RBNZ expectations for a tighter monetary policy

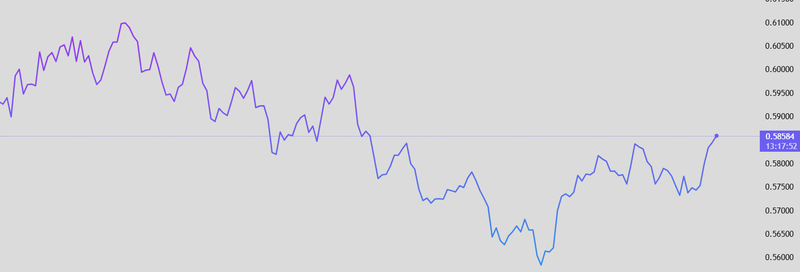

The New Zealand dollar has risen to around $0.585, hitting a four-month high, despite the official cash rate sitting at a low 2.25% the lowest since July 2022 the combination of above-target inflation and firming economic growth is tilting market expectations toward a tightening cycle. Investors are increasingly betting that the RBNZ will begin lifting rates later this year.

New Zealand dollar has risen to around $0.585, hitting a four-month high.

10-year government bond yield rose to 4.58%, the highest since July 2025.

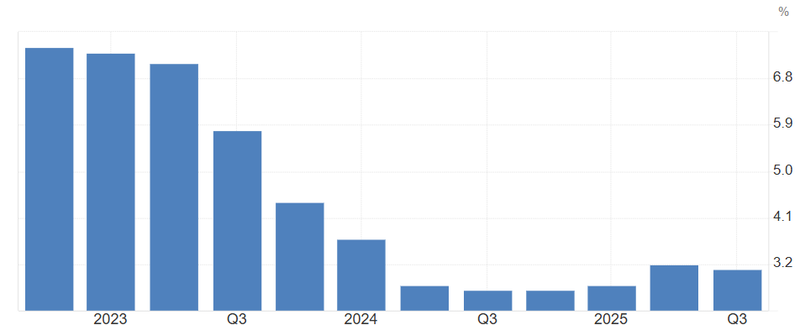

Inflation has now exceeded 3% for the second consecutive month, the highest readings since 2024.

RBNZ appears set to move gradually toward a tightening cycle.

New Zealand dollar strength

The New Zealand dollar has risen to around $0.585, hitting a four-month high, as investors position ahead of the fourth-quarter CPI report due this Friday. Annual inflation is expected to reach 3%, the upper bound of the Reserve Bank of New Zealand’s 1-3% target range. A surprise upside could reignite expectations for a tighter monetary policy, pushing markets to price in earlier-than-expected rate hikes. The kiwi has also gained support from improved global risk sentiment after President Trump eased tariff tensions with several European countries over Greenland. With the currency outperforming peers and risk-on sentiment returning, the NZD may continue to trend higher if inflation surprises to the upside or global markets remain supportive.

Source: Trading View

Bond yields rising

New Zealand’s 10-year government bond yield rose to 4.58%, the highest since July 2025, reflecting mounting expectations for future rate increases. Despite the official cash rate sitting at a low 2.25%, the lowest since July 2022, the combination of above-target inflation and firming economic growth is tilting market expectations toward a tightening cycle. Investors are increasingly betting that the RBNZ will begin lifting rates later this year, with the probability of a hike by July exceeding 50%. From a bond market perspective, this signals that long-term inflation expectations are rising, and any hawkish rhetoric in the upcoming CPI release could push yields higher, potentially creating headwinds for risk assets while reinforcing the attractiveness of NZ fixed income.

Source: Trading economics

Inflation and interest rate pressures

New Zealand’s economy is showing steady signs of recovery, supported by resilient domestic demand and favorable commodity prices. Inflation has now exceeded 3% for the second consecutive month, the highest readings since 2024. This persistent rise places the Reserve Bank of New Zealand in a delicate position. While the official cash rate remains at a stimulative 2.25%, above-target inflation could force the RBNZ to tighten policy earlier than markets currently expect. The combination of firm growth and rising prices suggests that interest rates are likely to rise sooner rather than later, and bond yields may continue climbing as markets price in a more hawkish trajectory.

Source: Statistics New Zealand

Central bank direction

Looking ahead, the RBNZ’s path is likely to remain data-dependent but leaning hawkish. If the upcoming CPI print confirms accelerating inflation, market expectations for rate hikes could shift sharply, pushing the New Zealand dollar higher and reinforcing tighter monetary policy. Conversely, a softer inflation report might temporarily temper NZD gains and delay tightening, but the underlying economic recovery indicates that any pause would likely be brief. Political developments, including Prime Minister Luxon’s announcement of a national election on November 7, add another layer of uncertainty, as fiscal policy and potential reforms could influence both market confidence and the central bank’s decisions. Overall, the RBNZ appears set to move gradually toward a tightening cycle, with the timing dictated by inflation trends and economic momentum.