Nikkei slips as BOJ caution weigh on sentiment

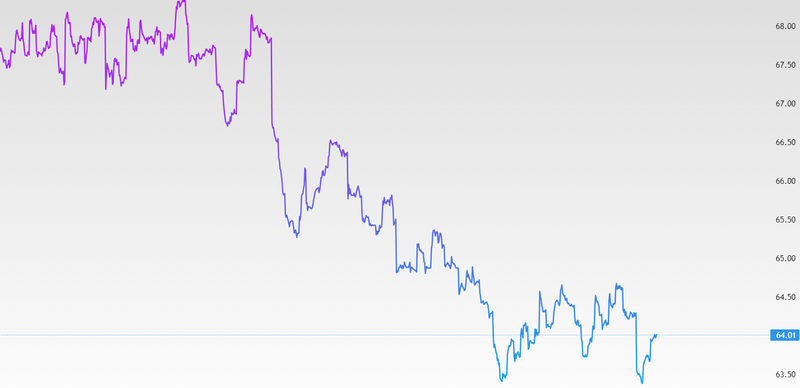

The Nikkei 225 ended Wednesday’s session lower, falling 212 points, or 0.4%, to close at 50,255, after early gains faded amid a stronger yen and shifting expectations around Japan’s monetary policy. Currency strength pressured export-heavy sectors, while financial stocks pulled back after last week’s rally. Technology shares, however, offered some support, with selective gains driven by positive analyst upgrades and global tech momentum.

A stronger yen weighed on exporters, especially automakers.

Financial stocks retreated after last week’s sharp rally.

Technology shares showed resilience, with select stocks rising on strong global semiconductor.

Stronger Yen turns sentiment and pressures exporters

The first and most important driver behind the Nikkei’s decline is the strengthening of the Japanese yen. Japan’s equity market is heavily exposed to exporters, especially automakers and industrial firms that earn a large share of their revenue overseas. When the yen strengthens, those foreign earnings translate into fewer yen once brought back home, directly hurting profits on paper. On Wednesday, the yen gained against major currencies, and that immediately changed market sentiment. Early optimism faded as investors reassessed earnings outlooks, particularly for export-heavy companies. This explains why automakers led the decline. Toyota fell 1.8%, Subaru dropped 1.2%, and Honda also moved lower. These companies are extremely sensitive to currency movements because even small changes in the yen can significantly impact margins. The key point here is that the market wasn’t reacting to bad company news. Instead, it was reacting to currency risk. Investors began pricing in the idea that a stronger yen could persist if Japan continues to normalize policy, making exporters less attractive in the short term. This currency-driven selling often happens quickly and broadly, which is why the index reversed despite opening higher.

Source: Trading View

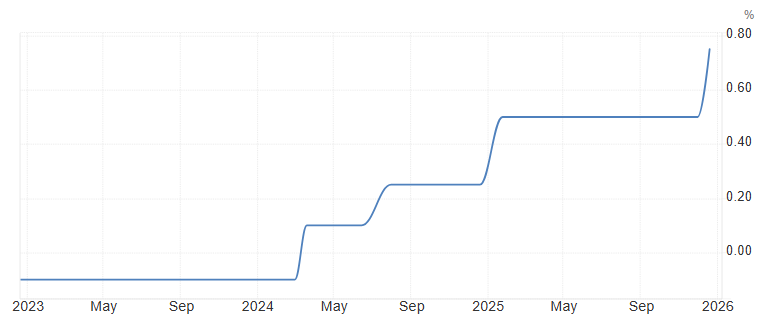

Bank of Japan rate hike aftershocks hit financials

The second major theme is the lagged impact of the Bank of Japan’s recent interest rate hike. Last week, the BOJ raised rates to their highest level in more than 30 years. Initially, this move sparked a strong rally in financial stocks, as higher rates generally improve profitability for banks and insurers. However, markets rarely move in straight lines. After last week’s sharp gains, financial stocks pulled back, giving up part of those advances. This wasn’t panic selling it was profit-taking. Investors who bought banks and insurers ahead of the rate hike began locking in gains once the immediate upside was priced in. Minutes from the BOJ’s October meeting added another layer. Policymakers broadly agreed that real interest rates remain low, signaling that monetary conditions are still accommodative. This reinforced expectations that future tightening will be slow and gradual, not aggressive. As a result, some investors adjusted their expectations downward to see how quickly financial earnings might improve. Rates are rising, which is positive for financials long-term, but the pace is slow, limiting near-term upside.

Source: Bank of Japan

Stock level strength keeps tech as a support pillar

The divergence inside the market, especially within technology stocks. While the Nikkei index fell overall, not all sectors moved lower. Technology shares were mixed but mostly firm, acting as a stabilizing force. Advantest rose 2.5%, supported by gains in U.S. semiconductor stocks overnight. Tokyo Electron added 0.7%, reflecting continued optimism around global chip demand and AI-related investment cycles. The standout was Screen Holdings, which surged 10% to become the top performer in the index after Morgan Stanley MUFG Securities raised its price target. Even as macro pressures like currency strength and rate uncertainty weigh on the broader market, stock-specific catalysts still matter. Investors are willing to buy companies with strong earnings visibility, favorable analyst revisions, or exposure to long-term growth themes like semiconductors and AI.