Oil ticks higher as OPEC+ holds the line and Venezuela risks stay in play

Crude started 2026 on a firmer note after its steepest annual drop since 2020, with traders balancing expectations for an OPEC+ pause on supply hikes against fresh geopolitical tension spanning Venezuela, the Black Sea and Iran.

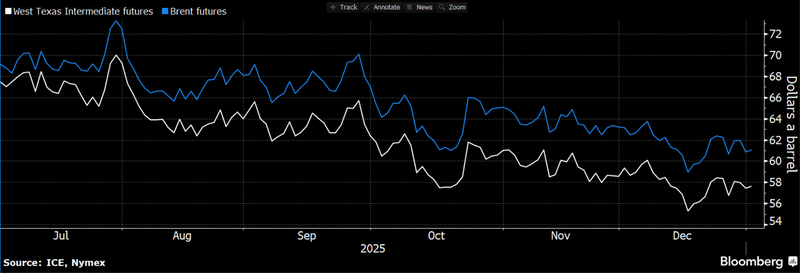

Brent traded above $61 and WTI near $58 as the new year opened.

OPEC+ is expected to keep its pause on additional supply increases at the Jan. 4 meeting.

Venezuela pressure intensified as the US sanctioned China- and Hong Kong-linked firms and vessels.

The IEA’s call for a sizable 2026 surplus kept the medium-term tone cautious.

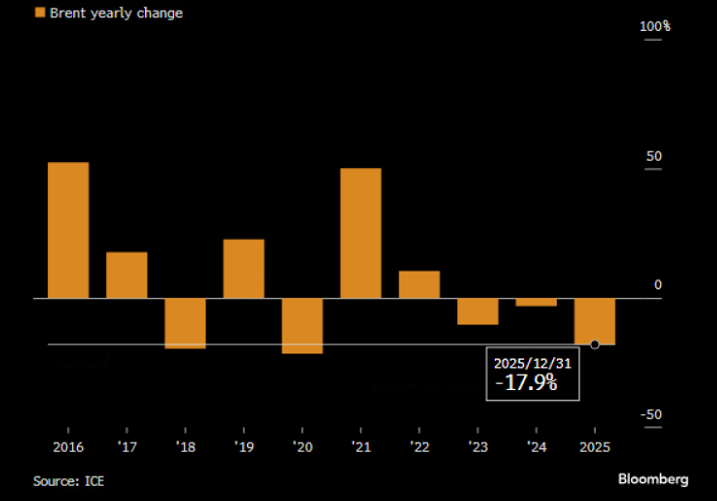

A small rebound after a bruising year

Oil edged higher on the first trading day of 2026, stabilizing after prices posted their deepest annual decline since 2020. Brent traded above $61 a barrel, while West Texas Intermediate hovered near $58, as markets weighed whether the early-year bounce can hold in a market still wrestling with oversupply concerns.

Source: Bloomberg

OPEC+ meeting anchors near-term expectations

Attention is now trained on OPEC+ talks scheduled for Jan. 4. The group, led by Saudi Arabia and Russia, is widely expected to stick with its decision to pause further supply hikes. With demand signals uneven and non-OPEC supply still expanding, traders are treating the meeting less as a catalyst for new bullish momentum and more as a test of the group’s discipline.

Source: Bloomberg

Venezuela returns to the front page

Geopolitics has reasserted itself as a short-term support factor. The Trump administration stepped up pressure on Venezuela’s oil exports, sanctioning companies in Hong Kong and mainland China, along with vessels accused of evading restrictions. The renewed focus on enforcement has added a risk premium at the margin, particularly for flows tied to opaque shipping routes.

Black Sea strikes keep energy infrastructure in focus

Tension between Russia and Ukraine also remained a live input for crude pricing after both sides struck Black Sea ports over the new year period. Damage to infrastructure — including a refinery — reinforced the market’s sensitivity to disruption risk even as the broader supply balance looks comfortable.

Iran volatility adds another layer of noise

Iran, an OPEC member, stayed on traders’ radar after the local currency fell to a record low and protests flared in Tehran and other cities. President Masoud Pezeshkian moved to dial down pressure by pledging to revise planned tax increases, acknowledging what he called legitimate public demands — a domestic storyline that markets often treat as a proxy for broader policy uncertainty.

The surplus story still dominates the bigger picture

Even with geopolitical tailwinds, the underlying narrative remains stubborn: the market is preparing for oversupply. The International Energy Agency has flagged a potential 2026 glut of about 3.8 million barrels a day, and last year’s selloff was driven by similar fears — OPEC+ supply increases colliding with rising production from rival drillers and uneven demand.

What traders are watching next

Near-term price action is likely to stay tied to two levers: any signal from OPEC+ that the pause is firm, and whether Venezuela-related enforcement escalates further. Beyond that, the market’s real argument is about the first quarter — whether supply growth keeps outpacing demand, and whether geopolitics can offset a surplus that, on paper, looks uncomfortably large.