Nvidia shares surge as hopes rise for Blackwell chip access to China

Nvidia’s stock continued its record-breaking rally after U.S. President Donald Trump said he plans to discuss the company’s Blackwell artificial intelligence processors with Chinese President Xi Jinping during their upcoming summit. The remarks sparked investor optimism that Washington could ease restrictions on AI chip exports, potentially reopening access to the world’s largest semiconductor market. While no formal agreement has been reached, even a limited breakthrough could reshape the balan

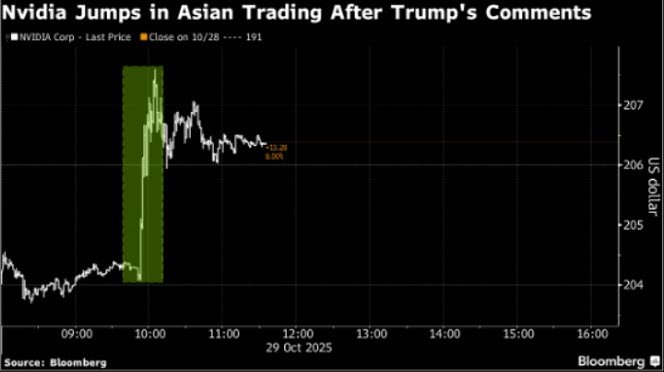

Nvidia shares surged more than 8% following Trump’s remarks on China.

Talks may include easing restrictions on AI chip exports.

The U.S. banned sales of Nvidia’s top-tier chips to China in 2022.

Market optimism reflects hopes of renewed tech cooperation between the world’s two largest economies.

The Blackwell factor: America’s most powerful chip

The latest rally in Nvidia’s shares followed comments from President Trump ahead of his expected meeting with Xi Jinping in Seoul later this week. He described Nvidia’s new Blackwell chip as “super duper” and said the company’s CEO had recently showcased the processor at the White House.

The prospect of renewed trade dialogue on technology — particularly in AI hardware — immediately lifted sentiment across global markets. Nvidia’s shares jumped 8.5% in Asian trading, adding to a 6.8% rise earlier in the week after the company posted stronger-than-expected earnings and a wave of new AI infrastructure partnerships.

Source: Bloomberg

For investors, the question is simple yet profound: will the world’s most valuable semiconductor maker regain access to China, the largest market for advanced computing chips?

Geopolitics meets artificial intelligence

Since 2022, Nvidia has been barred from selling its most advanced AI processors to Chinese buyers under U.S. export restrictions. Washington fears these chips could enhance China’s military and surveillance capabilities. In response, Nvidia developed modified models — like the H20 processor — designed for compliance. Yet, even those efforts faced renewed curbs earlier this year, prompting the company to write down billions in potential revenue.

Trump previously hinted that a “downgraded” version of the Blackwell processor could eventually be cleared for export to China — a move that would mark a significant shift in U.S. policy. Investors now view his latest comments as a possible signal of flexibility, especially as the administration seeks to de-escalate broader trade tensions with Beijing.

If such a policy pivot materializes, it could redefine the competitive landscape of the global chip market.

The strategic calculus: More than just chips

Beyond the market reaction lies a deeper geopolitical calculation. Granting partial access to Nvidia’s Blackwell processors would serve multiple purposes. It would temper China’s frustration over tech containment measures, preserve U.S. influence in AI architecture, and ease global supply bottlenecks that have strained data center expansion.

Yet, it would also expose Washington to criticism that easing export limits undermines its strategic stance on tech sovereignty. Chinese officials, for their part, continue to prioritize self-sufficiency in semiconductors — a goal reaffirmed in last week’s Central Committee meeting emphasizing national resilience in AI and chip manufacturing.

Whether a selective approval process emerges or not, both countries now recognize that complete decoupling in advanced technology is neither practical nor desirable.

The road ahead for Nvidia and ai markets

Nvidia’s rebound underscores how central AI infrastructure has become to modern geopolitics. The company’s dominance in GPU computing — powering platforms from OpenAI to Meta — makes it a strategic linchpin in both economic and security policy.

Even without a breakthrough, the symbolism of Blackwell appearing on the U.S.–China agenda highlights how the frontier of artificial intelligence is now inseparable from statecraft. For investors, this week’s Trump–Xi meeting could mark a turning point — not in rhetoric, but in the slow reconfiguration of global technology ties.