Silver whipsaws as thin liquidity magnifies violent price swings

Silver extended its roller-coaster trading, plunging sharply before rebounding, as fragile liquidity and fading speculative demand left the market struggling to establish a floor.

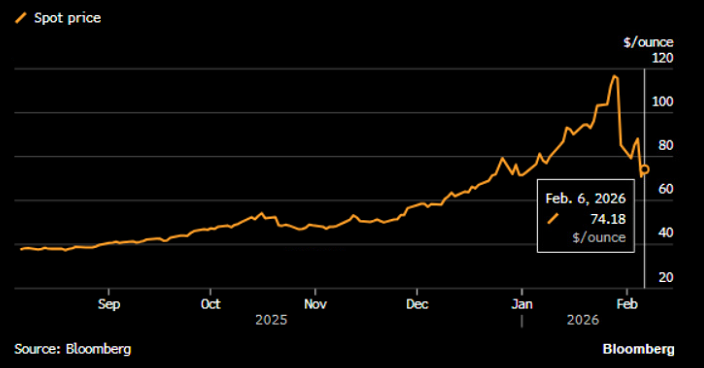

Silver swung nearly 10% intraday before rebounding in Asian trading

Prices are down more than one-third from the January record

Liquidity has thinned sharply, amplifying volatility

Chinese demand has cooled, removing a key source of support

Sharp moves expose a fragile market

Silver lurched between steep losses and sudden gains on Friday, underscoring how thin liquidity has turned routine positioning into outsized price swings. The metal fell close to 10% early in the session before snapping back, with spot prices later rising as much as 6.2% in Asia after dipping toward $64 an ounce.

Source: Bloomberg

The rebound followed a brutal selloff in the previous session, when silver tumbled around 20%, erasing the gains from its explosive rally in January. Gold also steadied after an earlier retreat, but the contrast between the two metals highlighted silver’s greater sensitivity to shifts in risk appetite.

Volatility accelerates after record peak

Silver’s recent moves rank among the most extreme seen since 1980. The metal has now lost more than a third of its value since hitting an all-time high on Jan. 29, a decline marked by speed as much as by size. Its smaller market and thinner liquidity compared with gold have left prices particularly exposed as speculative momentum reversed.

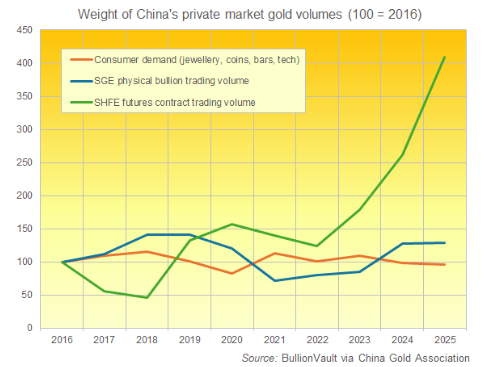

The multiyear bull run in precious metals accelerated sharply last month, driven by geopolitical risks, questions around the Federal Reserve’s independence and aggressive speculative buying, particularly from China. That surge encouraged heavy positioning through leveraged exchange-traded products and options, leaving the market vulnerable once sentiment turned.

Liquidity dries up as positions unwind

As prices began to slide, market depth deteriorated quickly. With volatility surging, dealers widened spreads and cut back balance-sheet usage, draining liquidity precisely when it was most needed. The result has been a self-reinforcing cycle in which sharp price moves trigger further position reductions.

The pullback intensified late last week, when silver suffered its biggest-ever daily drop on Jan. 30, while gold recorded its steepest fall since 2013. Since then, trading conditions have remained unstable, with price discovery impaired by limited participation.

Chinese demand fades, removing a key pillar

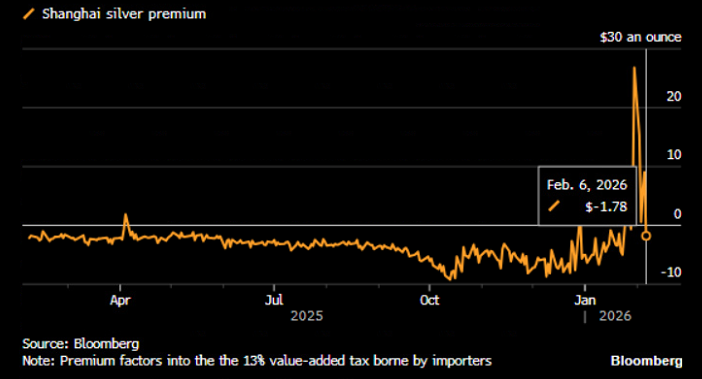

A sharp slowdown in Chinese buying over the past week has further undermined silver. Domestic prices in China have flipped to a discount relative to international benchmarks, a reversal from the premiums that previously signaled strong demand. At the same time, open interest on the Shanghai Futures Exchange has fallen to the lowest level in more than four years, indicating that traders are closing positions rather than adding exposure.

Source: China Gold Association

The violent swings have discouraged dip-buying, while the approach of the Lunar New Year has prompted investors to keep positions light ahead of the week-long holiday beginning Feb. 16. The combination has left silver struggling to find consistent support.

Source: Bloomberg

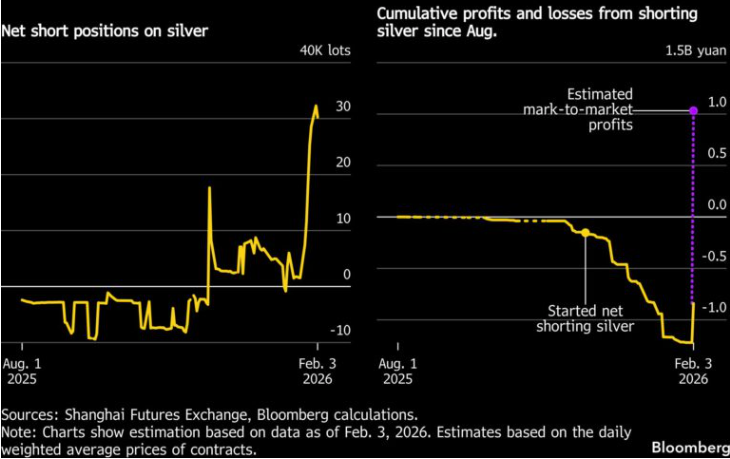

Bian Ximing… Shanghai’s “Gold King” Now Bets on a Silver Slump

Chinese billionaire trader Bian Ximing, who has made close to $3 billion from bullish wagers on gold contracts on the Shanghai Futures Exchange since 2022, is back in the spotlight from a very different angle: the single largest short bet on silver in China’s market. The shift looks less like a simple rotation between two metals and more like a sharp read on the quality of the rally. Gold has remained anchored by a long-term hedging narrative, supported by murky monetary-policy outlooks and central-bank buying, while silver’s surge in recent weeks has carried the fingerprints of a more speculative move—one that is far more sensitive to liquidity and sudden swings in risk appetite. Based on exchange data and position-tracking analysis tied to his brokerage channels, Bian’s large short has turned silver’s decline into paper gains worth hundreds of millions of dollars. But the trade comes with a steep price tag in risk: silver can be unforgiving when liquidity thins and volatility spikes, and that same backdrop has previously forced the trader to liquidate positions at a loss. The bottom line is that Bian’s wager isn’t merely a call for lower prices—it’s a high-conviction stress test of the idea that silver ran ahead of its fundamentals, and that any correction could be faster and harsher than the market is used to.

Source: Bloomberg

Gold steadier, silver still searching for balance

Gold’s deeper liquidity has allowed it to weather the turbulence more effectively, with many banks and asset managers maintaining constructive long-term views despite recent losses. Silver, by contrast, remains more exposed to sudden shifts in speculative flows.