Oil climbs after OPEC+ pauses supply hikes amid 2026 concerns

Oil extended its rally after OPEC+ confirmed it will pause production hikes in Q1 2026 to counter oversupply. Brent rose above $65 a barrel, with traders eyeing sanctions on Russia and geopolitical risks in Nigeria and Ukraine.

OPEC+ to pause output hikes from January through March 2026.

Brent crude rises above $65, marking its longest winning streak since September.

Oversupply fears persist as global inventories swell.

Traders eye disruptions from new sanctions and geopolitical risks.

OPEC+ signals a cautious stance for 2026

Oil prices moved higher after OPEC and its allies confirmed plans to halt production increases in early 2026. The group will proceed with a modest supply addition of about 137,000 barrels per day in December — consistent with the previous two months — before freezing output for the first quarter.

The decision reflects growing caution within the alliance amid signs of oversupply. Brent crude, which had fallen nearly 10% over the past quarter, has rebounded from a five-month low as markets adjust to tighter U.S. sanctions on Russian energy exports and renewed geopolitical tensions across key producing regions.

For now, the pause is being interpreted as a defensive move — an attempt to stabilize sentiment without reigniting price volatility.

Balancing act amid oversupply pressures

Despite the headline increase, OPEC+ members continue to under-deliver on pledged volumes. Technical constraints, maintenance issues, and earlier quota offsets have all kept actual output below planned levels. The group still has roughly 1.2 million barrels per day to restore from its current agreement, but persistent underperformance has muted the real impact on supply growth.

Market observers note that the group’s restraint acknowledges a looming surplus expected to peak in early 2026. At the same time, uncertainty persists over how recent U.S. sanctions on Russian oil firms will disrupt global flows. The result is a delicate equilibrium — with OPEC+ trying to manage expectations while maintaining market credibility.

Geopolitical risks add new layers of volatility

Beyond the supply equation, traders are closely watching a series of geopolitical flashpoints that could threaten physical flows. A large-scale Ukrainian drone strike in the Black Sea recently set an oil tanker ablaze and damaged key export terminals near Tuapse — home to one of Russia’s major refineries. The facilities, operated by companies already under U.S. sanctions, could face prolonged downtime.

Meanwhile, the U.S. administration warned of potential military measures in Nigeria, Africa’s largest oil producer, following reports of rising militant activity in the Niger Delta. Any escalation there could further unsettle supply dynamics just as the global market edges toward balance.

Prices steady but sentiment fragile

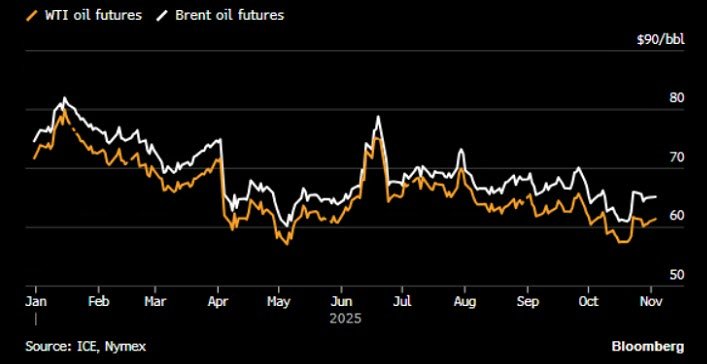

At midday trading in Singapore, Brent crude for January settlement was up 0.3% at $64.97 per barrel, while West Texas Intermediate (WTI) gained 0.3% to $61.17 per barrel.

Source: Bloomberg

Still, analysts caution that recent gains are fragile. The combination of slowing demand growth, high inventories, and rising non-OPEC output — particularly from the U.S. and Brazil — could cap further upside. The planned pause may delay, but not eliminate, the risk of renewed price weakness early next year.

Managing expectations, not the cycle

OPEC+ appears to be buying time — using its production strategy to smooth volatility rather than engineer a full-scale rebound. With inflation still moderating in major economies and global growth forecasts subdued, demand recovery remains uneven.

As the alliance enters 2026, the real test will be whether restraint today prevents deeper disruptions tomorrow. For now, the market seems willing to give OPEC+ the benefit of the doubt — but patience, like spare capacity, is a finite resource.