81%

Market pricing for a December rate cut continued to rise from 42% to 81%, especially after John Williams saying, “interest rates could fall without putting the Fed's inflation goal at risk”. The incoming economic releases this week will play a decisive role, GDP figures, retail sales and PCE reading any indications that growth is softening or that inflation is easing further could reinforce the case for a policy pivot before the end of year, the debate inside the fed appears divided, and the market is attempting to get ahead of uncertainty.

Source: CME Group

Geopolitical signals from Washington to Beijing

Washington suggested a warming in diplomatic tone between U.S and China, a potential meeting between the two presidents next year to maintain dialogue and helping to ease some of the tension that has lingered over trade sensitive sectors. AI sector is waiting for this meeting to have softer restrictions that may support cloud and data center growth and avoid escalating export control battles that have heavily affected the AI hardware eco system. Any progress between Washington and Beijing has the potential to ease systemic risks around AI supply chains, making the start of new rally in the sector more credible.

The market is comfortable for taking risks

Monday rally suggests that equity market remain willing to embrace risk when macro condition lean supportive and when AI leaders stabilize. But volatility is far from gone, with crucial economic events on deck a highly uncertain December fed rate cut even that probability is showing 81%, it can be change within minutes if the next data reading was not as expectations.

For now, S&P 500 has regained its footing, powered by familiar Ai tech companies, rate cut optimism, and slightly improve geopolitical tone.