Nvidia earnings land at a moment when wall street is suddenly nervous about AI spending

Nvidia’s blockbuster earnings arrive just as markets begin questioning whether the global ai spending boom is sustainable. With Megacap clients pouring hundreds of billions into infrastructure, solid results could calm a jittery market—or confirm that expectations have raced too far ahead of reality.

Analysts expect >50% revenue and profit growth in Nvidia’s fiscal Q3

Big tech is set to boost AI spending 34% to $440 billion over 12 months

Nvidia shares have fallen 15% in four weeks as AI sentiment cools

Valuation drops to 29x forward earnings—below its 10-year average

Markets brace as Nvidia prepares to reveal where the AI billions are going

Wall street is sharpening its pencils. after months of explosive investment in artificial intelligence infrastructure, the global market is finally getting a look under the hood: Nvidia reports earnings after the bell. But unlike previous quarters—when every stellar print sent tech into orbit—this time arrives with a nervous edge.

The chipmaker has become the gravitational center of the AI boom, the stock that moves the entire market. And with stocks under pressure, investors are desperate for confirmation that AI’s runaway spending still has a rational payoff.

Big tech’s AI bet: $440 billion in the next 12 months

Expectations are lofty. Analysts estimate more than 50% growth in both net income and revenue, driven by insatiable demand from Microsoft, Amazon, Alphabet and Meta. collectively, these giants—responsible for over 40% of Nvidia’s sales—are on track to increase AI spending 34% to $440 billion in the coming year.

But that forecast rests on fragile ground. if major players—or privately held OpenAI—slow spending, the entire revenue trajectory shifts. After raising expectations quarter after quarter, public companies now face a dangerous cycle: lofty promises must be met with ever-loftier results.

EPS revision chart for Nvidia shows how profit expectations have marched higher in lockstep with the stock, with consensus now looking for adjusted EPS of about $1.26 in fiscal 2026 Q3 and $1.44 in Q4—several times higher than estimates back in 2022 as the AI cycle has scaled up the company’s earnings power.

Source: Bloomberg

Bloomberg’s analyst dashboard for Nvidia remains decisively bullish, with 72 of 79 analysts (91%) rating the stock a Buy and only one Sell, a 12-month consensus target of about $237 versus a last price near $181 that implies roughly 31% upside on top of a 23% gain over the past year.

Source: Bloomberg

Nvidia’s slip rattles markets as AI euphoria cools

Nvidia’s share price has already told its own story. The stock has plunged more than 15% since its record peak four weeks ago, reflecting a market suddenly unsure whether ai demand can keep absorbing capital at this pace.

Source: Bloomberg

Yet despite the pullback, Nvidia remains one of 2025’s standout performers: up 35% year-to-date, dwarfing the Nasdaq 100’s 17% gain. Valuation-wise, the correction has made the stock look more reasonable—29x forward earnings, below its decade average of 35.

Source: Bloomberg

For a company growing at Nvidia’s speed, investors like martin argue the multiple barely looks stretched.

What investors want: Blackwell numbers, margins, and guidance

The coming earnings print will center on three metrics:

- Blackwell chip demand — viewed as the next major revenue engine

- Data-center margins — the segment drives nearly 90% of sales

- Forward guidance — the single biggest swing factor for the stock

Fund managers expect another powerhouse quarter, but guidance is the wild card. With sentiment fragile, even a conservative outlook could overshadow strong results.

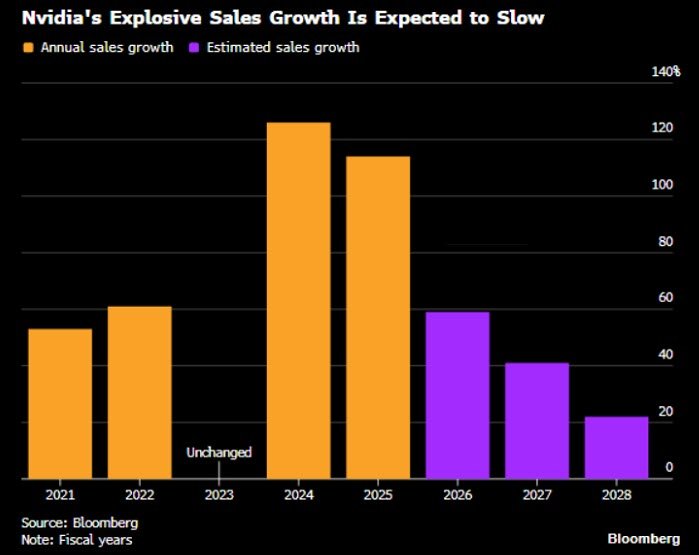

Growth stays strong—but the slowdown is visible

Nvidia’s growth remains extraordinary, but the deceleration is no longer theoretical. projections show:

- +60% revenue growth in fiscal 2026

- +41% in 2027

- +22% in 2028

Still huge numbers—just not the hypergrowth markets had grown accustomed to.

Hedge funds split as AI bubble fears intensify

Investors are divided. Billionaire Peter Thiel’s fund exited its entire position. Softbank also sold out to fund other ai bets. Michael Burry—the 2008 crash Cassandra—bought put options, warning of an ai-driven bubble.

Across 909 hedge funds filing 13f disclosures, the split is almost perfect: half increased Nvidia exposure, half reduced it. whether the selling reflects doubt or simple profit-taking remains unclear.

The stakes: a verdict on AI’s trillion-Dollar promise

Nvidia has powered the market for more than a year. its chips fuel everything—from chatbots to autonomous driving to frontier models—but the broader question is whether the total addressable market for ai infrastructure can justify the spending frenzy.

Nvidia’s results won’t settle the debate. but they will set the tone for global markets heading into year-end, at a moment when confidence in ai is starting to look less like certainty—and more like hope.